As the world looks towards China as a significant player in the global economy, the nation grapples with its own intricate challenges, particularly when it comes to stimulating consumer consumption. In July, the Chinese government unveiled an ambitious initiative aiming to boost domestic consumption through a substantial allocation of 300 billion yuan (around $41.5 billion) in ultra-long special bonds. This plan is designed to augment existing trade-in and equipment upgrade policies. While such initiatives have the potential to stimulate demand for consumer goods and support economic recovery, the pressing question remains: are these measures effective, or merely a band-aid on a deeper economic wound?

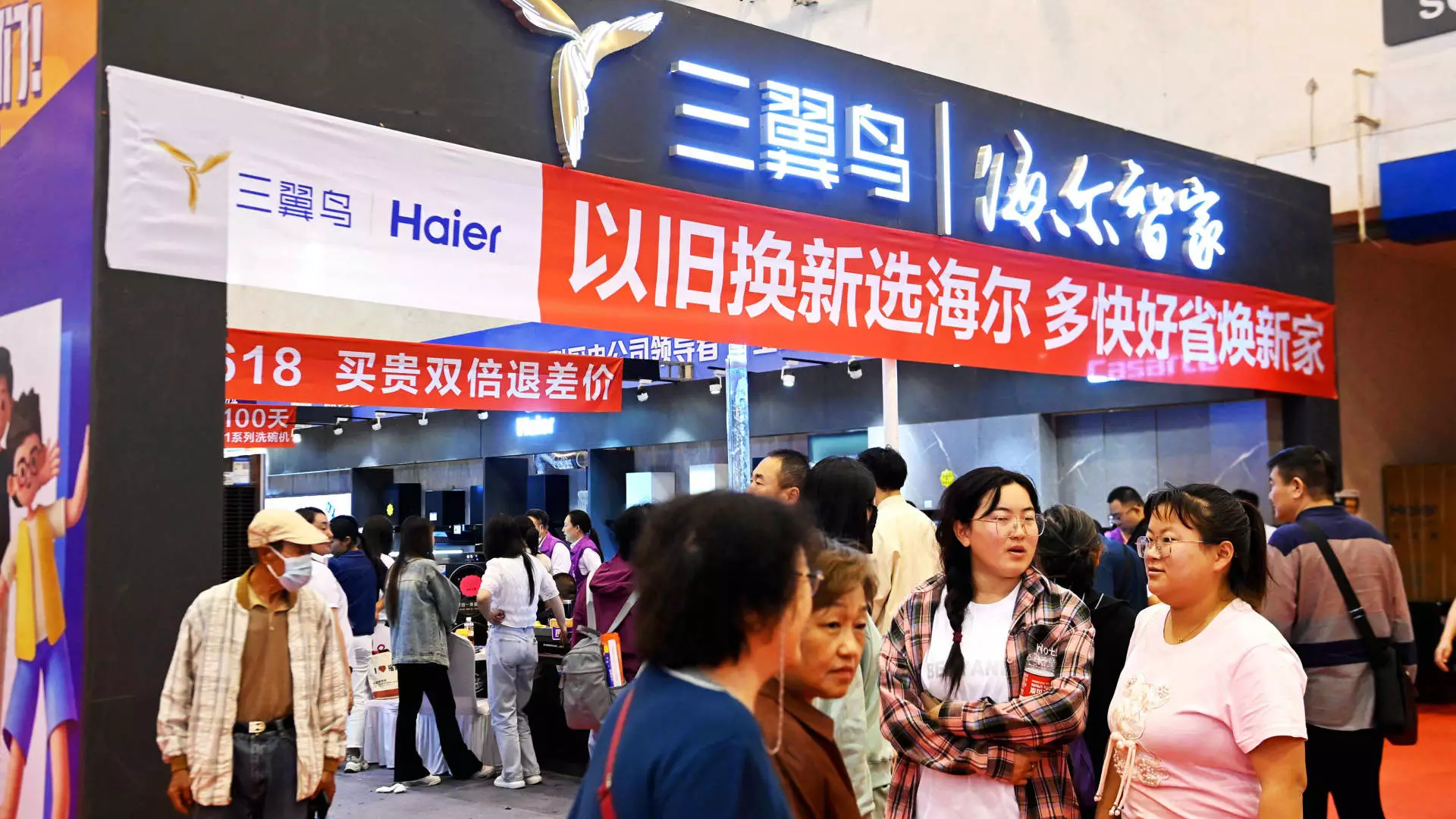

At the core of China’s new consumption strategy is a scheme that encourages consumers to trade in older, often larger-ticket items like vehicles and home appliances in exchange for subsidies on newer products. According to reports, around half of the allocated funds are specifically designated for these consumer goods, while the remaining capital is aimed at supporting the upgrade of essential equipment such as elevators. Local governments are charged with the responsibility of utilizing these ultra-long bonds to facilitate consumer purchases, but the effectiveness of this measure is under scrutiny.

One of the main challenges identified is the necessity for consumers to not only part with their old items but also invest their own cash upfront. Jens Eskelund, the President of the European Union Chamber of Commerce in China, has expressed skepticism, highlighting a lack of observable results stemming from the new measures. He pointed out that the central government’s effort has not translated into tangible consumer incentives on the ground, raising concerns about the practicality and execution of the program.

Despite the ambitious nature of the trade-in initiative, analysts remain dubious about its capacity to bring about a significant uptick in retail sales. This skepticism is echoed by UBS Investment Bank’s Chief China Economist, Tao Wang, who estimated that the scheme could account for merely 0.3% of retail sales for 2023. China’s retail sales growth remains sluggish, recording a modest increase of just 2.7% in July—still below pre-pandemic levels. Particularly concerning is the overall reduction in passenger car sales, while sales of new energy vehicles have seen a remarkable surge of nearly 37% during the same period. This raises questions about whether the government initiative is addressing the right segments of the market.

Local governments are faced with the daunting challenge of executing these policies effectively. Many municipalities are still in the early stages of understanding the directive and its implications for logistics and implementation. Without clear communication and direction from the central government, these initiatives risk falling flat or being ineffectively utilized.

The impact of the trade-in policy is further complicated by sector-specific challenges. The elevator industry, for example, has been slow to respond to these new initiatives despite acknowledgments of equipment that has exceeded its useful life. Representatives from major elevator companies such as Otis and Kone have reported negligible changes in new orders because of the trade-in program. They recognize the potential but now face delays and uncertainty regarding the allocation of the funding.

In light of these developments, Kone’s Chief Financial Officer emphasized the latent opportunities that lie within the market, especially as new elevators can offer greater energy efficiency. Yet, these possibilities require any governmental policies to be implemented swiftly and effectively to allow businesses to capitalize on them.

Interestingly, while immediate effects on large purchases remain uncertain, there are positive indicators emerging from the secondhand goods market. Companies such as ATRenew, which processes used products, have reported increased trade-in volumes from e-commerce platforms. This suggests that while the trade-in program faces difficulty in larger sectors, there is a growing acceptance and demand for secondhand goods, especially among younger consumers.

Nonetheless, the significant question revolves around how quickly this program can evolve from a theoretically solid concept to one that produces measurable results. Analysts caution that patience may be critical, as changes in consumer behavior and spending habits can take time to manifest fully.

While China’s trade-in policy represents a proactive attempt to invigorate consumer consumption, the journey from announcement to execution is fraught with obstacles. Current signs indicate that the initiative has not yet made the desired impact, raising questions about both strategy and implementation. As local governments attempt to roll out measures and consumers cautiously engage with new purchasing models, it remains to be seen whether these efforts will yield substantial improvements in retail consumption. Observers will be watching closely, as the efficacy of this trade-in initiative serves as a bellwether for broader economic recovery and consumer confidence in China.