China’s real estate sector is currently at a critical juncture, prompting government officials to take vigorous measures to address escalating economic concerns. The recent announcement by the Ministry of Housing and Urban-Rural Development to expand its “whitelist” for real estate projects and significantly increase bank lending signals an urgent attempt to stabilize a beleaguered market. This strategic move aims not only to support incomplete housing projects but also to restore confidence among homebuyers in a sector long haunted by financial instability.

Introduced in January, the “whitelist” initiative allows city governments to fast-track recommendations for residential projects, thereby facilitating quicker access to financial resources from banks. As officials from various financial regulatory bodies explained, the planned increase in lending to a staggering 4 trillion yuan (approximately $561.8 billion) by the end of 2024 indicates a focused strategy to complete unfinished residential projects. With 2.23 trillion yuan already pledged, this expansion is expected to enhance liquidity and provide much-needed support to developers who have struggled under the weight of prior financial restrictions.

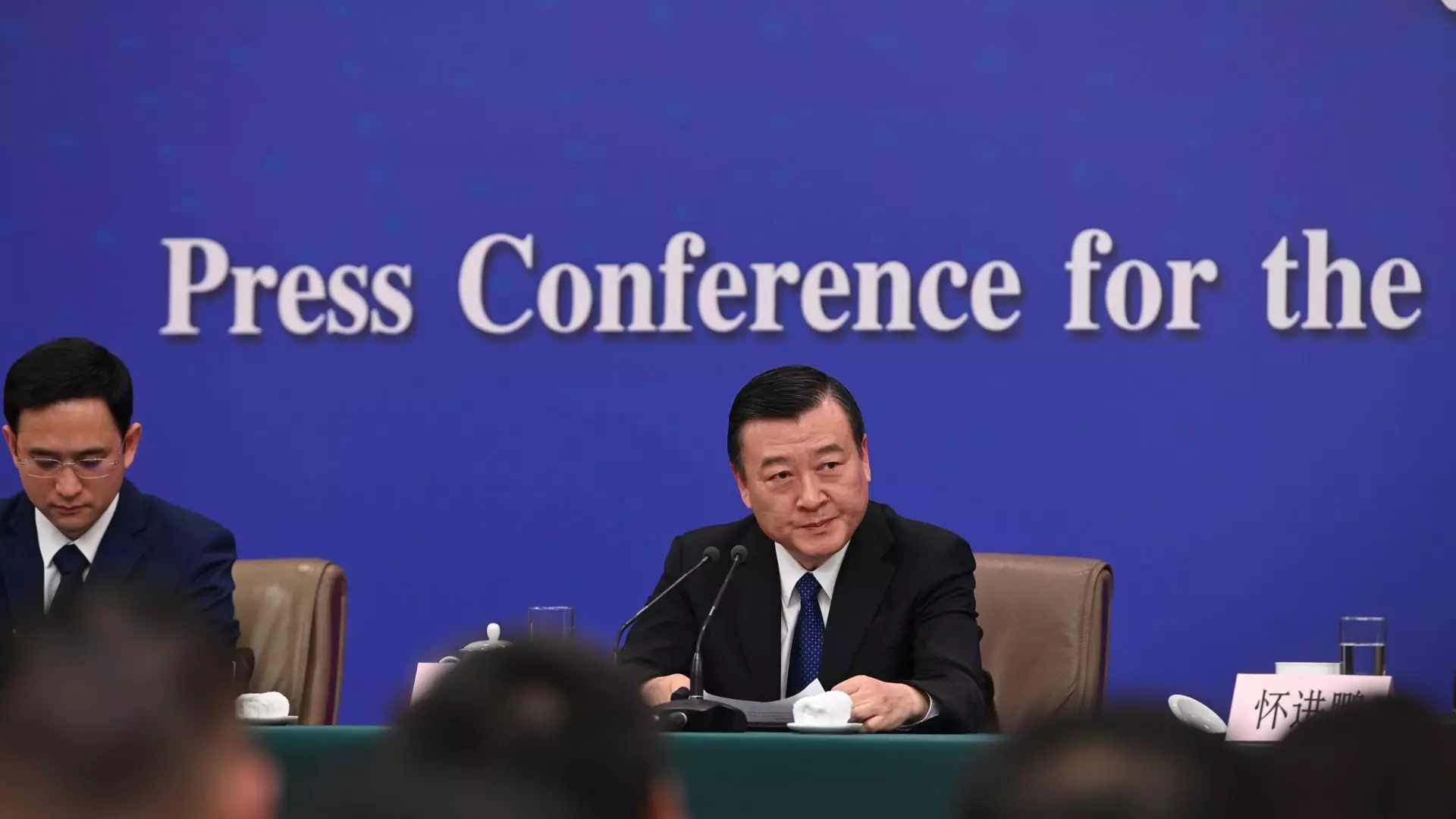

The housing ministry’s vice minister, Xiao Yuanqi, emphasized the need for banks to expedite funding distribution, a move that could prevent further economic slowdown by allowing developers to complete homes and deliver them to anxious buyers. This urgency underscores the government’s understanding of the significant role that the real estate market plays in the greater Chinese economy.

While the increased focus on the real estate sector is crucial, it is essential to recognize that the government is adopting a multi-faceted approach to economic recovery. Recent monetary policy adjustments, including a 50 basis-point cut in the reserve requirement ratio announced by Pan Gongsheng, govern the amount of liquidity banks must hold. Additionally, lowering down payment requirements for second-home purchases from 25% to 15% is likely to stimulate demand in a market where buyer confidence has been severely eroded.

These initiatives need to be viewed in conjunction with broader economic factors. Various government officials, including President Xi Jinping, have publicly expressed the need to halt declines in the real estate market and initiate a stable recovery. The call for comprehensive corrective measures highlights an understanding that real estate is an essential pillar within a complex ecosystem that supports multiple economic sectors.

Despite these encouraging announcements, many investors expressed skepticism about the effectiveness of the government’s measures. Following the briefing, the CSI 300 real estate index fell sharply, indicating a lack of confidence among market participants who are yet to be convinced that these stimulus measures will yield substantial improvements. Economic observers have pointed out that while these adjustments may provide immediate relief, translating sales volume growth into tangible investment and construction activity may take considerable time.

The persistent volatility in the Chinese stock market amplifies uncertainties surrounding the real estate sector. Many are questioning whether the government’s latest interventions will be enough to restore investor faith or whether they simply amount to rehashing old policies without addressing root issues. As Chi Lo from BNP Paribas Asset Management observed, the question remains whether new policies will effectively turn around the long-standing downturn.

In a bid to rejuvenate the market, cities across China are implementing localized policies aimed at facilitating housing purchases. As highlighted during the recent briefing, some municipalities have removed purchase restrictions entirely, while others have relaxed guidelines for non-local homebuyers. These actions reflect a strategic pivot in urban policies aimed at easing financial burdens on potential homeowners.

However, the overall economic landscape requires careful navigation. Real estate historically accounted for more than 25% of China’s GDP but has faced profound challenges since the crackdown on high debt levels. With new home prices reaching a nine-year low and the volume of new homes sold plummeting, a cautious approach is necessary to prevent further lapses in buyer confidence.

In concluding, China’s efforts to revitalize its real estate sector reveal a profound understanding of the complexities involved in steering the economy towards stability. The expansion of the “whitelist” initiative and increased bank lending reflect a commitment to addressing immediate challenges facing homebuyers and developers alike. However, patience and pragmatism will be essential as the transition from policy to practice unfolds. A true recovery will depend not only on proactive measures but also on the genuine restoration of trust within the market, allowing China’s real estate sector to regain its footing in the broader economic narrative.