In recent times, Advanced Micro Devices (AMD) has cultivated a narrative of robust growth and technological dominance. The company’s latest earnings report, however, exposes a stark discrepancy between its optimistic projections and the turbulent geopolitical landscape that threatens its future. While AMD touts a 32% rise in revenue to $7.69 billion—surpassing analyst estimates—it’s essential to scrutinize the fragility behind those numbers. The company’s reliance on a burgeoning data center segment hints at a possible overconfidence rooted more in market hype than in sustainable growth.

Despite reporting strong figures, AMD’s stock declined sharply—over 5%—by the close, reflecting investor skepticism about the company’s ability to sustain momentum amidst regulatory hurdles. A closer look at the dynamics reveals that AMD’s high-flying narrative is increasingly intertwined with geopolitical maneuvers, particularly U.S.-China relations and export controls. This environment injects unpredictability into AMD’s operational outlook, challenging the notion that continued growth is guaranteed.

Regulatory Roadblocks and the Mirage of Market Expansion

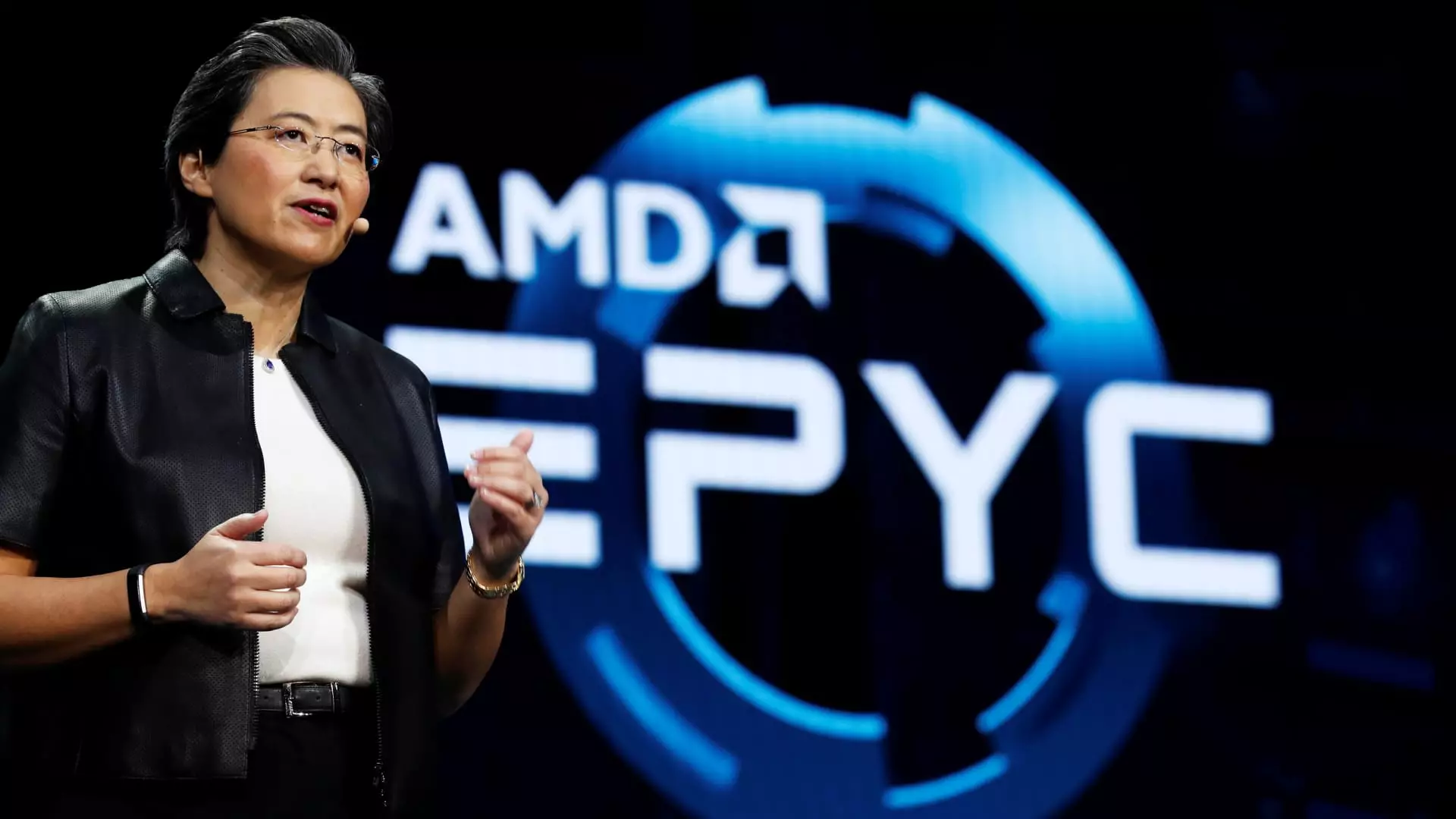

The core concern stems from U.S. restrictions on exporting certain advanced chips to China, which have already inflicted measurable damage—an $800 million hit in the second quarter. AMD’s CEO, Lisa Su, acknowledged this headwind, emphasizing that U.S. export restrictions effectively halted sales of critical AI chips to China, a vital part of the company’s strategic portfolio. The company’s current guidance does not even factor in revenues from its MI308 AI chip designed for the Chinese market, implying that the most lucrative segment remains on hold.

This sector-specific vulnerability underscores a fundamental flaw in AMD’s growth assumptions: dependence on international markets which are now politically embattled. The planned resumption of shipments depends on approval from the Department of Commerce—a process that remains opaque and uncertain, with analysts describing the timeline as “vague.” Such ambiguity is perilous for an investor base already wary of overestimating the immediate rewards of global expansion.

The Threat of Overextension and Internal Struggles

Meanwhile, AMD’s core growth driver—the data center business—while impressive with a 14% jump to $3.2 billion, is not immune to skepticism. Analysts at Goldman Sachs question whether AMD can maintain scale in the GPU space amid rising operating expenses. The company’s necessity to ramp up software and system support to support its hardware offerings signals mounting operational costs, which could erode profitability.

Furthermore, AMD’s optimistic outlook hinges on an “inflection point” in the third quarter, contingent upon large customers’ compute demands. However, such predictions often serve more as rallying points for optimistic investors rather than concrete evidence of future trends. The ever-growing operating expenses, combined with inventory risks and uncertain revenue from China, form a perfect storm that could undermine the company’s financial stability in the long run.

The Illusory Power of Market Opportunities

AMD projects a massive market opportunity—over $500 billion in the coming years—yet this figure appears to be more aspirational than grounded. The company’s strategic focus on gaming, AI, and data centers is promising but is also fraught with uncertainty born from geopolitical tensions and technological competition. The claim that the data center segment will be the main growth driver is compelling, but it oversimplifies the complex factors at play—including pricing pressures, technological race, and regulatory hurdles.

For a center-wing liberal perspective, AMD’s case exemplifies the delicate balance between fostering innovation and navigating the geopolitical minefield that now defines global technology trade. The company’s optimistic forecasts could serve as a distraction from the very real risks posed by shifting alliances, national security considerations, and the potential decoupling of major economies. If anything, AMD’s financial performance and strategic positioning reveal the fragility of assuming perpetual growth without addressing these fundamental challenges.

While AMD’s numbers may seem impressive on the surface, a critical examination reveals that their seeming prosperity is built on shifting sands. The company’s future depends as much on geopolitical stability as on technological innovation, and current optimism risks blinding investors to the storm clouds gathering on the horizon.