In an era where monetary policy debates often remain within the confines of cautious consensus, the recent dissent from Federal Reserve Governor Stephen Miran signals a deeper ideological divide on how best to steer the economy. Miran’s call for a more aggressive half-point rate cut—doubling the Fed’s official move—stands out not just as an individual stance, but as a reflection of a broader debate about economic priorities. His position challenges the often conservative approach of the Fed’s leadership, hinting at a willingness to embrace risk in pursuit of more immediate economic stimulation. While other members remain comfortable with incremental steps, Miran’s dissent screams a sense of urgency, perhaps bordering on desperation, in addressing current economic uncertainties.

This divergence within the FOMC underscores something worrying: the potential erosion of a prudent, balanced approach in favor of impulsive fiscal experimentation. The fact that Miran, the newest appointee, has jumped straight to advocating for a significantly larger cut reveals a deviation from traditionally cautious monetary policy. It raises questions about whether his stance is backed by a comprehensive assessment of inflation, employment, and financial stability, or if it’s driven by external political influences seeking a rapid and dramatic shift in economic policy.

Political Influence and the Fragile Independence of the Fed

The connection between Miran’s seat on the Fed and the political landscape cannot be ignored. Appointed by Donald Trump amidst a contentious backdrop, Miran’s aggressive stance seems emblematic of a broader effort to influence monetary policy in ways that align with partisan interests. President Trump’s explicit calls for even larger rate cuts, alongside his recent threats to fire Fed officials, cast a shadow over the institution’s independence. This perceived politicization risks transforming the Federal Reserve from a buffer against political whims into a battleground for electoral ambitions.

Furthermore, Miran’s simultaneous role as Chair of the White House’s Council of Economic Advisers suggests a troubling conflation of political and monetary authorities. His presence on the Fed’s board, while temporary, hints at a strategic positioning that favors rapid economic stimulus—an approach that could jeopardize the central bank’s credibility and its ability to function as an independent arbiter of economic stability. The danger lies in what happens if political pressures sway monetary policymaking too heavily, potentially leading to reckless rate cuts or hikes based less on economic data and more on superficial political gains.

The Risks of Overzealous Rate Cutting

Miran’s push for more aggressive rate reductions raises critical concerns about the long-term health of the economy. While rate cuts can temporarily boost demand, they often come with hidden costs: asset bubbles, wage inflation, and increased financial instability. Central banks, by their nature, aim for a delicate balancing act—supporting growth without fueling runaway inflation or creating speculative excesses. To advocate for a half-point cut, especially in a climate of economic uncertainty, is to flirt with the edge of that balance.

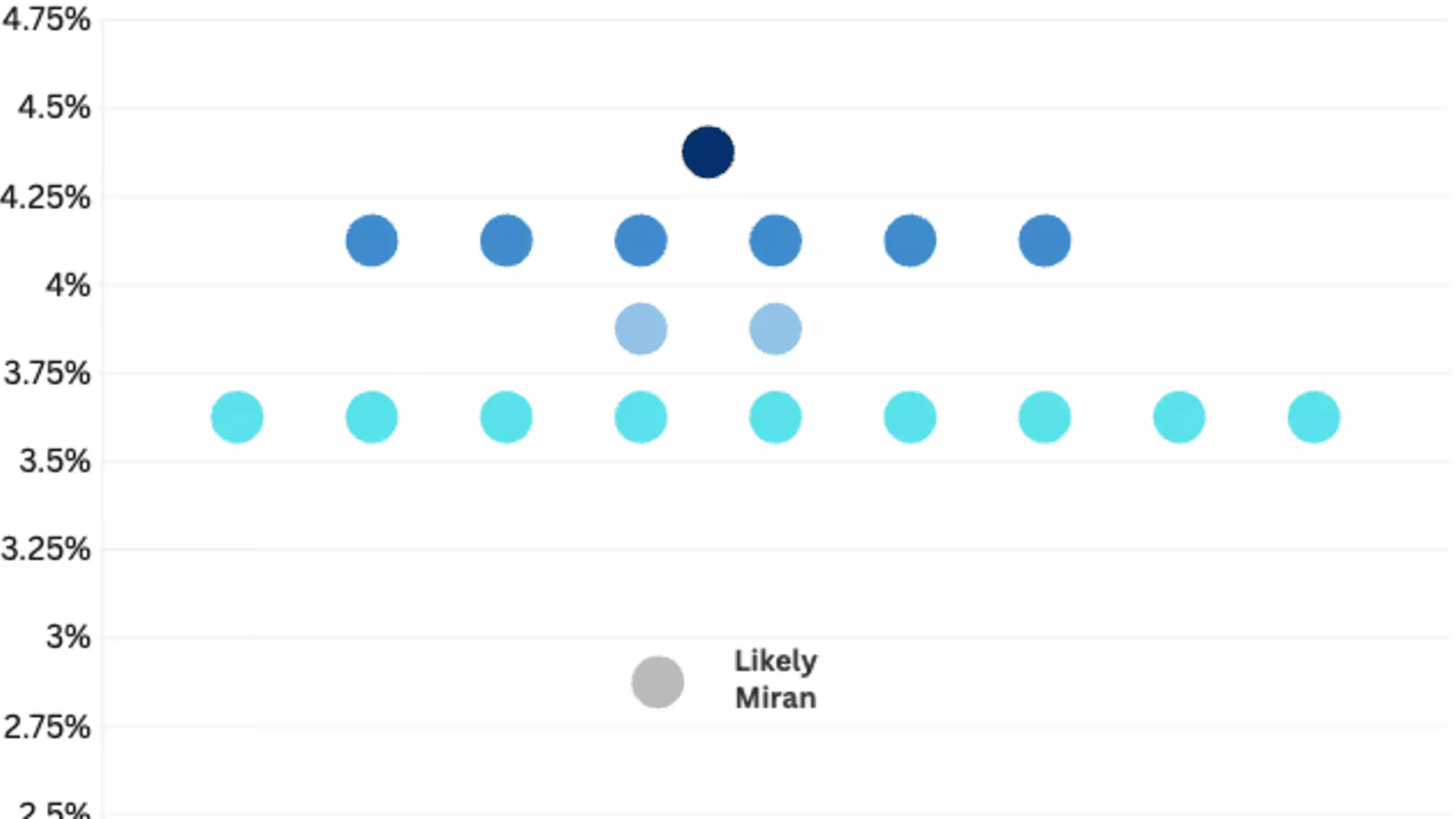

The looming disagreement on future cuts, particularly the wide range of predictions for 2026, demonstrates how divided the policymakers are about the economy’s trajectory. Some see the potential for several more cuts, risking a prolonged cycle of easy money that could destabilize the financial system. Miran’s stance accentuates this risk, embodying a mindset that prioritizes short-term growth over caution and sustainability. If such an approach is adopted without proper checks, it could set the country on a perilous path toward inflationary spirals when the economy inevitably overheats.

The Broader Implication: A Central Bank at Crossroads

At its core, the controversy surrounding Miran and the Fed’s current rate policy debate reveals much about the future of American economic governance. The tension between conservative prudence and bold experimentation reflects deeper ideological rifts within the political spectrum — a fight over the role of government and the importance of maintaining financial stability versus spurring rapid growth.

From a center-leaning liberal perspective, there is peril in embracing aggressive cuts solely to appease short-term political pressures. The Federal Reserve’s legitimacy depends on its independence and its ability to craft policies rooted in economic realities, free from partisan influence. A reckless pursuit of rapid cuts risks undermining decades of stability, which only benefits those advocating for short-sighted gains at the expense of long-term sustainability.

In the end, the debate over rate cuts is less about the technicalities of monetary policy and more about the kind of economic future America wants to forge. Will it be one of cautious, data-driven decisions that prioritize stability? Or will it succumb to political whims and hasten toward economic volatility? The answer hinges on whether voices like Miran’s are allowed to prevail or are dismissed as dangerous outliers in a fragile system.