This past week proved once again that the stock market can be a precarious playground, with Wall Street experiencing extreme fluctuations that left many investors grappling for clarity. The chaotic ebb and flow of stock prices provides a reflection of broader economic and political uncertainties, particularly the ongoing tussles between the United States and China. As the trading week concluded, investors watched with bated breath as the White House hinted at optimism regarding a potential trade resolution with China, amidst retaliatory moves like the surprising increase of Chinese tariffs on U.S. goods. Such volatility does not just affect stock prices; it reflects the angst of a society caught in the throes of policy upheaval.

One cannot deny the thrill of a market upswing, yet this comes tinged with caution as seasoned traders have learned the hard way: euphoria is often followed by despair. This week illustrated perfectly how quickly fortunes can change. The S&P 500 received a jolt with its most significant single-day jump since World War II, only to wind up dramatically giving back much of its gains just 24 hours later. This week merely exemplifies a larger trend where economic uncertainty leads to knee-jerk reactions that can be maddening for investors seeking consistent growth.

The Impact of Earnings Reports

As if political tensions weren’t enough of a catalyst, the weekly earnings reports provided yet another layer of complexity. Wells Fargo’s disappointing earnings announcement showcased how even well-established entities are feeling the sting of economic turbulence. The bank’s stock price swung by as much as 5% before partially recovering, illustrating the fragility of public confidence. Conversely, BlackRock managed to shine, rising nearly 3% thanks to its resilient performance amidst challenging scenarios.

This conflicting narrative of financial health speaks volumes about modern capitalism: resilience exists, but it’s increasingly rare, and the stakes are rising. With ongoing shifts in interest rates and the banking sector feeling pressure both locally and globally, the investment landscape remains a mixed bag where victories and losses are closely intertwined.

Chipmakers Ready for a Comeback

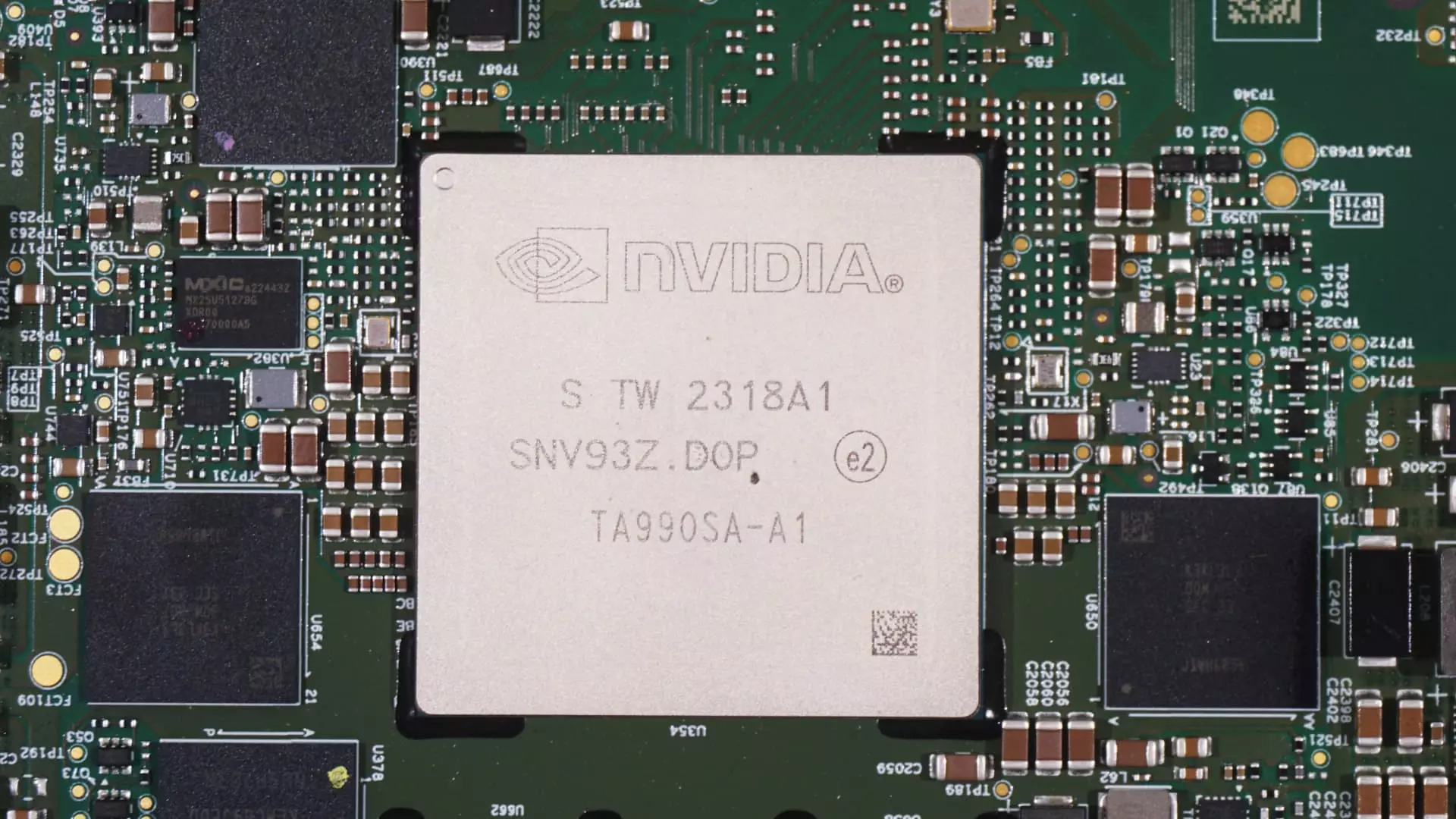

In the midst of this chaotic scene, a beacon of hope emerged from the tech sector. Chipmakers like Broadcom and Nvidia demonstrated remarkable resilience, making significant gains that defied overall market trends. Having been among the hardest hit during the initial sell-off triggered by tariff announcements, these stocks seemed primed for recovery as market conditions shifted. Such rebounds often signal the adaptability of high-tech companies in navigating geopolitical turmoil.

The recent announcements surrounding chip tariffs framed this recovery nicely; the focus now lies on where chips are manufactured rather than just shipped from, creating a more favorable market landscape. This elasticity is vital in a world where tech dominates discussions about future economic stability, making it imperative for investors to keep a keen eye on the dynamics of the semiconductor industry.

Economic Indicators on the Horizon

Of course, all eyes are now pivoting toward next week’s slew of critical economic indicators, with reports on import and export prices and retail sales poised to provide fascinating insights into consumer behavior. Investors are hanging on every release, as these indicators can ultimately shape sentiment and market confidence in a volatile environment. The Bureau of Labor Statistics’ readings will signal whether the economy is contracting or expanding; with consumer spending being a robust driver of growth, a decline may fuel apprehension.

Additionally, the anticipated earnings from Goldman Sachs and Abbott Labs add another layer of intrigue. Given the rising scrutiny on financial institutions following the recent turmoil, these reports could either calm the waters or ignite further unrest among investors.

A Call for Pragmatism and Engagement

In times of broad economic uncertainty, it is disappointing how narratives often get skewed, trapping many investors in a cycle of panic and speculation. There’s a crucial need for pragmatism; rather than succumbing to market hysteria, investors should seek insightful analysis and sustainable strategies. In a world where rapid information can mislead as easily as it can inform, engaging with credible resources is more important than ever.

Ultimately, navigating this unpredictable terrain requires more than just a reactive mindset. It compels investors to hold tight to their convictions, assess long-term potential versus immediate market noise, and position themselves for future growth opportunities. Rather than being swept away by the chaotic tides, this moment underscores the value of vigilance and thoughtful deliberation in investment decision-making.