Nvidia’s recent earnings report for the fiscal fourth quarter showcased the company’s ability to outshine Wall Street forecasts, yet the details reveal a tapestry of mixed results that evoke a broader narrative about its growth trajectory. As the tech giant surges within the artificial intelligence (AI) space, it grapples with the challenges of sustaining momentum in an increasingly competitive landscape.

In a quarter that saw revenue climb to $39.33 billion—surpassing analyst expectations of $38.05 billion—Nvidia demonstrated its financial prowess. Additionally, the adjusted earnings per share (EPS) hit 89 cents, exceeding predictions of 84 cents. However, despite the encouraging numbers, shares remained flat in after-hours trading, highlighting market skepticism regarding the sustainability of such growth.

Nvidia’s guidance for the upcoming quarter is similarly optimistic, with revenue expectations hovering around $43 billion, a striking 65% increase from the prior year. Yet, this growth rate signals a noticeable slowdown compared to the staggering 262% surge recorded a year prior. Chief Financial Officer Colette Kress highlighted forthcoming sales boosts from the highly anticipated Blackwell AI chip, marking a critical juncture in Nvidia’s efforts to maintain its competitive edge.

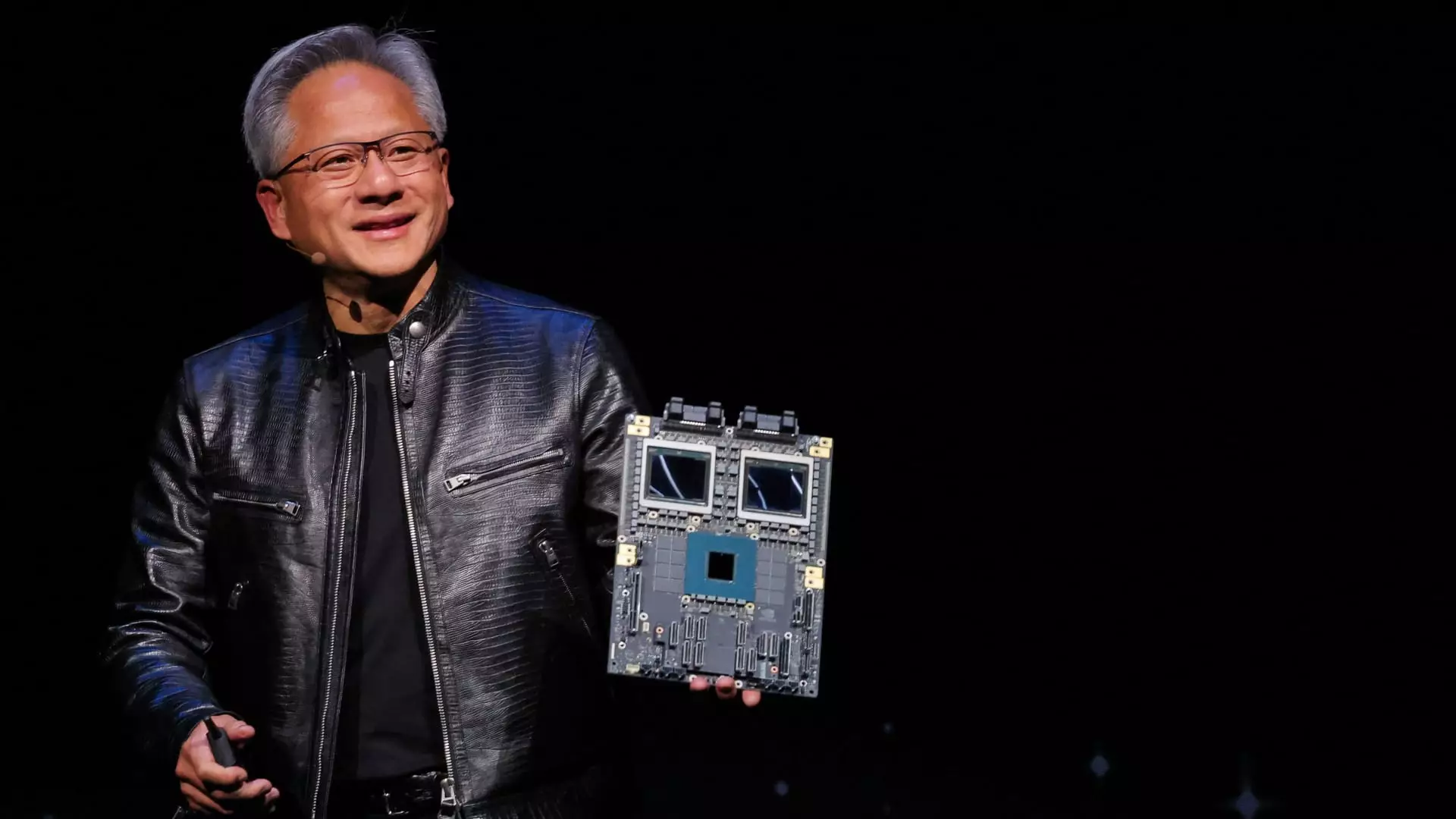

The hype surrounding the Blackwell AI chipset cannot be understated; its projected revenue of around $11 billion is a testament to unprecedented demand. Kress characterized the ramp-up to Blackwell sales as “the fastest in our company’s history,” diminishing concerns about the competitive threat posed by emerging AI models. Nevertheless, these models—like DeepSeek’s R1—could potentially demand vastly more computational resources, thereby escalating the reliance on Nvidia’s chips.

Interestingly, Blackwell’s swift adoption by major cloud service providers, which contributed to nearly 50% of data center revenue, does illustrate Nvidia’s continued relevance in AI training and inference. However, the underlying tension between rapid expansion and the complex landscape of AI innovation poses a strategic dilemma for the firm.

The data center segment remains the cornerstone of Nvidia’s success, accounting for a staggering 91% of total sales. Revenue from this sector ballooned to $35.6 billion in the fourth quarter, representing an impressive 93% increase year-over-year. This colossal growth not only surpassed estimates by analysts but underscores Nvidia’s dominance as the go-to provider of AI accelerators.

Yet, the company’s traditional strength is tinged with caution. As Nvidia’s data center business secures substantial revenue, it grapples with the maturing growth rate that comes with scale. The previous quarter showcased sales that more than tripled, marking a clear sign of deceleration in growth momentum as the firm expands its base.

While Nvidia shines in AI and data centers, challenges persist in its gaming segment. Reporting sales of $2.5 billion—falling short of expectations—highlights a concerning trend for the company. This sector yield an 11% decline on an annual basis, indicating shifting market dynamics and potentially eliciting re-evaluation of Nvidia’s gaming strategies. New graphics cards released during the quarter, aimed at enriching consumer experience, could be viewed as a necessary but insufficient remedy against this downturn.

As Nvidia marches forward, it faces an intricately woven tapestry of challenges and opportunities. The company’s exploration into automotive and robotics generated $570 million in sales, an astonishing 103% year-over-year increase. However, this figure pales in comparison to the colossal AI and data center business and reflects the hurdles faced in diversifying revenue streams.

Furthermore, Nvidia has signaled a proactive stance through substantial share repurchases totaling $33.7 billion, showing confidence in its long-term potential. Yet, as industry giants like Amazon and Google craft their custom chips, Nvidia must remain vigilant in addressing uncertainties related to market competition.

Nvidia’s fiscal performance paints a picture of overwhelming success tempered by emerging challenges. As the AI landscape continues to evolve, the company is at a pivotal juncture, navigating through both groundbreaking opportunities and potential pitfalls. Investors and market analysts will keenly observe how Nvidia adapts to these evolving dynamics in the quest for sustained growth and market dominance.