The dawn of 2025 has awakened a surge of exuberance in the markets, characterized by a significant uptick in speculative trading. On the first trading day of the year, various segments of the stock market experienced a remarkable surge, leaving analysts and investors to ponder the underlying forces driving these movements. Notably, the S&P 500 concluded 2024 with its best two-year performance since 1998, setting a buoyant tone for the new trading year.

Among the standout trends was the performance of stocks linked to the cryptocurrency market. As Bitcoin surpassed the $96,000 mark, companies with heavy investments in crypto, such as MicroStrategy, Coinbase, and Robinhood, saw significant increases in their share prices. Such momentum indicates a reinvigorated interest in cryptocurrencies that could suggest a broader adoption and integration into traditional investment portfolios. The rise of a lesser-known crypto token, humorously dubbed “fartcoin,” exemplifies the bizarre nature of speculative investments today, as it enjoyed a staggering 45% increase in its market capitalization.

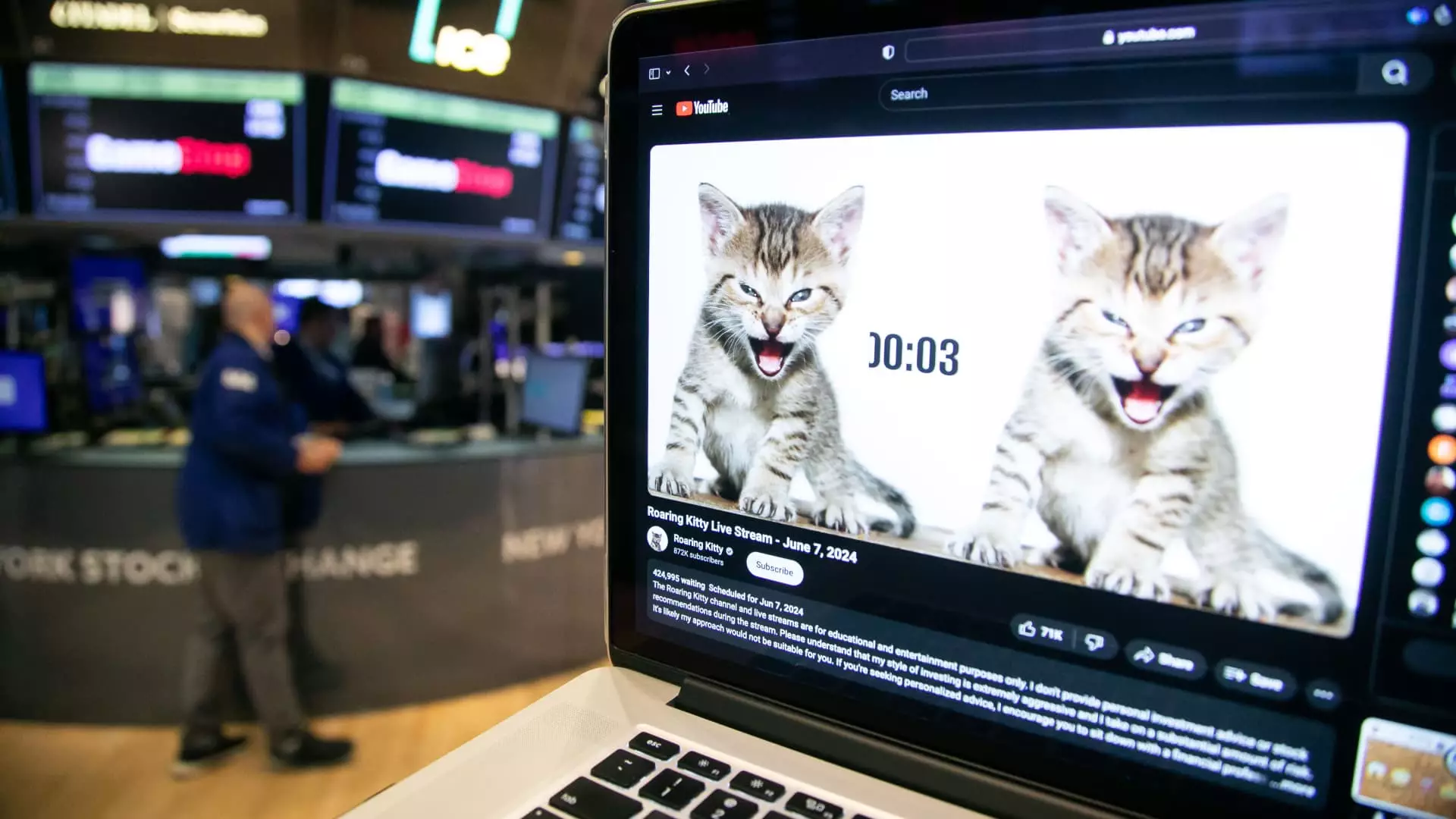

Amidst this volatile market environment, retail investors continue to harness the power of social media, with platforms like X (formerly Twitter) playing a crucial role in spreading information and speculation. A recent enigmatic post from online personality Roaring Kitty, or Keith Gill, sparked a flurry of activity as retail traders scrambled to decipher its implications. The eclectic choice of referencing the late musician Rick James has introduced a layer of intrigue, with some speculating that Gill’s cryptic signals point towards Unity Software or, potentially, the beloved meme stock GameStop.

This phenomenon highlights the evolving nature of stock trading, where traditional metrics and fundamental analysis are sometimes overshadowed by social sentiment and collective excitement. As investment dynamics increasingly shift towards meme-driven stocks, Far removed from traditional indicators, the market’s fluctuations appear to be a reflection of the collective consciousness rather than economic fundamentals.

The Semiconductor Sector’s Resilience

Another notable aspect of the early trading session was the impressive performance of semiconductor stocks, which had been prominent gainers throughout 2024. The enthusiasm around AI technologies had propelled these stocks to new heights, although a slight deceleration in this sector’s growth had emerged towards the end of last year. However, companies such as Broadcom and Nvidia continue to lead the charge as institutional and retail investors keep a close watch on their potential for future growth. The ongoing demand for advanced technology applications, including AI and machine learning, ensures that semiconductors remain a pivotal piece of the market puzzle.

The upgrade of Topgolf Callaway Brands by Jefferies—shifting its rating from hold to buy—demonstrates how analysts’ reassessments can significantly impact stock prices, particularly in niche markets like golf. This rise was prompted by the belief that the company’s shares were undervalued, leading to an optimistic outlook for its future performance.

Despite the positive trading results, there is room for caution as several uncertainties loom on the horizon. The shift in policy anticipated from the incoming administration could unleash what Morgan Stanley’s Lisa Shalett refers to as “animal spirits,” a term coined to describe the instincts and emotions that drive human behavior in economics. While the prospect of deregulation may be enticing, the potential impact of protectionist policies and tight monetary policy could hinder market performance.

As investors reminisce about the post-election rally of 2016, parallels have emerged between the current market behavior and sentiments at that time. However, with the Federal Reserve signaling fewer interest rate cuts for 2025, skepticism remains about sustaining the momentum seen during the initial trading sessions. While the market has begun the year with remarkable rallies, the sustainability of this trend will depend heavily on geopolitical developments, economic indicators, and continued investor enthusiasm in a landscape shaped increasingly by digital interactions.

The early days of 2025 trading have showcased a blend of optimism and caution. As speculation thrives and social media influences trading decisions, the future trajectory of the market will rely not only on the fundamental health of companies but also on the intricate dance between investor sentiment and emerging trends.