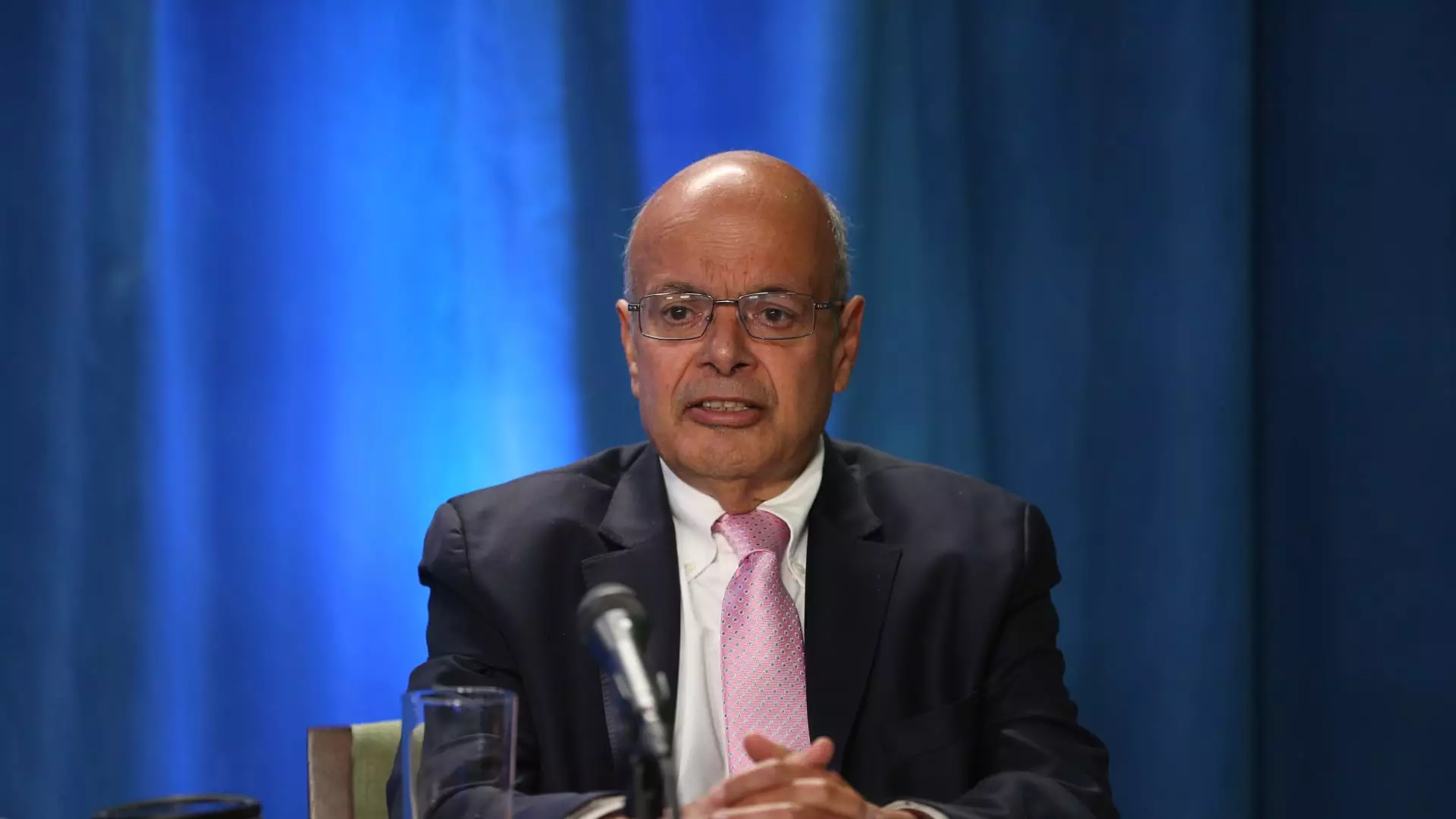

Ajit Jain, a prominent figure in the insurance sector at Berkshire Hathaway, has recently captured attention after liquidating a substantial portion of his stake in the conglomerate. This move, highlighted in a regulatory filing, raises questions about motivations and future implications for both Jain and Berkshire. As the vice chairman of insurance operations, Jain’s financial actions could signal broader market sentiments and strategic business decisions within one of the world’s largest holding companies.

The data reveals that Jain sold 200 shares of Berkshire Class A stock at an impressive average price of $695,418 per share, totaling approximately $139 million. Following this transaction, Jain’s direct ownership has significantly reduced, leaving him with only 61 shares. Additionally, family trusts and his nonprofit organization, the Jain Foundation, hold 105 shares collectively. This sale effectively represents more than half (55%) of Jain’s overall stake in Berkshire, constituting his most considerable reduction since he joined the company in 1986.

Such a dramatic decrease can hardly be viewed as an isolated decision. It’s essential to understand the context: the market price for Berkshire Hathaway shares had recently surged, leading the conglomerate to briefly hit a substantial market capitalization of $1 trillion. Analysts suggest that this high valuation may have prompted Jain to reevaluate his investments, taking advantage of favorable market conditions before potential corrections occur.

The Implications of Market Valuation

David Kass, a finance professor at the University of Maryland, interprets this significant divestment as a potential signal from Jain that he considers Berkshire to be fully valued at current market prices. This perspective resonates with sentiments shared by other market analysts, such as Bill Stone, Chief Investment Officer at Glenview Trust Co., who suggests that Berkshire Hathaway stock is presently trading at about 1.6 times its book value. This price level could indicate that the stock is neither undervalued nor an exceptional buying opportunity, thus discouraging further investments or repurchase activities from the company itself.

The dynamics behind Jain’s sale also correspond with a noticeable drop in Berkshire’s stock buyback activities, which were substantially less in the last quarter compared to previous periods. Such a slowdown may reflect a strategic shift in how Buffett and his executive team are perceiving the company’s current valuation and share performance.

Ajit Jain’s contributions to Berkshire Hathaway are indisputable. Throughout his tenure, he has driven significant advancements within the Reinsurance domain and orchestrated a remarkable turnaround for Geico, the auto insurance giant under the Berkshire umbrella. In 2018, Jain’s position as Vice Chairman of Insurance Operations solidified his standing as a pivotal player in Berkshire’s operations. Warren Buffett himself has repeatedly praised Jain, stating that he has generated tens of billions in value for shareholders, underscoring Jain’s heuristics in navigating complex insurance market dynamics.

However, speculation about Jain’s future role, particularly regarding succession to Buffett, has become a recurring theme. While discussions have illuminated the potential for leadership transitions within Berkshire, Buffett’s recent comments clarify that Jain has no aspirations to lead the conglomerate, deflating prior assumptions of competition between Jain and Greg Abel, another lead executive.

Concluding Thoughts

Ajit Jain’s recent divestment from Berkshire Hathaway is a multifaceted issue encapsulating strategic financial planning and market valuation perceptions. As the landscape of Berkshire continues to evolve, understanding the motivations behind such transactions becomes crucial for investors and analysts alike. Jain’s historical significance and involvement in Berkshire’s insurance operations position him as a critical figure whose decisions could signal broader shifts within one of the world’s most respected conglomerates. The clear takeaway from this event is that even the most seasoned executives are continually assessing their positions and the market environment, highlighting the importance of adaptability in investment strategies.