Warren Buffett, the iconic investor and chairman of Berkshire Hathaway, has made significant changes to his investment strategy regarding Apple Inc. For four consecutive quarters, Buffett has reduced his stake in this tech giant, signaling a shift in both his approach to equity holdings and possibly responding to broader market dynamics. As of September’s end, Berkshire held approximately $69.9 billion in Apple shares, reflecting a remarkable reduction of about 67.2% compared to the same period the previous year. This significant cut, which equates to nearly a quarter of his total stake, has raised eyebrows and sparked debates about the motivations behind such a drastic measure.

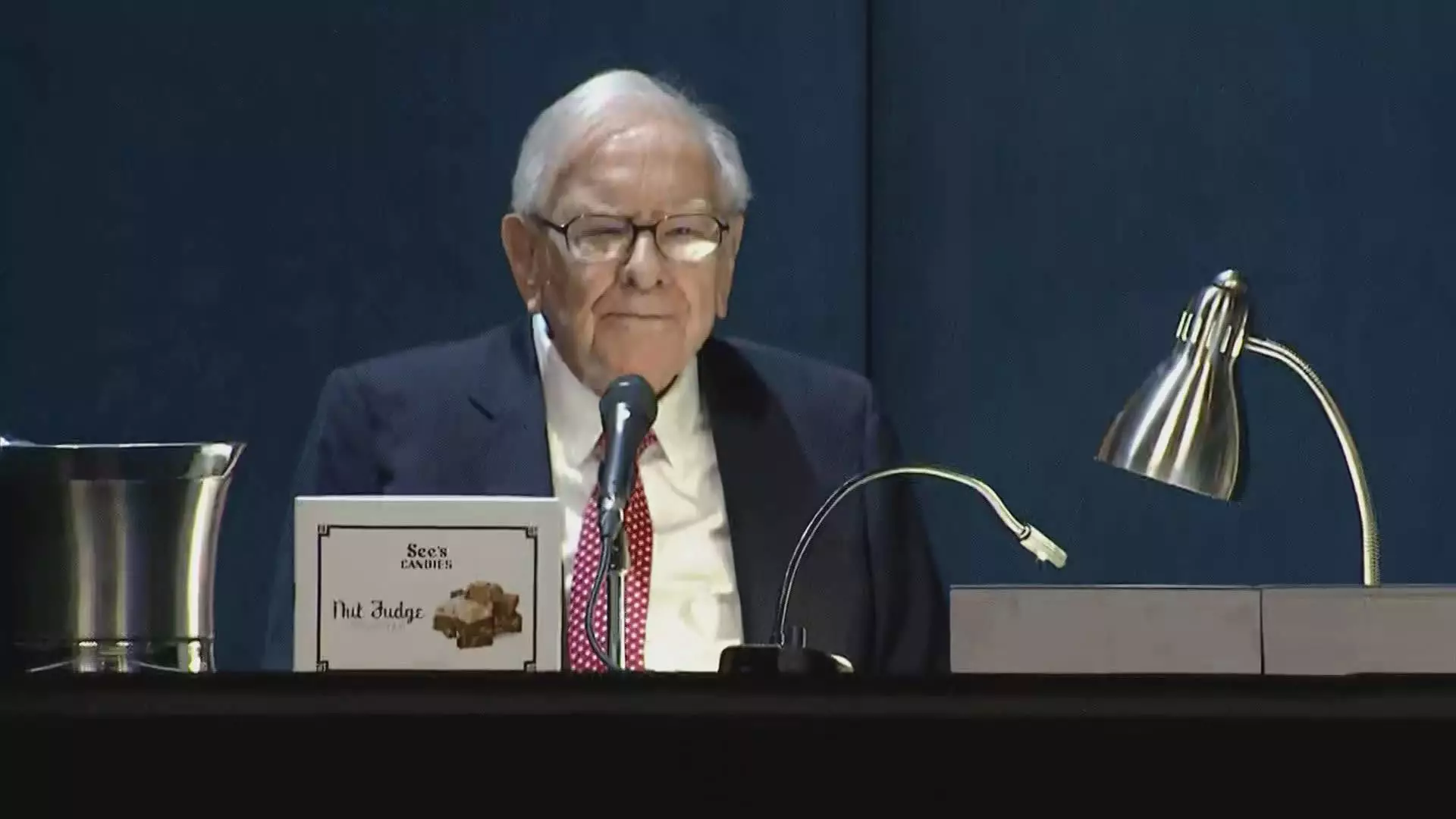

Buffett’s journey with Apple began over eight years ago, yet the recent selloff raises questions about what has prompted such a strategic retreat. Analysts surmise that high valuations of Apple stocks combined with a desire for diversified portfolio management might be at the forefront of this decision. At one point, Apple’s shares constituted as much as half of Berkshire’s entire equity portfolio, which makes its size both an investment strength and a potential risk. Buffett hinted at tax considerations during the latest Berkshire annual meeting, suggesting that anticipated increases in capital gains tax could drive his decision to sell now rather than later. However, the scale of the divestment points towards underlying concerns that extend beyond mere tax strategies.

It is noteworthy that Buffett traditionally steered away from technology investments for most of his career, claiming such endeavors exceeded his realm of expertise. Yet, the allure of Apple and its robust customer loyalty convinced him to invest, a decision initially championed by his investing protégé Todd Combs and Ted Weschler. Over the years, Buffett has often praised Apple, elevating its status within Berkshire to one of the most important assets in the portfolio, second only to his longstanding insurance businesses. His faith in Apple’s innovative approach, particularly its flagship product, the iPhone, propelled it into the heart of Berkshire’s investment strategy.

Interestingly, as Buffett marked down his Apple stake, Berkshire Hathaway’s cash reserves swelled to a staggering $325.2 billion by the third quarter—a record high for the conglomerate. This fiscal positioning opens up numerous possibilities for future investments and financial maneuverability, especially as the company has halted buybacks in the past quarter. Despite Apple showing a healthy 16% increase in its stock price this year, it lags behind the broader S&P 500 index, which has benefited from a 20% uptick, indicating that market pressures may have also influenced Buffett’s decisions to pare down his holdings.

While many ponder whether Buffett’s actions represent a mere reaction to market fluctuations or a more profound change in investment philosophy, what’s clear is that the landscape of his portfolio is in flux. The ongoing reductions in Berkshire’s Apple stake may well reflect a calculated strategy aimed at rebalancing the company’s asset allocation while keeping an eye on future market developments. As Buffett navigates this shifting financial terrain, investors and analysts alike will be keen observers of how these trends unfold in the coming quarters.