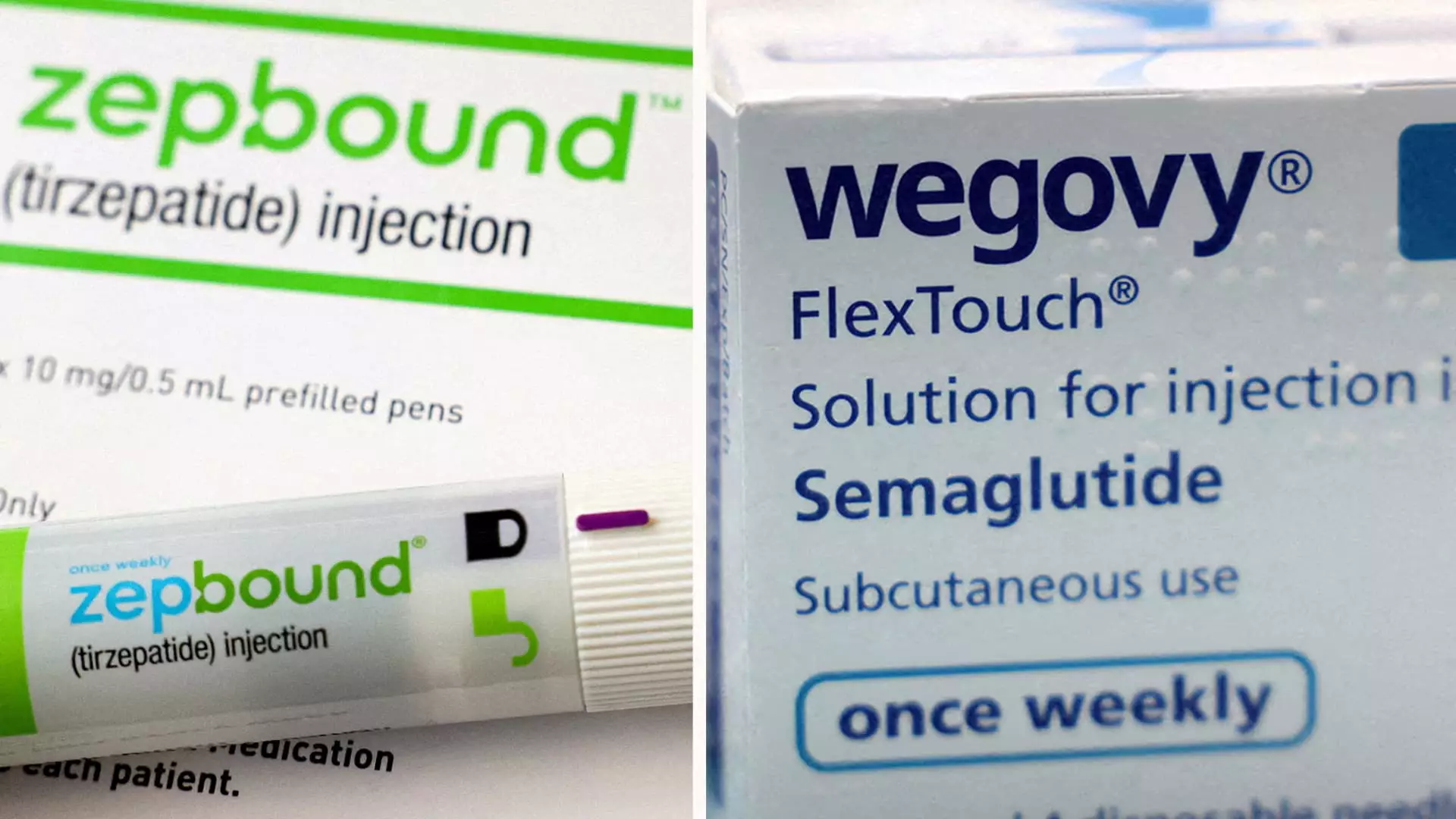

The landscape of obesity treatments is rapidly changing, particularly with the emergence of Eli Lilly’s drug Zepbound. Recent clinical trials reveal that Zepbound significantly outperforms its primary competitor, Novo Nordisk’s Wegovy. This development is poised to alter treatment paradigms for obesity and could lead to significant shifts in market dynamics.

Clinical Evidence and Comparisons

In the most comprehensive phase three clinical trial comparing Zepbound and Wegovy, Eli Lilly reported that patients using Zepbound experienced an average weight loss of 20.2%—approximately 50 pounds—over a span of 72 weeks. In stark contrast, subjects treated with Wegovy achieved an average weight reduction of only 13.7%, translating to about 33 pounds. This notable disparity indicates that Zepbound not only aids in weight loss but also may enhance patients’ quality of life by significantly reducing associated health risks.

Importantly, the trial’s design was robust, involving a random assignment of 751 participants who were clinically categorized as obese or overweight. These patients were monitored for weight-related medical conditions—excluding diabetes. According to Dr. Leonard Glass, a senior vice president at Eli Lilly, these findings bolster the strong interest in obesity medications, providing vital information for patients and healthcare providers making treatment decisions.

The divergent efficacy of Zepbound and Wegovy may stem from their differing mechanisms of action. Zepbound works by activating two important gut hormones, GIP and GLP-1, which play a crucial role in hunger regulation and blood sugar levels. Wegovy, while effective, primarily targets only the GLP-1 pathway. This distinction could be critical in explaining the superior weight loss observed in patients using Zepbound, as targeting multiple pathways may lead to more comprehensive metabolic effects.

The implications of Zepbound’s promising results are significant not only for patients seeking effective obesity treatments but also for the pharmaceutical market as a whole. Analysts predict that the global market for weight loss drugs could reach around $150 billion annually by the early 2030s. Zepbound, which received its U.S. approval in late 2023, is anticipated to capture a substantial share of this burgeoning market.

Some forecasts suggest that Zepbound’s revenue could reach $27.2 billion by 2030, surpassing Wegovy’s projected earnings of $18.7 billion for the same period. This potential for high revenue showcases Eli Lilly’s aggressive strategy to position Zepbound as a leader in the obesity treatment sector.

Despite the promising results and high expectations, concerns regarding accessibility remain. Both Zepbound and Wegovy have faced challenges in meeting the overwhelming demand, which has outstripped their available supply. This supply shortage led both Eli Lilly and Novo Nordisk to invest significantly in scaling their manufacturing capabilities. Furthermore, while the Food and Drug Administration (FDA) has designated all doses as “available,” patients still grapple with inconsistent insurance coverage, limiting access to these treatments.

Zepbound and Wegovy’s price tag of roughly $1,000 per month presents additional barriers for many potential users, particularly for those without insurance or financial support. Addressing these accessibility issues will be crucial for maximizing the therapeutic potential of these drugs and ensuring that patients receive the treatments they desperately need.

As Eli Lilly prepares to publish the full results of their head-to-head trial and present their findings at upcoming medical conferences, the anticipation surrounding Zepbound continues to grow. The developments in obesity drug therapy not only promise weight loss but also signify a broader acknowledgment of the medical and societal importance of addressing obesity as a critical health issue.

Zepbound stands at the forefront of a potential revolution in obesity treatment. With its promising clinical data and innovative mechanism, it may become a key player in the fight against obesity, leading to improved patient outcomes and significant growth in the pharmaceutical sector. The next few years will be pivotal as stakeholders evaluate the broader implications of these treatments on healthcare systems and patients alike.