In the dynamic world of music publishing and copyright management, Reservoir Media stands out as a pivotal player. As an independent music royalty company, Reservoir Media has made a significant mark since emerging from private ownership to the public market in July 2021. It operates through two core segments—Music Publishing and Recorded Music—both of which contribute to its robust portfolio of over 130,000 copyrights and 36,000 master recordings. This article delves into the company’s business model, market performance, and the ongoing conversation surrounding its strategic future.

Reservoir Media’s operations are categorized into two primary segments: Music Publishing and Recorded Music. The Music Publishing segment focuses on acquiring interests in music catalogs and forming agreements with songwriters to generate royalty income. With a catalog boasting works from influential artists like Joni Mitchell and John Denver, this segment is foundational to the company’s identity.

On the other hand, the Recorded Music segment emphasizes the discovery of emerging artists, as well as the marketing and distribution of sound recordings. The interplay between these two segments allows Reservoir to capitalize on various revenue streams and maintain a diverse catalog, contributing approximately 66.41% and 29.25% of the total revenue, respectively. The company’s growth trajectory reflects a year-over-year revenue increase, showcasing its ability to harness the stability of classic hits while adapting to the evolving demands of the music industry landscape.

In terms of financial performance, Reservoir Media has demonstrated impressive growth metrics. The year-to-date gross profit surged from $47.39 million to $89.38 million, highlighting nearly double growth since its first earnings report in March 2021. Such figures are not just winds of change; they underscore a broader trend in the music industry—the rise of subscription streaming services. As of 2023, the subscription streaming sector has grown by 11.2%, amassing approximately $14 billion in revenue. This growth has been beneficial for Reservoir, which sees streaming revenues account for around 54.17% of overall revenue from its music catalog.

Despite these positive indicators, the stock performance reveals a more complex narrative. Since its SPAC debut, Reservoir Media’s share price has declined by 22.24%, a statistic that raises questions about market perceptions and investor sentiments towards the company.

The investment landscape surrounding Reservoir Media has attracted attention from activist investors, notably Irenic Capital. Founded by industry veterans, Irenic has taken a keen interest in Reservoir Media, publicly urging the company to conduct a strategic review and potentially consider a sale. This plea aligns with common activist strategies but highlights a critical juncture for Reservoir, which operates as a collector of royalties rather than a traditional operating company.

With Irenic holding an 8.14% stake in Reservoir, the dialogue has ignited broader discussions about the company’s trajectory. The investor activism particularly underscores the tension between the stability of royalty streams and the anticipated growth that seems stifled under the current public profile. Irenic’s perspective advocates for considering a sale to capitalize on current market conditions and maximize shareholder value.

Reservoir Media faces challenges typical of companies transitioning from private to public environments. One central issue involves the perceived value of its assets. Trading at a multiple of 8-9 times net publisher’s share, the disparity with peers indicates a potential undervaluation. This situation raises the question: should Reservoir pursue acquisitions using its stock, or would it be wiser to consider a buyout?

A recent precedent in the industry occurred when Hipgnosis was acquired by Blackstone for a substantial multiple, indicating a potential interest from financial buyers in music catalogs of this nature. However, Reservoir’s unique ownership structure—particularly the Khosrowshahi family’s significant stake—adds another layer of complexity, making the company less appealing as a target for confrontational activism.

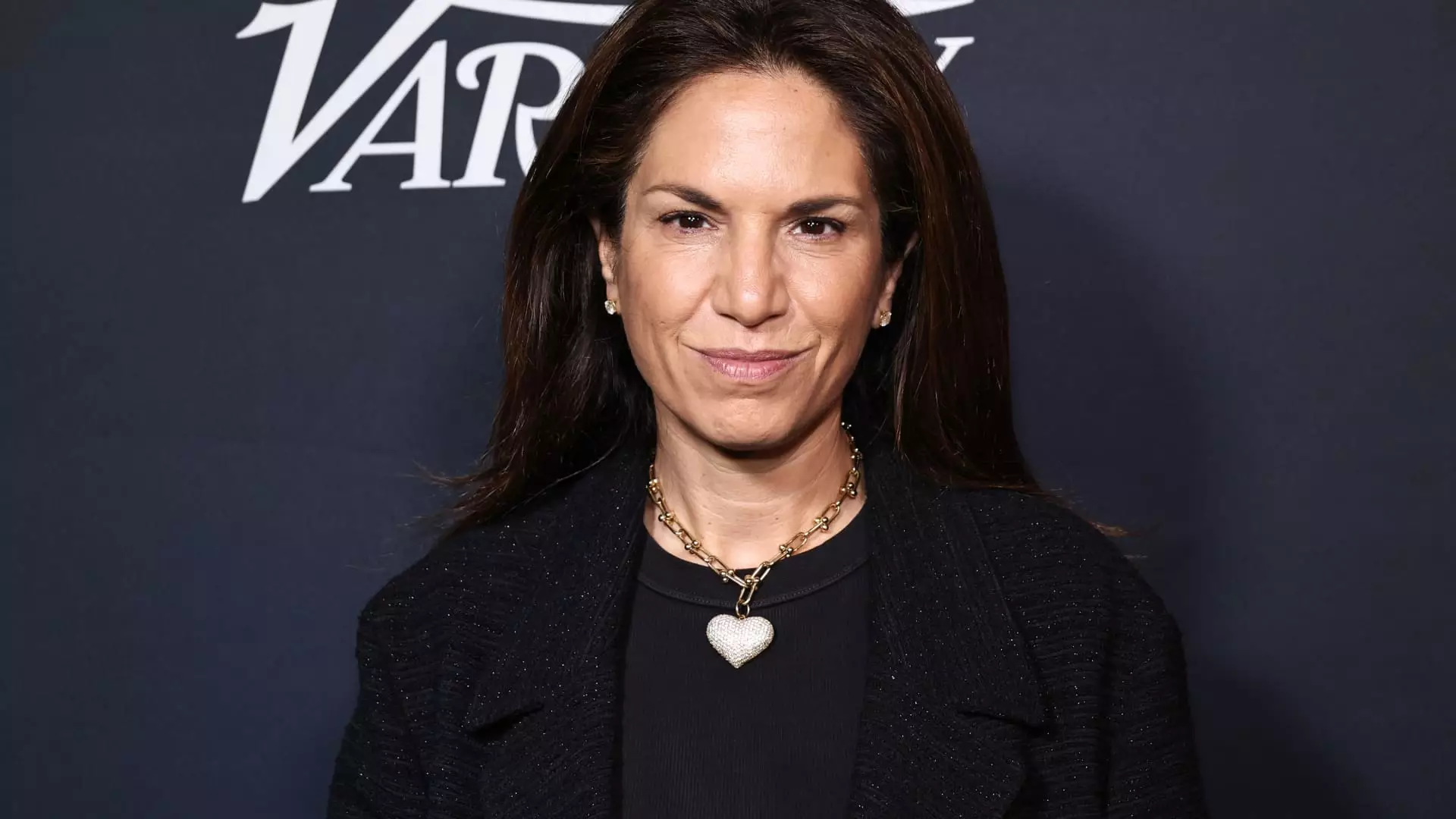

Despite these hurdles, the management team, led by CEO Golnar Khosrowshahi, is acknowledged for their excellent stewardship in navigating the company through this transition. As Reservoir maintains its course, potential collaborative efforts among major stakeholders could facilitate strategic transitions that honor existing interests while amplifying growth.

Reservoir Media stands at a crossroads in the evolving music publishing landscape. While the company possesses a robust catalog and impressive growth metrics, the current market sentiment and activist pressures pose significant challenges. As discussions around strategic reviews unfold, Reservoir must deftly navigate the complexities of its unique position, balancing the promise of future growth against the realities of the music industry’s intricate dynamics. Moving forward, the company’s ability to adapt to market demands while leveraging its assets will ultimately determine its path in this ever-shifting terrain.