The announcement of Donald Trump Jr.’s appointment to the board of PSQ Holdings has triggered a remarkable response in the stock market, exemplifying how celebrity affiliations can dramatically influence investor perceptions and stock performance. On the day the news broke, shares of PSQ Holdings, which oversees the online marketplace PublicSquare, experienced a staggering increase of up to 185% in just a few hours of trading. This spike is a vivid illustration of the volatility that can result from high-profile endorsements, particularly in sectors sensitive to political and ideological affiliations.

PSQ Holdings operates within the commerce and payments space, emphasizing principles aligned with “life, family, and liberty.” Its focus positions it uniquely in a marketplace increasingly shaped by consumer preferences for brands that they perceive as aligned with their values. With a market capitalization of just $72 million as of the previous trading session, PSQ is categorized as a microcap stock, suggesting that fluctuations in its valuation can be particularly pronounced. The company reported a net revenue of $6.5 million against operating losses exceeding $14 million for the September quarter, painting a picture of a business still navigating its path to profitability.

Michael Seifert, the chairman and CEO, has framed Trump Jr.’s involvement as pivotal for the company’s aspiration to create a “cancel-proof” economy. Such terminology resonates with a segment of the population that fears ideological censorship in today’s digital landscape. This narrative not only reinforces brand loyalty but also attempts to attract investors who seek a sense of community aligned with specific political ideals.

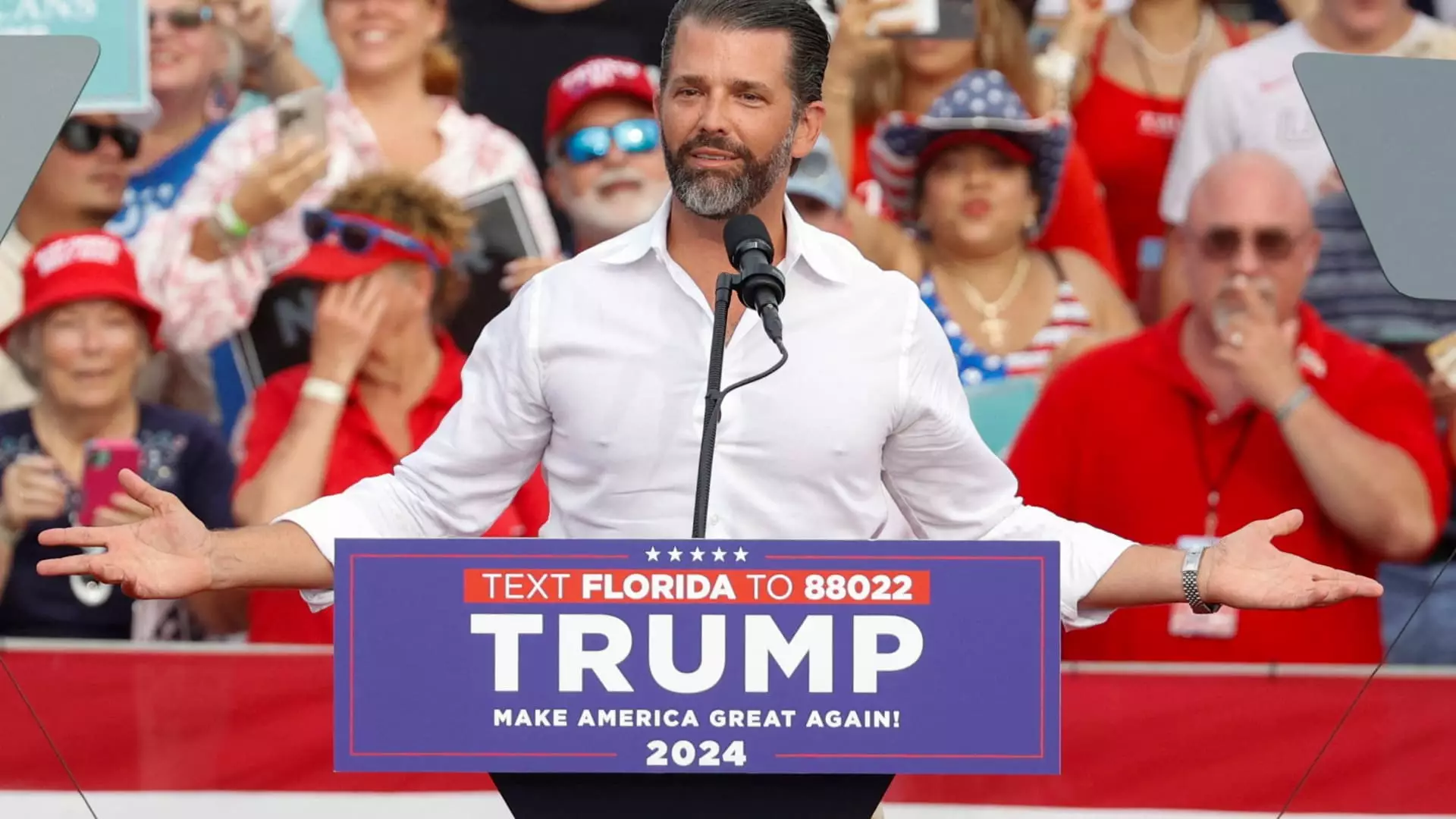

Trump Jr.’s prior experience as an investor in PublicSquare precedes this board appointment, which may lend some credibility to his role. His statements upon joining point to an emphasis on liberty and marketplace growth, which, while compelling, encapsulate a broader trend where conservative values are employed as a branding strategy. This strategy could attract both investment and consumer loyalty, particularly among demographics disenchanted with mainstream economic enterprises perceived as left-leaning.

Moreover, this instance isn’t an isolated case; just a week prior, Trump Jr. catalyzed a 100% increase in shares of Unusual Machines, a drone manufacturing company, following his board appointment there. Such consistent patterns of behavior indicate a possible trend where Trump Jr.’s name recognition is strategically leveraged to boost company visibility and stock performance.

In light of the recent stock rally, it’s notable that PSQ board member Kelly Loeffler, a former U.S. senator, significantly invested in the company, acquiring 1.2 million shares shortly before the stock surge. This potential alignment of insider investment with market performance raises concerns about the ethics of trading based on non-public information and the influence of regulatory bodies in maintaining market integrity.

As PSQ Holdings moves forward with an enhanced board comprising individuals with strong ties to conservative movements, the company faces both opportunities and challenges. It is imperative for the management to ensure that growth is sustainable, balancing the pursuit of profit with the ideals that attracted such significant endorsements in the first place.

The interplay between celebrity connections and financial markets underscores a growing trend where ideological and social values can dictate stock performance, making the landscape increasingly complex for investors and companies alike. As PSQ navigates this nuanced terrain, its ability to leverage its unique position while ensuring fiscal responsibility will determine its ultimate success in a fiercely competitive environment.