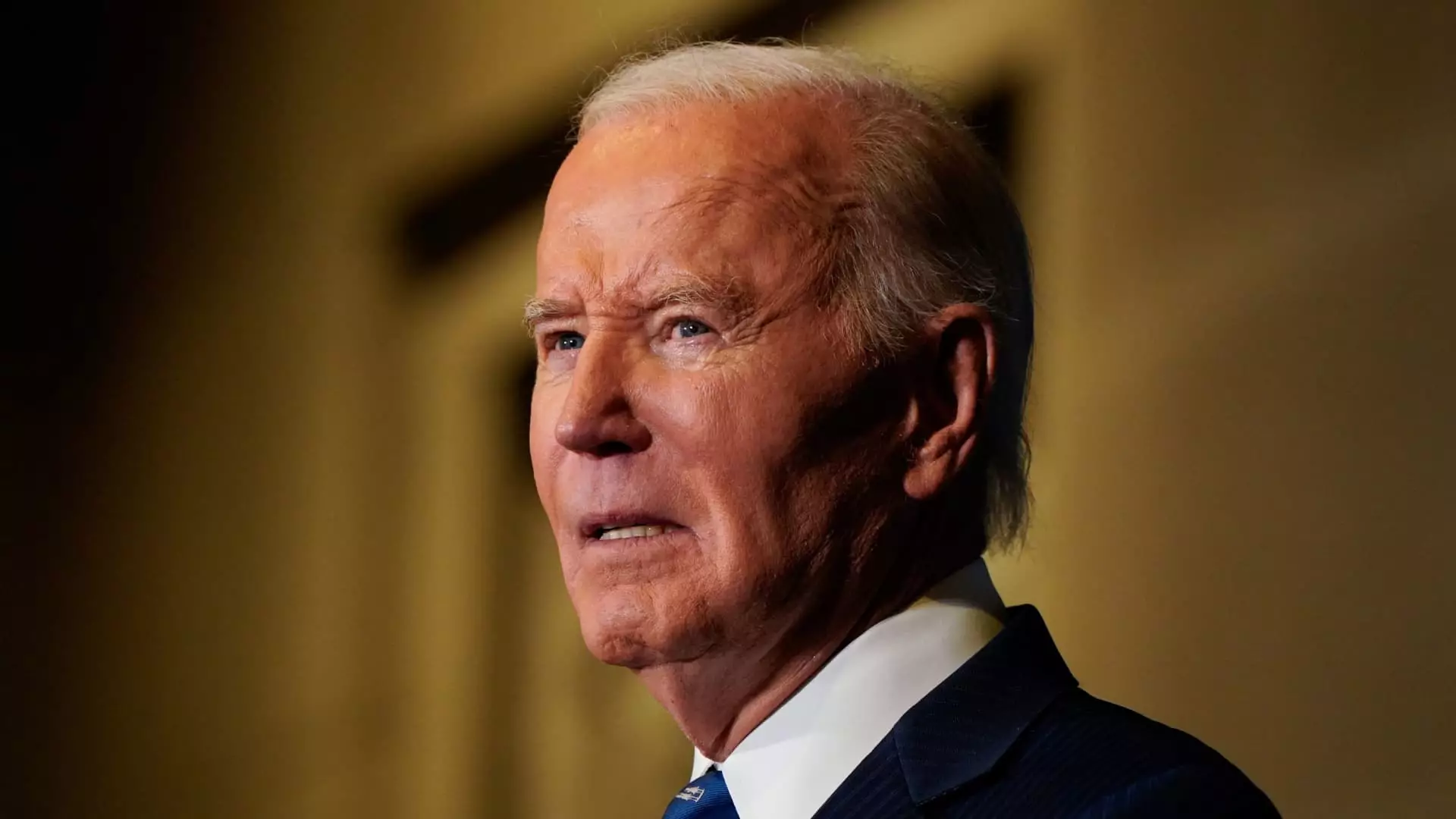

The abrupt withdrawal of significant student loan forgiveness initiatives by the Biden administration raises critical questions about the future of educational debt relief in America. Just weeks before the anticipated transition of power to President-elect Donald Trump, the U.S. Department of Education announced the cessation of two major plans aimed at alleviating the financial burdens of millions of borrowers. These proposals were intended to empower the secretary of education to cancel the loans of specific groups, including long-term borrowers and those grappling with financial hardships. The decision to pull back these initiatives, described as a response to “operational challenges,” suggests that the administration has recognized the impending obstacles presented by a potentially unsupportive administration.

This decision undeniably affects a vast demographic of American borrowers. The implications were felt particularly acutely by individuals who have been repaying their loans for decades without relief or hope for a brighter financial future. In their announcement, the Education Department mentioned a reallocation of resources towards assisting “at-risk borrowers” in returning to repayment; however, many stakeholders view this redirection with skepticism. Critics argue that this shift aims to sidestep the larger issue of rising student debt, which continues to plague economic mobility for many.

Experts in higher education, such as Mark Kantrowitz, asserted that the administration’s awareness of the new administration’s hostile stance on student loan forgiveness played a role in its decision. Trump’s opposition to such initiatives was no secret; during his campaign, he labeled Biden’s plans as “vile” and questioned their legality. The unfolding political landscape has stifled what was perceived as a promising lifeline for those in financial straits due to educational debts.

The backlash to the withdrawal of the proposed policies reflects a broader concern among borrowers regarding their financial future. Consumer advocacy groups, including the Student Borrower Protection Center, expressed deep disappointment. The disappointment is rooted in the stark reality that millions could have benefited from relief measures designed to reduce or eliminate student debt burdens. Advocates like Persis Yu argue that the proposed measures had the potential to create a pathway for economic improvement for many families and individuals trapped in the cycle of debt.

As borrowers brace for the transition of power, they are increasingly aware of the limitations of the existing loan forgiveness programs. While options like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF) continue to be available, they cater to specific groups and may not address the urgency faced by a broader range of borrowers. PSLF, for instance, requires individuals to make ten years of on-time payments to qualify for loan cancellation, which may feel insurmountable for many.

Limited Options amidst Uncertainty

Despite the setbacks in broader forgiveness efforts, the Education Department has asserted its commitment to providing alternatives for struggling borrowers. Recently, they announced the forgiveness of an additional $4.28 billion in loans for nearly 55,000 public service workers through PSLF, signaling that even within a constrained environment, support remains for those in designated roles. This approach, however, raises questions about sustainability and scalability as future administrations come and go.

Elaine Rubin from Edvisors highlights the anxiety surrounding the PSLF program, indicating that any drastic change to it would necessitate Congressional involvement. This serves as a reminder that the legislative framework supporting such programs is not immutable; it could be rendered ineffective by future policy changes. For borrowers seeking assistance, resources like Studentaid.gov remain crucial, while databases like that of the Institute of Student Loan Advisors provide localized information on forgiveness programs available via state-specific initiatives.

Looking Ahead

As we navigate through this complex landscape, the commitment to addressing the student debt crisis remains paramount. The withdrawal of large-scale forgiveness plans necessitates a critical evaluation of existing frameworks and their efficacy amidst a shifting political environment. Borrowers must remain vigilant and informed about their options while advocating for policies that align with their needs. As the landscape evolves, ensuring educational accessibility and debt relief will be crucial for fostering economic stability in the years to come.