In recent days, the Federal Reserve’s lavish renovation project has become a symbol of fiscal arrogance and unchecked government excess. The reported $2.5 billion price tag for refurbishing the central bank’s headquarters is not just a reflection of poor management—it is a glaring indictment of a system that has lost all sense of economic prudence. This spectacle of spending, often cloaked in bureaucratic jargon, exposes a deeper malaise: the tendency of powerful institutions to prioritize spectacle and elite privilege over accountable governance and the public good.

What particularly stings is the blatant disconnect between the costs incurred and the supposed purpose of such renovations. Labeling the project a “palace” might be seen as an insult to historic architecture; however, it’s a fitting metaphor for a culture obsessed with grandeur at the expense of responsible stewardship. Most Americans, facing rising living costs and stagnating wages, rightly question why their government sees fit to indulge in such monumental displays of opulence, especially when those funds could alleviate actual economic hardship.

The ongoing inquiry by the Office of Management and Budget is a necessary countermeasure to this veneer of legitimacy. Yet, it’s equally a reflection of the broader failure of oversight that allowed such an extravagance to unfold unchecked for so long. It raises uncomfortable questions: Who benefits from this waste? Is the public being served, or are these renovations merely a playground for political and financial elites to project their dominance? The size and scope of this project underline a dangerous trend where institutions serve their own interests rather than the nation’s.

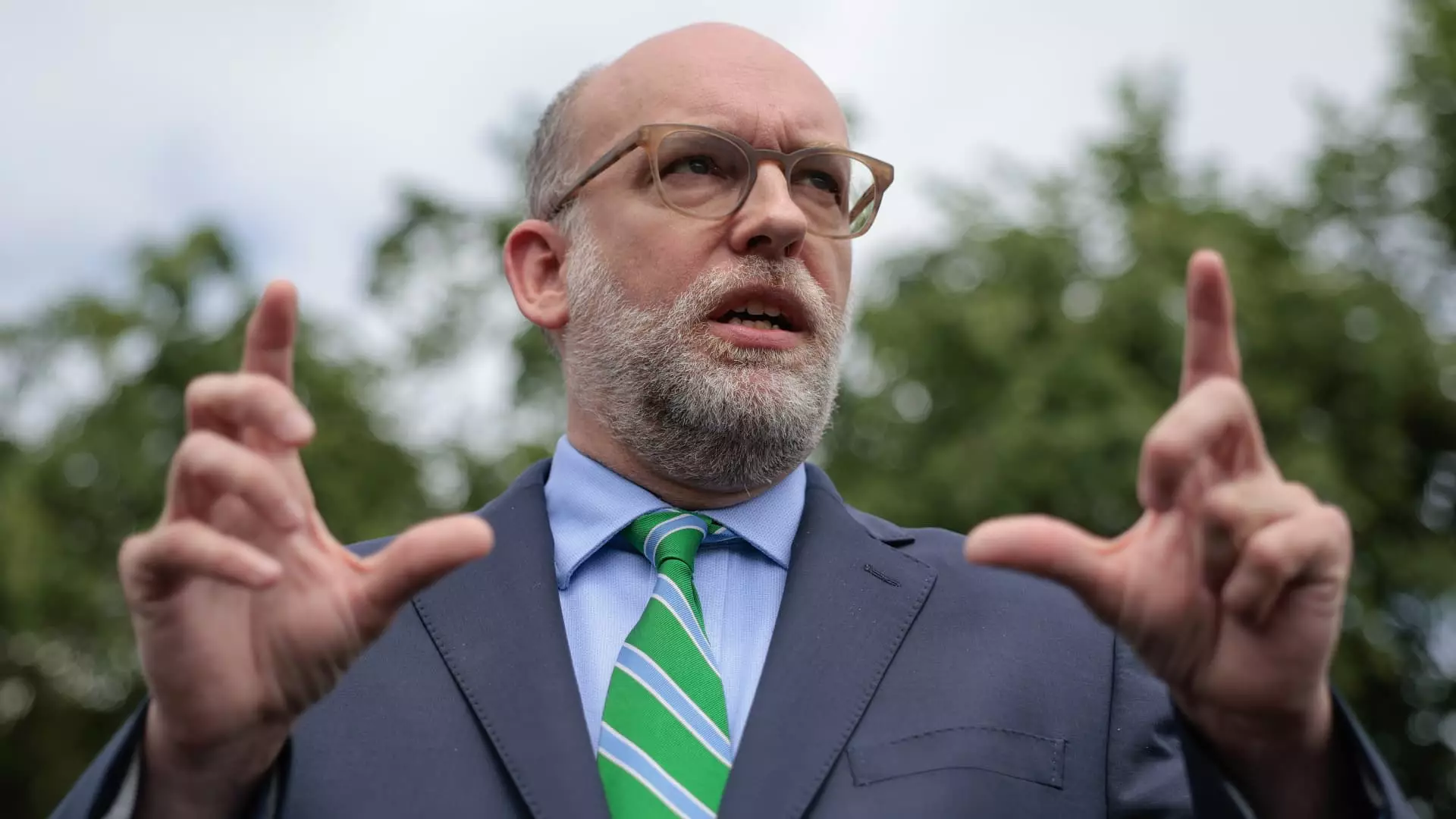

The Political Circus Surrounding Jerome Powell

The feud between President Trump’s administration and Federal Reserve Chair Jerome Powell is more than just political theatrics—it’s a manifestation of the deep mistrust that wealth and power breed in modern governance. Vought’s accusations of “gross mismanagement” push the narrative that the Fed is wantonly wasting taxpayer resources to satisfy its own excesses. While the details of the renovation are technically within the Fed’s purview, the timing and tone of these criticisms suggest a broader strategy: to weaken Powell’s authority and justify political interference.

Trump’s relentless attacks on Powell’s interest rate policies reveal a government that struggles to balance sound economic judgment with political expediency. The insistence that rates should be cut—regardless of economic reality—serves as a distraction from deeper issues: a central bank trying to navigate a complex economic landscape under undue political pressure. Powell’s insistence on independence is vital, but the mounting accusations threaten to undermine that independence by turning the Fed into a pawn in partisan power struggles.

This politicization of the Fed illustrates how executive branch interests seek to control monetary policy for short-term political gains rather than long-term economic stability. It also reflects a troubling trend of wielding accusations of mismanagement as tools for political dismissals. When the legitimacy of a central bank becomes entangled in accusations of mismanagement—whether about a building project or interest rate policy—it erodes public trust in the institution at a time when sound monetary policy is most crucial.

The Illusion of Accountability and the Cost of Power

It’s essential to recognize that the Fed, despite its claims of independence, operates within a complex web of political influences. The recent appointments of allies with direct ties to the White House inject further suspicion about the institution’s integrity. Such moves threaten to politicize the central bank’s decision-making process, which has long been a foundation of its credibility.

Furthermore, the legal status of the Fed complicates this narrative. Its autonomy from direct congressional oversight is constitutionally designed to shield it from political swings, yet this independence can be exploited for personal or institutional gain. The lavish renovations symbolize that the Fed, while autonomous, is not immune from the impulses of a system driven by power and privilege.

The situation raises profound questions about the future of monetary governance. If such extravagant spending is allowed to continue unchecked, it risks normalizing a culture where institutions operate above accountability, shielded by legal protections and political allegiances. It’s a perilous path towards a centralized authority that values its own comforts over the well-being of the broader society.

Ultimately, the controversy surrounding the Federal Reserve’s renovation project and Powell’s leadership is a mirror reflecting deeper societal issues: the prioritization of power and wealth over transparency and accountability. If we, as a nation, continue to accept the spectacle of unchecked spending by our institutions, we betray the very principles of democratic governance. It is time to demand a political culture rooted in responsibility rather than excess, and institutions that serve the public rather than their own opulent enclaves.