Warren Buffett, one of the world’s most revered investors, has articulated his reservations about the implications of tariffs being imposed under President Donald Trump’s administration. In a rare commentary, Buffett warned that the introduction of punitive tariffs could lead to inflationary pressures, ultimately undermining the purchasing power of consumers. His remarks came during an interview with CBS News, shedding light on his views regarding economic policy and its broader impacts, particularly amid a context marked by global trade tensions.

Buffett characterized tariffs as a form of economic warfare, noting that they serve as a hidden tax on goods that consumers merely end up paying. “The Tooth Fairy doesn’t pay ’em!” he humorously remarked, underscoring a serious point: that consumers bear the brunt of tariff-induced price increases. This perspective emphasizes a fundamental economic principle: when the government imposes tariffs, the costs are often shifted to consumers, contributing to a potential rise in inflation.

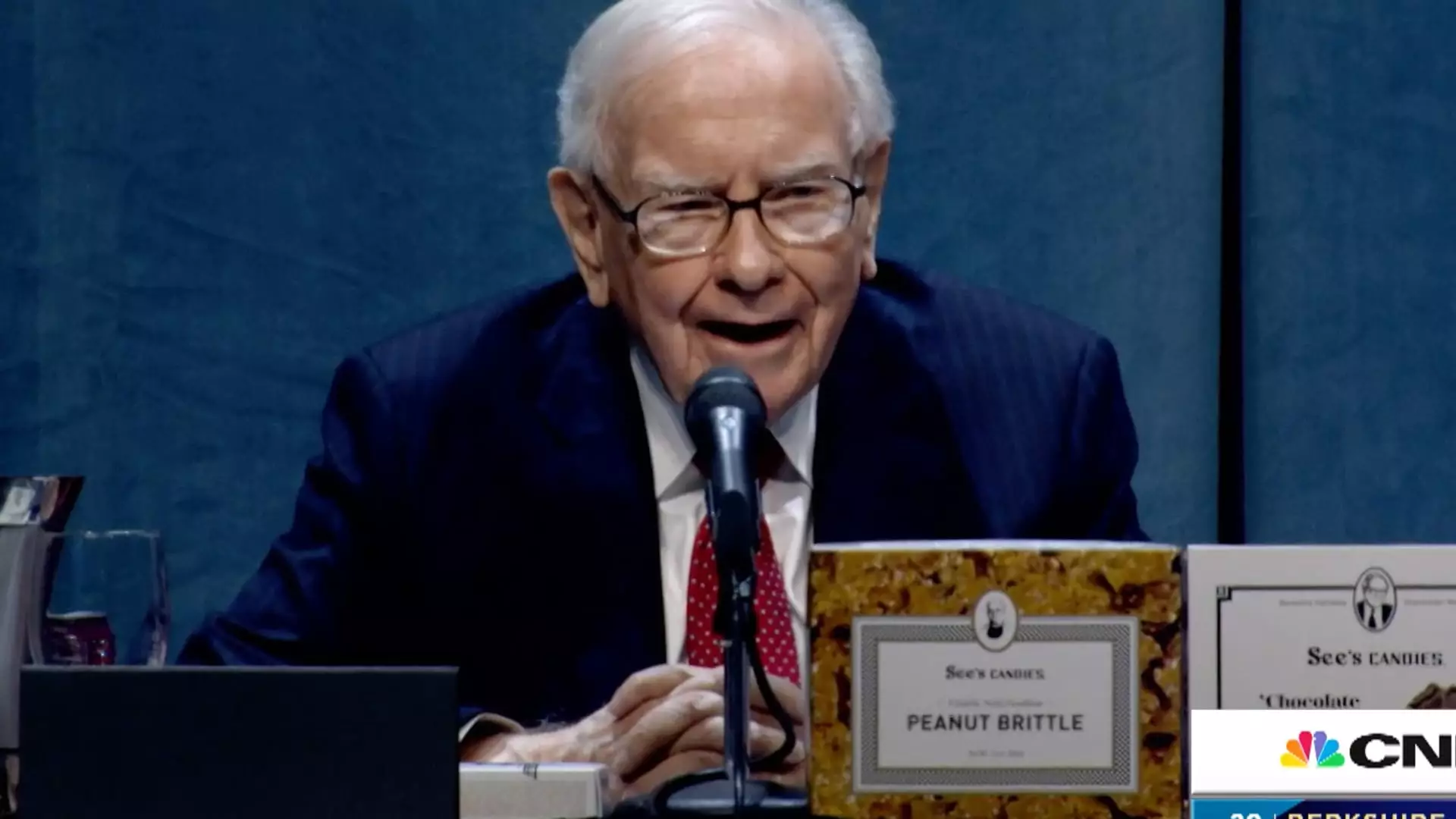

Buffett’s comment signifies a well-informed caution rooted in decades of investment wisdom and experience. His extensive business dealings through Berkshire Hathaway, which spans insurance, retail, and manufacturing, offer him an intricate understanding of how tariffs influence market dynamics. Despite the complexity of trade policies, Buffett underscores the importance of examining their long-term consequences and remaining vigilant to the sequence of economic events they may provoke.

The recent move by President Trump to implement 25% tariffs on imports from Canada and Mexico, along with an additional 10% tariff on goods from China, has prompted widespread speculation about potential retaliatory measures from those nations. The stakes are high, as such actions not only affect bilateral trade relationships but could also dampen global economic growth. Buffett’s cautious stance—coupled with his decision to significantly decrease his stock holdings while hoarding cash reserves—has led to interpretations that he may be bracing himself and his company for a more volatile economic landscape.

His actions convey a message of prudence; whether these decisions stem from a belief in an impending market downturn or a strategic approach for a smooth transition of leadership at Berkshire Hathaway remains open to debate. His pronounced liquidity position contrasts sharply with aggressive investment strategies, suggesting that Buffett is attuned to changing market conditions and is perhaps preparing for turbulence ahead.

Amid rising market volatility and fluctuating economic indicators, Buffett’s insights resonate significantly. The S&P 500’s modest gains of around 1% this year reflect sluggish growth concerns fueled by unpredictable policy shifts and market sentiments. As investors scrutinize both the domestic economy and international trade policies, Buffett’s reflections provide necessary grounding in fundamental economic principles.

Ultimately, Buffett’s analysis serves as a reminder of the intricacies of economic policy and investor sentiment. In an age when tariffs and trade wars dominate discussions, his seasoned perspective invites us to consider the broader implications of such policies not just on corporations, but on everyday consumers navigating an uncertain financial landscape. As always, in a world where economic decisions can ripple across sectors and borders, it pays to heed the wisdom of experienced voices like Buffett’s, who remind us to ask, “And then what?”