As Nvidia approaches the release of its fiscal third-quarter earnings, investors are eager to glean insights into the company’s growth trajectory. Scheduled for Wednesday after market hours, Nvidia is projected to report revenue of approximately $33.16 billion, accompanied by adjusted earnings per share (EPS) of 75 cents according to LSEG consensus estimates. However, the financial metrics may only reveal part of the picture. The pivotal factor for investors is not merely the preceding quarter’s results, but the company’s forward-looking statements on prospects for continued expansion amidst an evolving landscape of artificial intelligence.

Wall Street anticipates an even stronger outlook, with projections of $37.08 billion in revenue and EPS of 82 cents for the upcoming quarter. This optimism largely hinges on the successful launch and reception of the Blackwell, Nvidia’s latest AI chip tailored for data centers. Expected to deliver substantial performance upgrades, Blackwell has already commenced shipping to industry giants such as Microsoft, Google, and Oracle. How the company communicates about the demand for these cutting-edge products will likely set the tone for investor sentiment in the coming months.

The Impact of Blackwell’s Performance

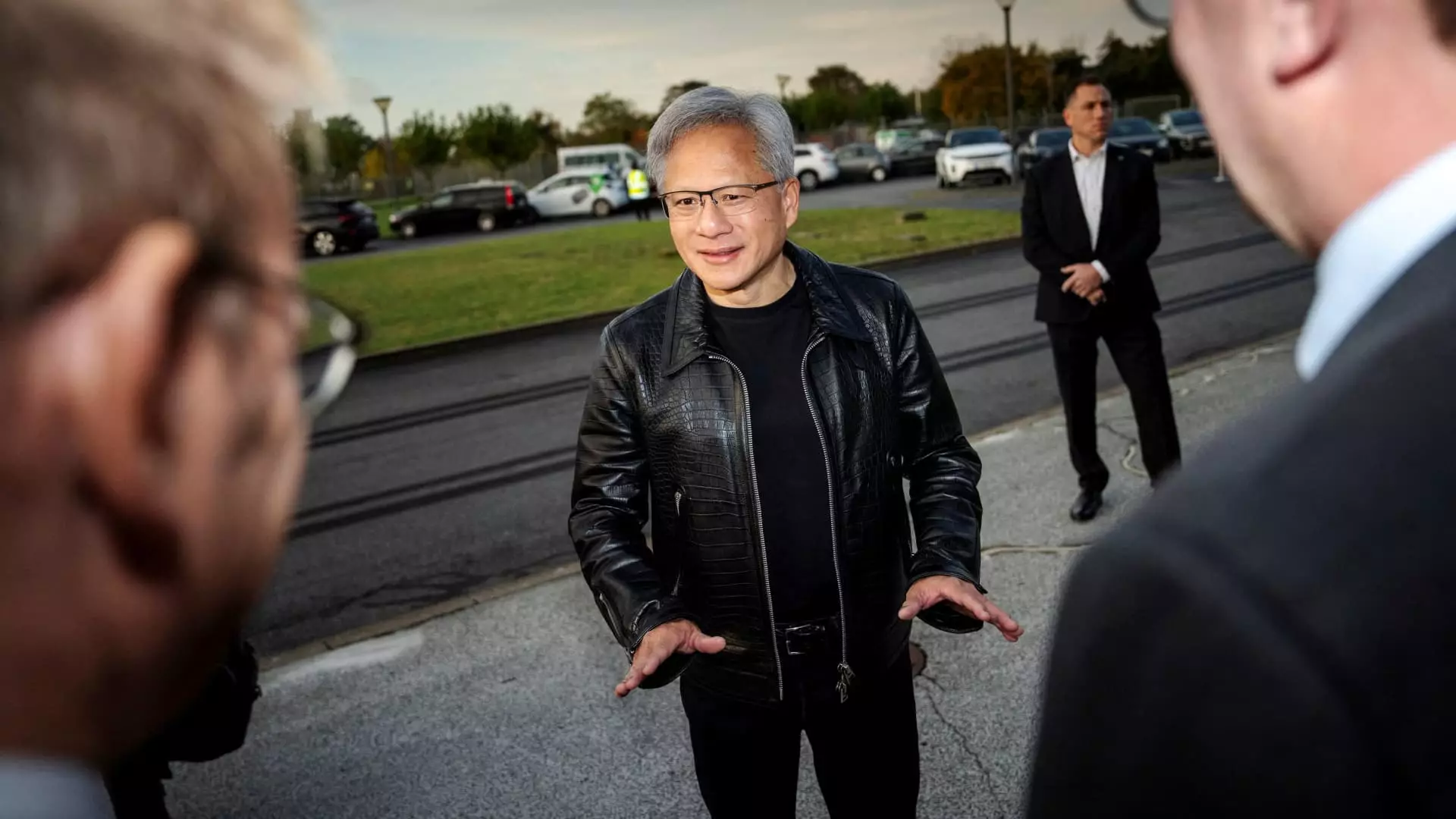

The launch of Blackwell is a crucial pivot point for Nvidia as the demand for advanced AI capabilities accelerates. With the market eagerly watching, CEO Jensen Huang’s commentary on Blackwell’s demand during the earnings call will hold considerable weight. Investors seek assurance that the chipmaker can not only maintain its meteoric rise but can also adeptly navigate any challenges that may arise.

Notably, there have been circulating reports suggesting that some systems powered by Blackwell chips are facing overheating issues. Such complications could overshadow the initial excitement surrounding its release. In August, Nvidia projected substantial sales potential for Blackwell, expecting “several billion” dollars in sales in the January quarter. Investors will likely be attuned to any discussions regarding these overheating challenges, as they could influence both sales forecasts and market confidence.

A Look Back at Growth Trends

While Nvidia’s stock has surged almost threefold since the onset of 2024, its growth rate has shown signs of deceleration. The company reported an impressive 122% increase in sales in the most recent quarter; however, this is a marked decrease compared to the astonishing 262% year-over-year growth reported in April and 265% in January. This trend invites scrutiny. Is Nvidia’s growth beginning to plateau, or does it merely reflect a transitional phase as the company adapts to the sustained excitement surrounding AI innovations?

The fluctuations in growth rates will undoubtedly shape future analyses and expectations. Investors must assimilate the quarterly results and projections that will be shared. The forthcoming earnings report is not merely a reflection of past performance, but a barometer for Nvidia’s ability to sustain its leadership in an increasingly competitive tech landscape driven by the insatiable demand for AI and cloud-based solutions.

Nvidia’s fiscal third-quarter earnings not only present an opportunity for reflection but serve as a potential launching pad into the next phase of AI evolution. How the company balances current performance with future prospects, especially concerning the capabilities of Blackwell, will be critical in defining its market trajectory.