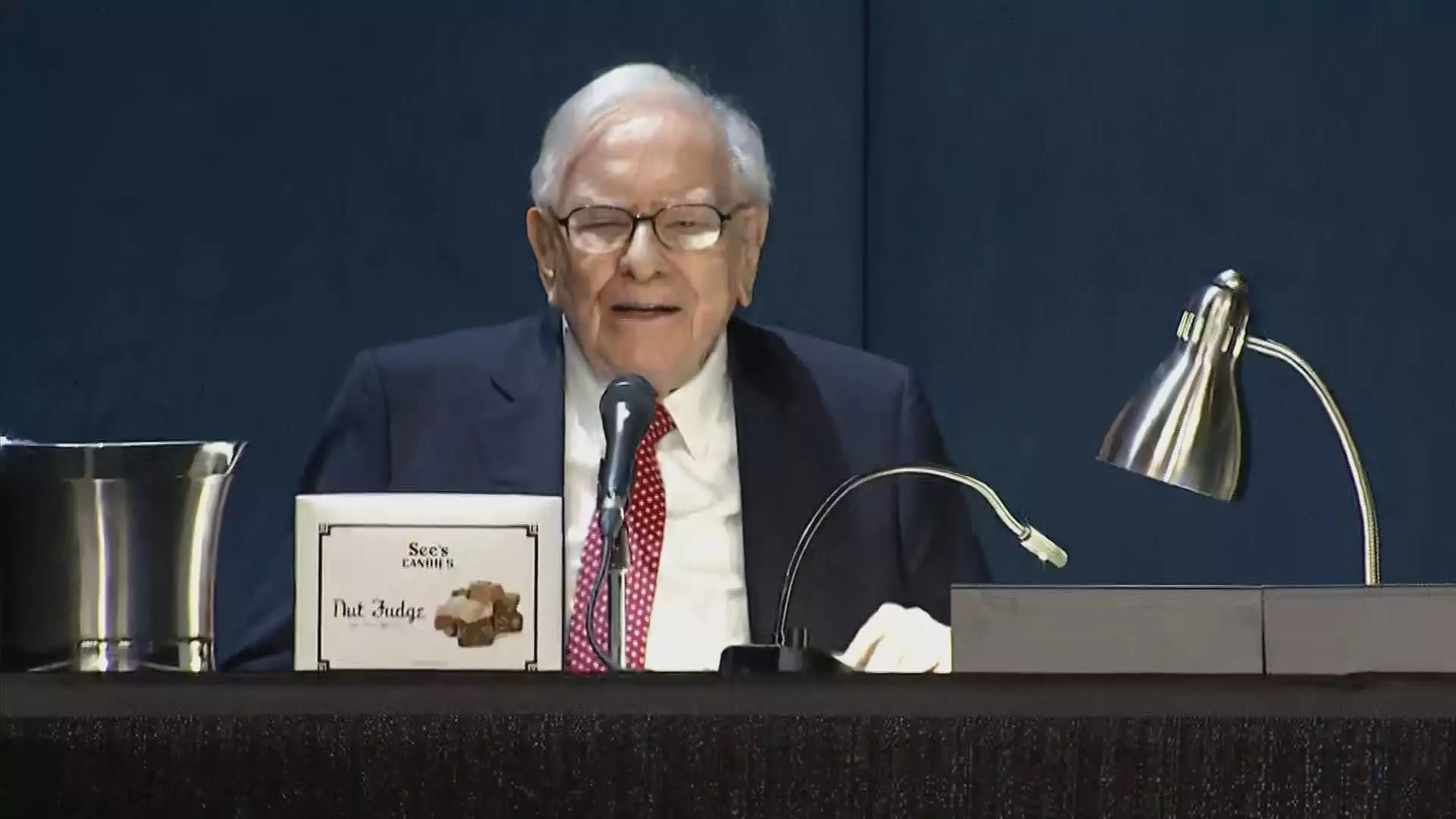

Warren Buffett’s investment strategies have long been a point of fascination and intrigue in the financial world, and recent movements from his investment vehicle, Berkshire Hathaway, only add to this narrative. The conglomerate’s decision to reduce its stake in Bank of America (BofA) signals potential shifts in strategy, market sentiment, and investor confidence. Most notably, since mid-July, Berkshire Hathaway has divested over $7 billion in BofA shares, bringing its ownership down to 11%. This article explores the implications of this sale, the performance of BofA, and the broader market context.

Berkshire Hathaway has reported significant offloading of its Bank of America holdings, shedding approximately 5.8 million shares across three days and generating around $228.7 million in proceeds. This wave of selling constitutes a continuation of a trend that has seen the company sell shares for an extended 12-session stretch, matching a previous selling period from July 17 to August 1. With more than 174.7 million BofA shares sold for a staggering $7.2 billion, Berkshire’s investment in BofA has inevitably changed its position among the company’s top holdings. Once a shining second in Buffett’s investment portfolio, BofA now ranks third behind Apple and American Express.

This decision to divest has provoked critical questions: Is this a reaction to anticipated market pressures, a reevaluation of long-term perspectives on Bank of America, or a simple profit-taking maneuver? Buffett’s history with BofA, which began with a $5 billion investment in 2011, speaks volumes about the rescue and recovery narrative that enveloped the financial industry during the aftermath of the 2008 crash. By converting warrants in 2017 and making additional purchases, Buffett capitalized on what he deemed an undervalued asset at the time.

Market Reactions and Leadership Comments

Bank of America’s CEO, Brian Moynihan, recently made headlines when he commented on Buffett’s selling spree during the Barclays Global Financial Services Conference. According to Moynihan, the true motivations behind Buffett’s actions remain enigmatic. He emphasized that understanding such maneuvers from one of the titans of investment is practically impossible. Nevertheless, Moynihan reassured stakeholders by indicating that the market has successfully absorbed the shares sold by Berkshire, reaffirming the financial health of Bank of America.

His remarks seem to reflect a nuanced understanding of the banking sector’s resilience, despite a slight dip in BofA’s stock, down about 1% since early July but overall up 16.7% for the year. The relatively modest performance of BofA’s stock, particularly as it outgains the S&P 500 average, indicates pervasive confidence in the broader financial sector, underscored by supportive commentary from Moynihan, who has overseen the bank’s growth since 2010.

The legacy of Buffett’s investment in Bank of America is profound; it transformed not only the bank’s trajectory but also underscored Buffett’s status as a stabilizing force during tumultuous market moments. As Moynihan poignantly noted, if investors followed Buffett’s lead when he first invested, they would have capitalized on a low-ball price of $5.50 per share. The current trading closer to $40 signifies an enormous upside and emphasizes Buffett’s reputation for making well-timed, high-risk investments.

However, as Buffett’s strategy evolves, one must consider whether this selling trend reflects a broader reevaluation of his portfolio. The fact that BofA is now overshadowed by Apple and American Express in Berkshire’s holdings signifies a shift that could either be tactical or a mere response to changing market conditions.

As Berkshire Hathaway edges away from what was once a cornerstone investment, the implications for both entities are manifold. For Buffett, the potential reassignment of capital may pave the way for new investment avenues, while for Bank of America, the reassurance provided by Moynihan indicates ongoing confidence despite the selling pressure. The market remains attentive, and future actions from Buffett will certainly be closely scrutinized, as his investment decisions have a considerable impact not just on specific companies, but also on broader economic sentiments. As the financial landscape continues to evolve, both Berkshire Hathaway and Bank of America will remain central figures to watch.