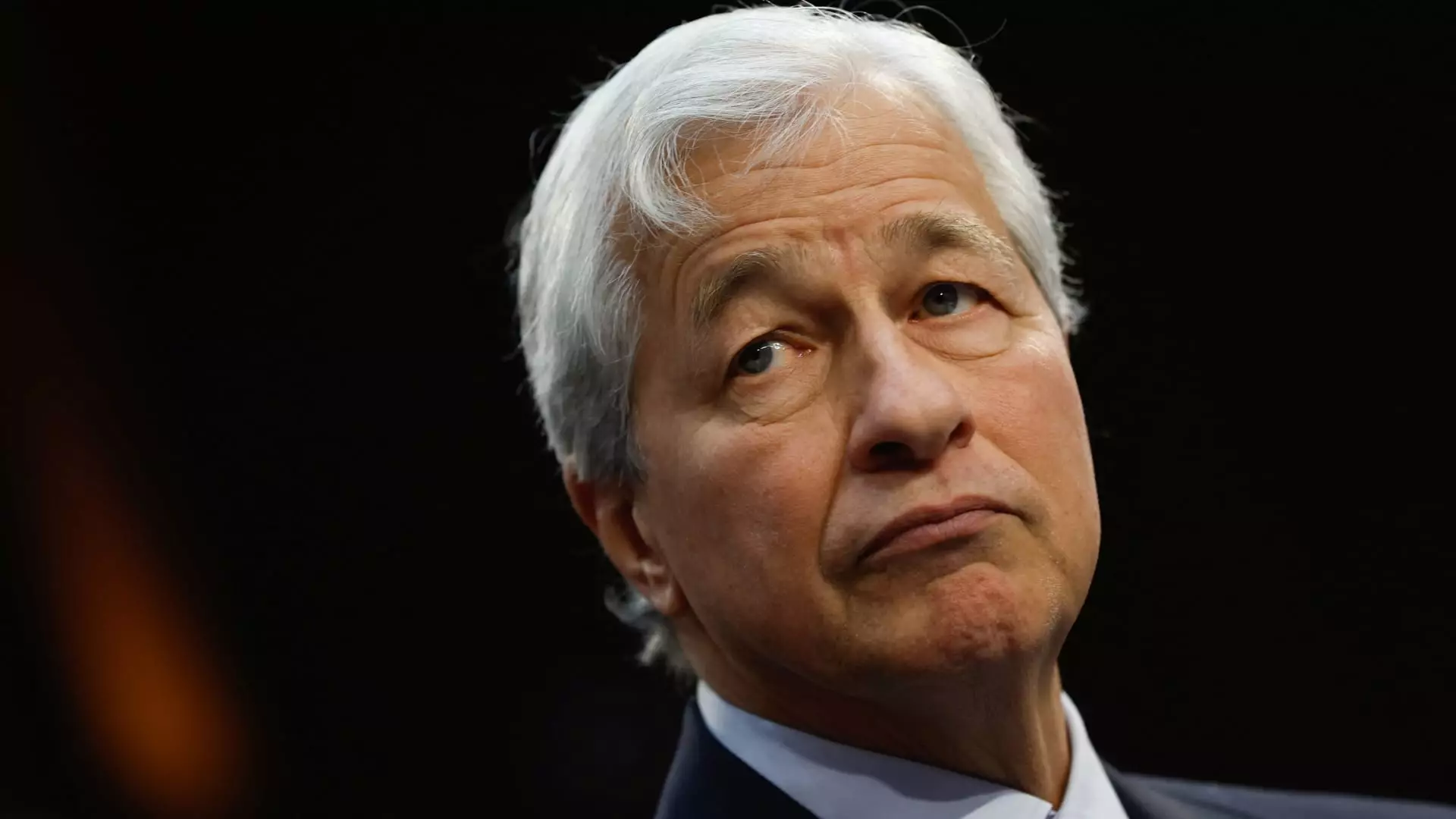

In a world increasingly fraught with conflicts, Jamie Dimon, the CEO of JPMorgan Chase, has voiced significant concerns about the rising geopolitical risks that threaten global stability. As crises unfold in the Middle East and with the ongoing ramifications of Russia’s invasion of Ukraine, Dimon highlights the treacherous nature of current international relations. He notes that the pervasive violence and humanitarian crises have broader implications, not only for the immediate regions affected but for the global economic landscape as well. The third-quarter earnings release from the banking giant serves as a platform for Dimon to dissect these complexities, revealing a landscape where human suffering intertwines with economic outcomes in ways that could shape historical trajectories.

The post-World War II international framework, which has governed diplomacy and commerce for decades, now appears to be unraveling. According to Dimon, tensions have escalated particularly concerning U.S.-China relations, as well as the looming threat of nuclear posturing from countries like Iran, North Korea, and Russia. His remarks during a recent fireside chat at Georgetown University underscored an urgent need for robust leadership from the United States and its allies to navigate these escalating tensions. Dimon articulated a profound worry regarding the instability of international relations, a sentiment that resonates deeply in the corridors of global finance, where uncertainty can trigger swift shifts in markets and investment strategies.

The human toll of the ongoing conflicts, particularly the war between Israel and Hamas, cannot be understated. Dimon’s acknowledgment of the devastation—highlighted by tens of thousands of casualties—reflects a broader crisis that transcends geopolitics. The violence has spread, drawing in regional actors like Hezbollah and stretching the humanitarian catastrophe to new depths. With reports of airstrikes causing casualties in Lebanon and missile strikes impacting Israel, the situation remains volatile. This instability not only perpetuates human suffering but also raises alarms about potential economic repercussions that could ripple through global markets, affecting everything from oil prices to trade agreements.

Despite some signals suggesting that the U.S. economy may achieve a soft landing, Dimon expresses a cautious outlook on the future. He points to underlying issues such as fiscal deficits, infrastructure shortcomings, and the remilitarization trends worldwide. These elements, he argues, could pose significant threats to economic stability. The stark reality of increased defense spending in Russia, directly linked to its unwavering invasion of Ukraine, serves as a troubling indicator of a shifting focus away from economic productivity towards military preparedness.

In light of these pressing challenges, the need for strategic leadership becomes paramount. Dimon’s concerns reflect a broader anxiety among financial leaders about the trajectory of international relations and their economic consequences. As global dynamics grow more intricate and interconnected, understanding the interplay between geopolitical instability and economic health will be essential for navigating the future. Leaders must engage not merely in reactive strategies but adopt a proactive stance that prioritizes diplomacy and economic resilience. The stakes have never been higher, and the momentum of world affairs demands that we approach them with clarity, urgency, and above all, a commitment to ensuring a more stable future for all.