In a pivotal announcement made on Thursday, the Biden administration revealed its last wave of student loan forgiveness, eliminating over $600 million in debt for approximately 8,650 borrowers. This move primarily affects individuals enrolled in the Income-Based Repayment (IBR) plan and former students of the for-profit institution, DeVry University. The decision to discharge loans for DeVry students stems from findings released by the U.S. Department of Education in February 2022, which highlighted that the institution had significantly misled students about its job placement rates. This instance accentuates the broader issues concerning accountability and transparency within for-profit educational institutions.

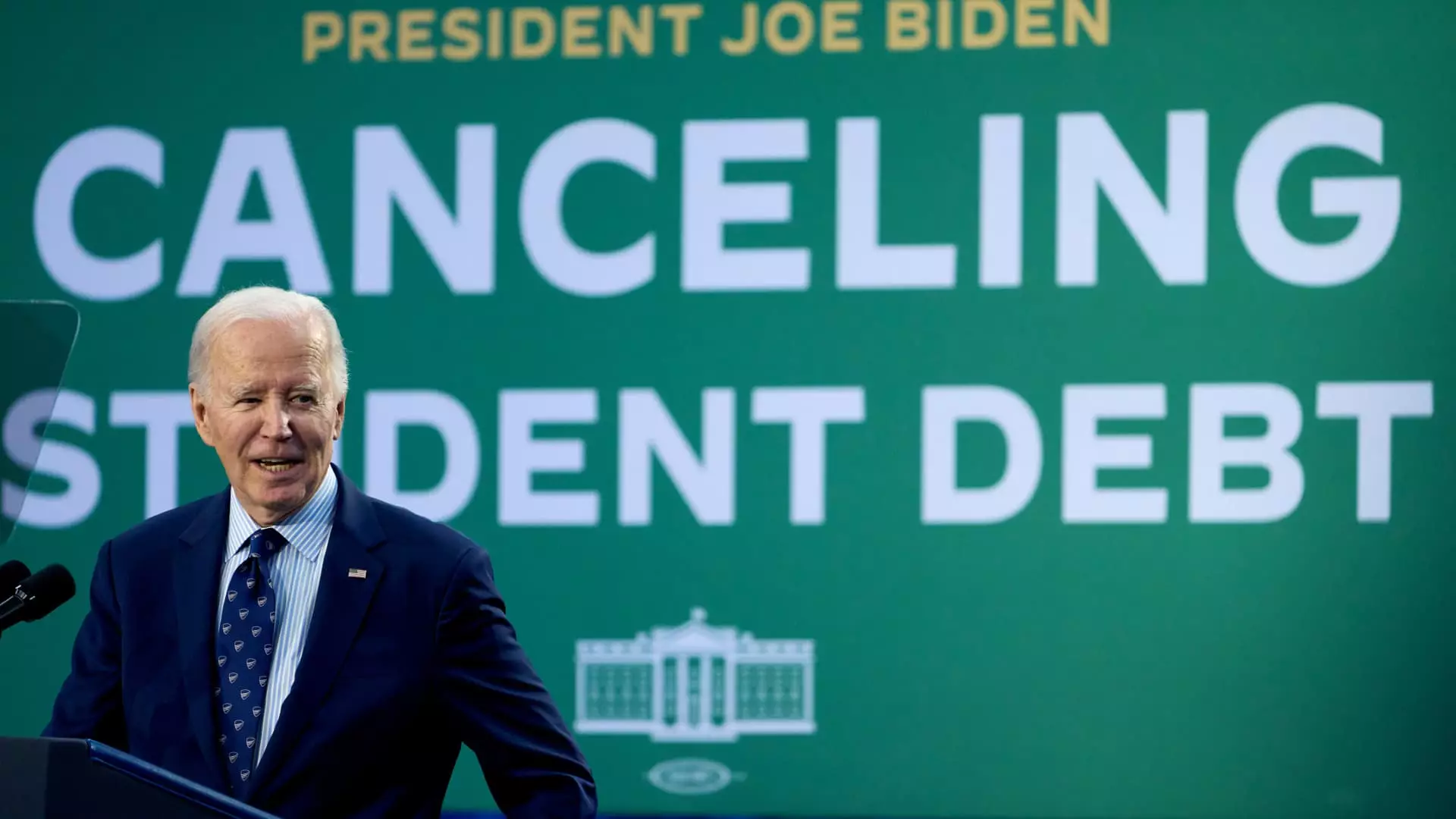

As President Joe Biden prepares to conclude his term, he leaves behind a substantial record in student loan forgiveness, having canceled an impressive total of $188.8 billion for around 5.3 million borrowers. Mark Kantrowitz, a recognized higher education expert, remarked that this marks the closure of a significant chapter in the history of student debt management. Indeed, Biden’s administration has surpassed the previous efforts of any president regarding loan forgiveness, making a decisive impact on millions of borrowers burdened by student debt.

However, this achievement is shadowed by the challenges encountered earlier in 2023, when the Supreme Court obstructed Biden’s attempts to implement a wide-ranging student loan forgiveness strategy. Despite this setback, the administration has taken considerable steps to enhance existing programs aimed at debt relief, ultimately offering substantial alleviation to a significant proportion of the nation’s outstanding student loans.

Simultaneously, the U.S. Department of Education announced the completion of a critical overhaul concerning income-driven repayment (IDR) plans. Borrowers typically qualify for loan forgiveness after 20 to 25 years of consistent payments under these plans. Despite the promise of these programs, many borrowers repeatedly expressed their frustration with loan servicers failing to accurately account for their progress toward forgiveness. The Biden administration’s initiative to address these discrepancies marks a notable effort to restore trust in the system and provide clarity for those seeking relief.

Now, borrowers can verify their payment status and ensure that they receive the credits they deserve. By accessing their accounts on Studentaid.gov, they can monitor their journey toward debt forgiveness more transparently. This is a crucial step in rectifying the past inefficiencies that have plagued the student loan landscape for years.

As students and graduates await the final resolutions regarding their loans, the broader conversation around the future of education financing continues. A commitment to not only forgiveness but also systemic reform is essential. The Biden administration’s actions have undeniably provided essential financial breathing space for many, but on a larger scale, the push for comprehensive changes to the student debt paradigm remains imperative.

While the final rounds of loan forgiveness showcase a significant stride in alleviating the burden for thousands, they also highlight the lingering complexities of the student loan system that future administrations must address. The focus must shift toward ensuring that all students have equitable access to reliable educational pathways without the looming threat of crippling debt.