In an era where the Federal Reserve’s recent rate cuts have set off a speculative frenzy, many investors are blindly rushing toward dividend-paying stocks, convinced these assets are safe havens in a turbulent economy. This belief, however, is a comforting mirage rooted more in optimism than reality. The notion that steady dividends equate to stability

In recent years, the credit card industry for the elite traveler has begun to spiral into a troubling cycle of inflated fees. Major issuers are pushing annual costs to dizzying heights, with some of the most sought-after travel rewards cards reaching nearly $900 per year. For consumers, these astronomical fees come with an expectation—often an

This week’s unexpected surge in long-term Treasury yields shatters the narrative of a stable economic recovery driven by the Federal Reserve’s recent interest rate cuts. Despite the Fed’s attempt to signal easing monetary policy by lowering rates, bond investors displayed a deep skepticism, flocking to sell long-dated bonds and pushing yields to levels unseen since

In an era where innovation and global competitiveness define economic strength, the United States risks undermining its own future by clamping down on the very talent injections that fuel technological progress. The recent decision to impose a $100,000 annual fee on H-1B visas, targeting highly skilled immigrants, is not merely a bureaucratic tweak—it is a

Buying a vehicle, whether brand new or pre-owned, is often heralded as a significant milestone — a symbol of independence and success. Yet, beneath this shiny facade lies a treacherous financial landscape that many underestimate. The popular “20-4-10” rule promises a straightforward guideline to keep your car-related expenses in check, but adherence to this framework

Workday’s remarkable journey from a start-up to a $58 billion enterprise has been nothing short of a rollercoaster for investors. For over a decade, the company thrived on an aggressive “growth at all costs” strategy, prioritizing expanding revenues over profitability. While such a mentality propelled Workday into the ranks of industry giants—serving over 11,000 organizations,

The recent decision by the CDC’s Advisory Committee on Immunization Practices (ACIP) to soften Covid vaccine recommendations marks a troubling shift in public health policy. This change, driven by politically appointed figures like Robert F. Kennedy Jr., underscores a move away from the uniform, science-backed approach that prioritized universal access to Covid vaccines. Instead, it

The proposal to transition from quarterly to semi-annual earnings reports threatens to undermine the very transparency that keeps our markets honest and investors protected. While proponents argue that less frequent reporting would reduce corporate burdens and foster long-term growth, this view grossly underestimates the profound risks involved. The push for financial brevity may seem like

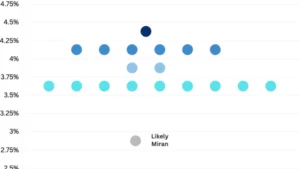

The story of Federal Reserve Governor Stephen Miran’s recent public statements reveals a troubling reality about the independence of the United States’ central banking system. Despite formal structures designed to insulate monetary policy decisions from political influence, recent episodes expose cracks in this armor. Miran’s insistence that he made his vote independently and that his

The Federal Reserve’s decision to cut interest rates this Wednesday may seem like a beacon of hope for overstressed consumers drowning in debt, but in reality, this move is largely superficial. While such adjustments can momentarily reduce borrowing costs, they do little to address the deeper, more entrenched issues underlying personal debt. The narrative that