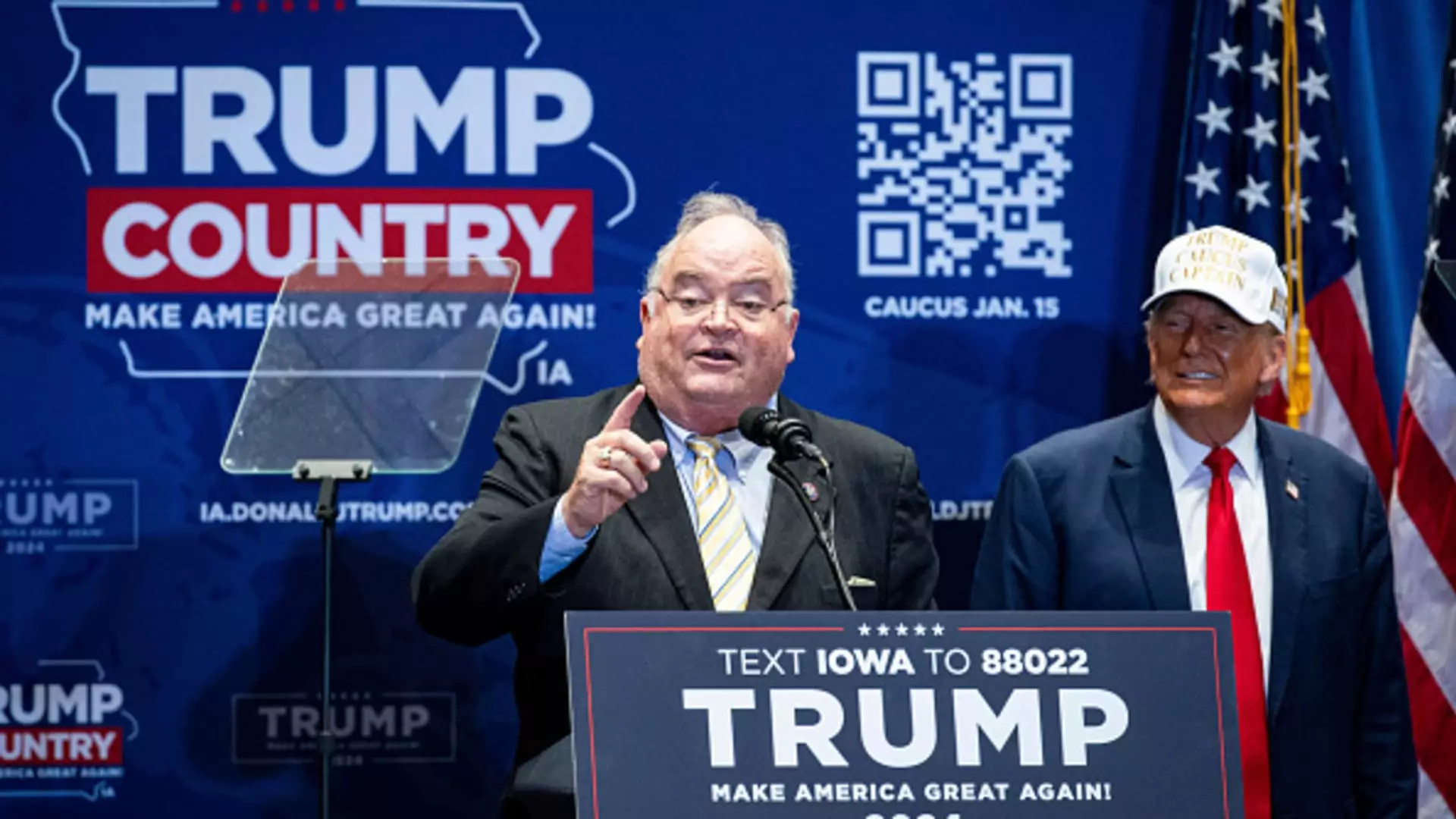

The recent nomination of former Congressman Billy Long by President-elect Donald Trump to lead the Internal Revenue Service (IRS) has stirred considerable debate in the political and financial communities. As the IRS embarks on a significant overhaul—which includes enhancements in technology, customer service, and a free filing initiative—Long’s selection reflects broader fiscal policies that may shape the agency’s direction under the Trump presidency.

Under President Biden, the IRS received a historic funding boost of nearly $80 billion, aimed at revitalizing its capabilities to enforce compliance among high-income earners and complex partnerships. With this capital, the agency sought to modernize its operations significantly, adapting to the demands of 21st-century taxpayers and their evolving needs. A critical aspect of this transformation is the effort to implement a more user-friendly filing process while simultaneously ramping up enforcement on tax delinquents.

The focus on these dual objectives highlights an essential balancing act that the IRS must navigate: accommodating the taxpayer while ensuring compliance. Billy Long, in his proposed role, may be tasked with this dual mandate, incorporating his experience in tax advisory roles into the operational framework of the IRS.

Before embarking on a political career, Billy Long gained notoriety as an auctioneer, a profession that demands strong communication skills and persuasive abilities. These attributes may serve him well in his new role, particularly when advocating for the IRS’s needs to Congress. Serving as a congressman for six terms, Long developed a thorough understanding of the intricacies of federal legislation, which could enhance the IRS’s standing among lawmakers, an advantage noted by former IRS Commissioner Mark Everson.

However, the transition from politics to an operational leadership position within the IRS is not without its challenges. While Long’s congressional experience provides a foundation, critics argue that his post-congressional involvement in the employee retention credit arena raises red flags regarding his suitability for overseeing a federal agency. This concern stems from allegations of rampant abuse regarding the pandemic-era tax credit and the potential implications his past work could have on the public’s trust in the IRS.

The political landscape surrounding Long’s appointment is heavily charged. Republicans, like Senator Mike Crapo, express optimism about Long’s capacity to address long-standing issues facing the IRS, such as inefficiency and taxpayer privacy concerns. They view his leadership as essential for fostering a responsive and accountable agency that prioritizes taxpayer rights, particularly in light of heightened scrutiny regarding IRS operations.

Conversely, Democrats, such as Senate Finance Committee Chair Ron Wyden, cast doubt on Long’s nomination, describing it as “bizarre.” They highlight concerns over his post-congressional involvement in the employee retention tax credit, characterizing it as a troubling association that could undermine the integrity of the IRS. These sentiments underscore the contentious political dynamics surrounding appointments to federal agencies, particularly ones that administer revenue collection.

If confirmed, Billy Long faces the monumental task of steering the IRS through a landscape rife with expectations and existing challenges. His leadership will likely be judged based on his ability to implement the ambitious roadmap laid out under the previous administration while simultaneously responding to significant pressures from both sides of the political aisle.

A successful tenure will require Long to navigate the complexities of taxpayer expectations, legislative priorities, and the overarching goal of modernizing an agency long criticized for its bureaucratic shortcomings. The balance he strikes will ultimately influence public perception of the IRS, shaping taxpayer confidence and compliance rates in the years to come.

The appointment of Billy Long to the IRS represents a pivotal moment in the agency’s evolution. With critical challenges ahead, his ability to unite a beleaguered agency and restore public confidence will be a significant determinant of his legacy. As the confirmation process unfolds, stakeholders within the tax community and broader public will be watching closely to see how this chapter in IRS management develops.