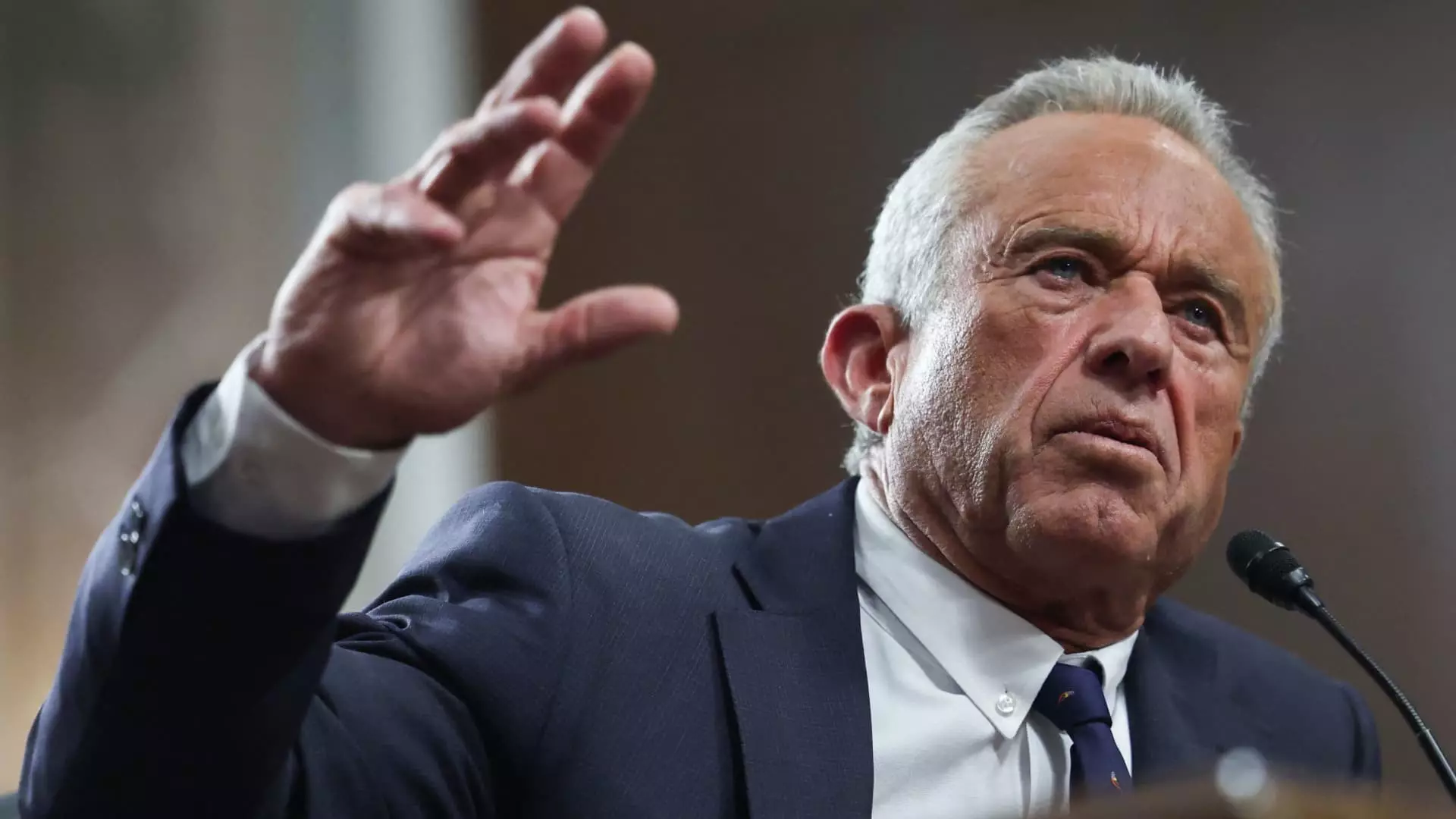

As of 2024, the alarming statistic of Americans’ credit card balances reaching a staggering $1.17 trillion has caught the attention of financial experts and the public alike. This figure signifies a broader trend where individuals across various economic strata, including the wealthy, are increasingly reliant on credit. The case of Robert F. Kennedy, Jr., who reportedly carries between $610,000 and $1.2 million in credit card debt, exemplifies this unsettling reality. Despite an estimated net worth of around $30 million, Kennedy’s struggles with maintaining such high balances raise critical questions about financial management and decision-making in affluent circles.

This surge in credit card debt reflects more than just individual situations; it underscores a societal trend influenced by various factors including inflation, rising living costs, and altered consumer behaviors. Financial analysts indicate that ongoing credit card debt has increasingly become a coping mechanism for many Americans navigating a challenging economic landscape.

Mary Schulz, chief credit analyst at LendingTree, pointed out that inflation has considerably diminished many people’s financial flexibility, compelling them to treat credit cards as a makeshift emergency fund. This shift in consumer behavior is particularly concerning; when financial emergencies arise, the response often defaults to reliance on credit, rather than exploring alternative savings or spend management strategies.

Many Americans may not recognize the long-term repercussions of sustaining such hefty credit balances. They tend to overlook the accumulating interest that makes repayment not just arduous but sometimes insurmountable. For instance, analysts contended that if Kennedy were to pay off a lower estimated balance of $610,000 at a rate of $50,000 per month, it would still take him approximately 15 months, accumulating around $93,000 in interest charges alone. In stark contrast, if he attempted to tackle the maximum estimated debt of $1.2 million under the same payment plan, he would require over two-and-a-half years, racking up nearly $434,000 in interest.

These figures illustrate why financial experts stress the importance of being proactive in debt management. As Kennedy represents a wealthier demographic, his situation prompts broader inquiries into the financial habits of high-income individuals, many of whom similarly struggle with long-term credit debt.

Interestingly, higher-income groups have been shown to be more inclined to carry long-term credit card balances. Recent data indicates that 59% of borrowers earning $100,000 or more have been in credit card debt for at least one year, with 24% trapped for five years or more. This trend raises critical questions about financial literacy among the affluent. An excess of credit available—a result of higher earnings—can lead to complacency, encouraging overspending and a false sense of security regarding one’s ability to manage debt.

General estimates indicate that American credit card borrowers carried an average balance of $6,380 in 2024. The mounting pressure of high interest rates, currently averaging 20.13%, further complicates financial landscapes for both affluent consumers and lower-income households. Many financial advisors recommend that for borrowers, prioritizing debt repayment over other financial aspirations makes strategic sense, especially when faced with exorbitant interest charges.

High-net-worth individuals, like Kennedy, may benefit from alternative borrowing mechanisms better suited for substantial expenses. For large purchases, utilizing established lines of credit can be more advantageous than credit cards, which often come with high fees and interest rates. Experts, including certified financial planner Charlie Douglas, argue that maintaining liquid assets—equivalent to one year’s worth of expenses—can serve as a buffer against the unpredictability of market fluctuations or unexpected large expenditures.

Additionally, wealth management strategies should focus on minimizing unnecessary debt, advocating approaches that encourage wealth preservation through careful spending, and informed investment decisions. The contextual framework of managing credit must evolve alongside changing economic climates to ensure that individuals cultivate long-term financial stability.

As consumer credit card debt reaches unprecedented levels, understanding the implications of such borrowing becomes essential for all personalities across the income spectrum. Whether wealthy or struggling, Americans face the challenge of navigating a complex financial landscape that can easily lead to overwhelming debt. The stories of individuals like Robert F. Kennedy, Jr. offer critical lessons in financial management, emphasizing the importance of prioritizing debt repayment, embracing alternative credit strategies, and ensuring financial literacy. Ultimately, creating a culture of informed spending and robust financial planning could provide a pathway out of the debt cycle currently ensnaring millions.