Nvidia, once basking in the glow of extraordinary revenue growth stemming from insatiable demand for its graphics processing units (GPUs), now finds itself at a crossroads. The company has consistently been a darling of Wall Street, driven by the meteoric rise of artificial intelligence and machine learning. However, with geopolitical tumult taking center stage—specifically, tensions with China—Nvidia’s trajectory is more precarious than ever before. Just as markets began to stabilize, off-the-shelf export restrictions from the U.S. government raised eyebrows. The very infrastructure that propelled Nvidia to stratospheric heights is now revealing cracks.

The upheaval began in April when Nvidia received alarming news from the Trump administration: an export license would be required for its latest H20 chip, specifically designed for the Chinese market. This, of course, brings unavoidable complications, not merely in navigating bureaucratic red tape but also in the chilling effect it has on Nvidia’s bottom line. In essence, these restrictions are less about protecting U.S. interests and more indicative of a broader technological war that’s brewing.

The Calculated Risks of Dependence on China

In a world increasingly defined by digital capabilities, China represents a colossal market. Nvidia’s previous command of 95% market share in GPUs within the nation has now dwindled to a mere 50% as a direct result of these regulations. This isn’t a mere statistical blip; it’s a clear signal that reputational contusions and financial losses are on the horizon. The company announced a staggering $5.5 billion write-down, a figure paralleled only by the most severe of industry crises. Analysts caution this could mean a $15 billion revenue hit over the next year—a colossal dent that raises questions about Nvidia’s future growth trajectory.

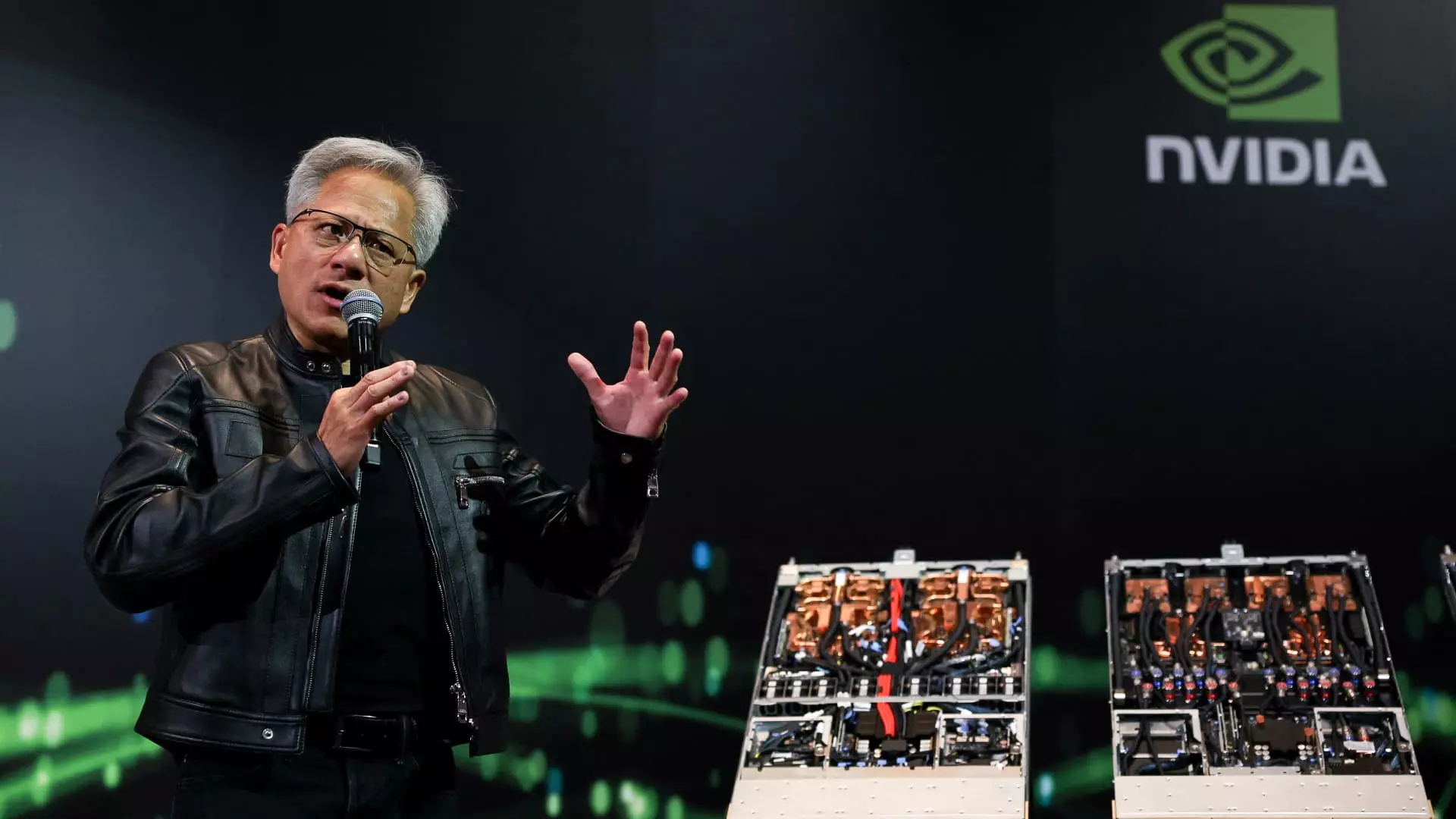

CEO Jensen Huang’s contention—that these restrictions will only galvanize Chinese engineers to develop their technologies—has serious implications for not just Nvidia but for America’s technological supremacy as well. The innovative prowess of a nation often hinges on its market freedom, and by restricting exports, the U.S. may unwittingly be fostering its own competition. To think Americans negatively view AI’s potential, while empowering foreign developers to take the lead, seems like an egregious miscalculation.

Policy Paradoxes: What Lies Ahead?

The winds of regulatory change have been tumultuous, to say the least. Recently, the Trump administration moved to rescind the “AI diffusion rule,” which could have imposed even stricter limitations on AI exports. While this might have offered a glimmer of hope, the sincerity of this political maneuver remains in question. The U.S. government hinted at the creation of a new regulatory framework intended to simplify exports, yet how effective this will be in stabilizing Nvidia’s operations is uncertain.

Morgan Stanley’s analysts express skepticism about future projections and profitability, underlining the unpredictability entrenched in market sentiment. It becomes increasingly clear that while Nvidia’s immediate earnings may reflect a strong quarter, the long-term implications of these geopolitical intricacies cannot be understated. Will Nvidia’s lobbying efforts in Washington pay off? Or will they meet deaf ears in a politically charged climate?

As Nvidia gears up for its next earnings report, the atmosphere surrounding the event is not one of triumph, but rather a cautious anticipation tinged with anxiety. The growth expectations for the coming quarter have been revised downwards from previous highs. What was once a narrative of unchecked growth has entered a phase of careful scrutiny.

The Broader Implications for the Tech Ecosystem

It’s not just Nvidia that feels the reverberations of these constraints. The entire tech ecosystem stands to be affected when a leading company faces such significant adversity. Partners, suppliers, and competitors all watch nervously. If one of the world’s largest AI chipmakers can falter, what does that say for smaller entities? The situation prompts a reflection on how vulnerable the tech industry has become in the face of political strife.

The erosion of market share can have a cascading effect; as Nvidia’s foothold in China diminishes, this serves as a launchpad for potential contenders to emerge. Startups in other countries may seize the opportunity for innovation, especially if they find support from governments eager to compete in this new arms race of semiconductor technology. The irony here is palpable: U.S. restrictions, specifically intended to safeguard national security, may inadvertently help foster an alternative market that could ultimately undermine American technological advantage.

The stakes have never been higher. Nvidia’s future is embedded not just in its ability to innovate but in navigating a labyrinth of bureaucratic challenges. As analysts sharpen their pencils for a new round of earnings reports, one can’t help but wonder—will Nvidia weather this storm, or could this be the beginning of a more profound decline?