On Thursday, shares of Micron Technology experienced a significant decline of 16%, marking the company’s steepest drop since the onset of the Covid-19 pandemic in March 2020. Investors reacted sharply to the chipmaker’s disappointing guidance for the second quarter, which fell short of analysts’ expectations. The stock dipped to $86.78 amid this turmoil, reflecting a staggering 45% decrease from its peak valuation in June of the previous year. Such a drastic decline raises questions about the company’s future prospects and overall health within the semiconductor market.

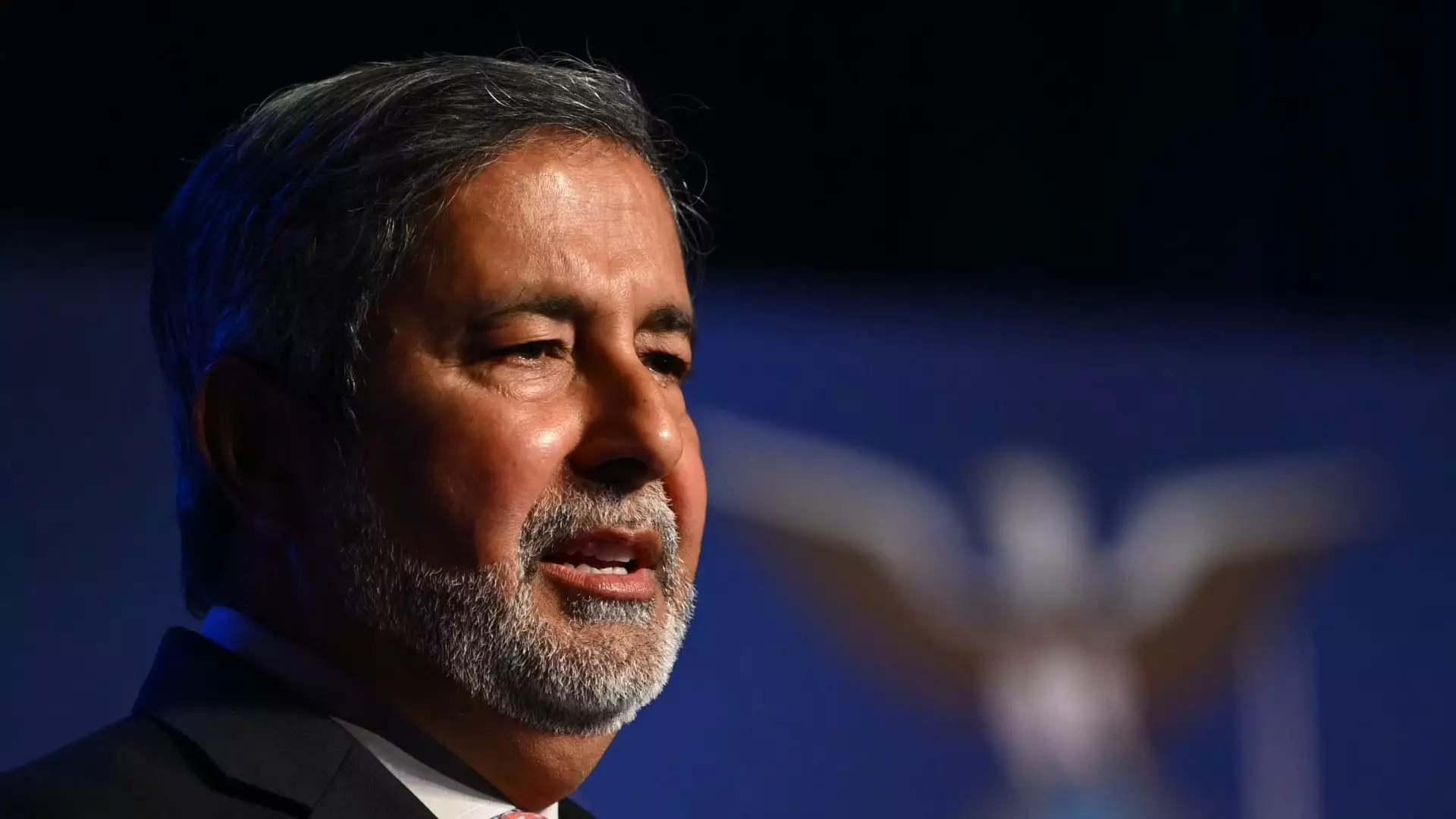

According to Micron’s latest earnings report, the company anticipates second-quarter revenues to hover around $7.9 billion, with a potential variance of $200 million. In comparison, analysts were projecting revenues of approximately $8.98 billion, alongside earnings per share (EPS) of $1.91. This gap between expected and actual forecasts has undoubtedly fueled investor skepticism and could lead to heightened volatility in the stock price moving forward. Micron’s CEO, Sanjay Mehrotra, shed light on the overall situation, stating that the company is grappling with sluggish growth in specific sectors of consumer electronics, alongside “inventory adjustments” within their market segments.

Recent commentary from analysts illustrates the underlying challenges facing Micron. Stifel analysts remarked on a broader industry trend of delayed PC refresh cycles and an increase in customer inventory levels, particularly within the smartphone sector. These observations indicate that Micron is not alone in facing headwinds; rather, the semiconductor industry as a whole could be experiencing a slowdown due to changes in consumer demand patterns. Such conditions could have long-term implications for revenue, particularly as companies look to manage elevated inventories.

Despite the troubling guidance, Micron did manage to report a solid first-quarter performance, boasting EPS of $1.79, which surpassed the average analyst estimate of $1.75. Additionally, revenue surged 84% year-over-year, totaling $8.71 billion. This growth was largely attributed to a remarkable 400% rise in data center revenue, spurred by the growing demand for artificial intelligence. It reflects that while there are alarming trends in specific sectors, there remains significant strength in areas like data centers, which could provide a lifeline for Micron as it navigates its future.

As analysts continue to assess the situation, some, such as the team at Stifel, have opted to maintain a ‘buy’ rating on Micron. However, even they have adjusted their price target from $135 to $130, illustrating a tempered outlook in light of the recent developments. The marked volatility in Micron’s stock and the mixed signals from its earnings report hint at an uncertain path ahead. The company’s ability to adapt to fluctuating market demands, manage inventory levels effectively, and continue capitalizing on AI-related growth will be critical in shaping its trajectory over the coming quarters. For investors, remaining vigilant and understanding the broader market dynamics will be essential in making informed decisions regarding Micron Technology.