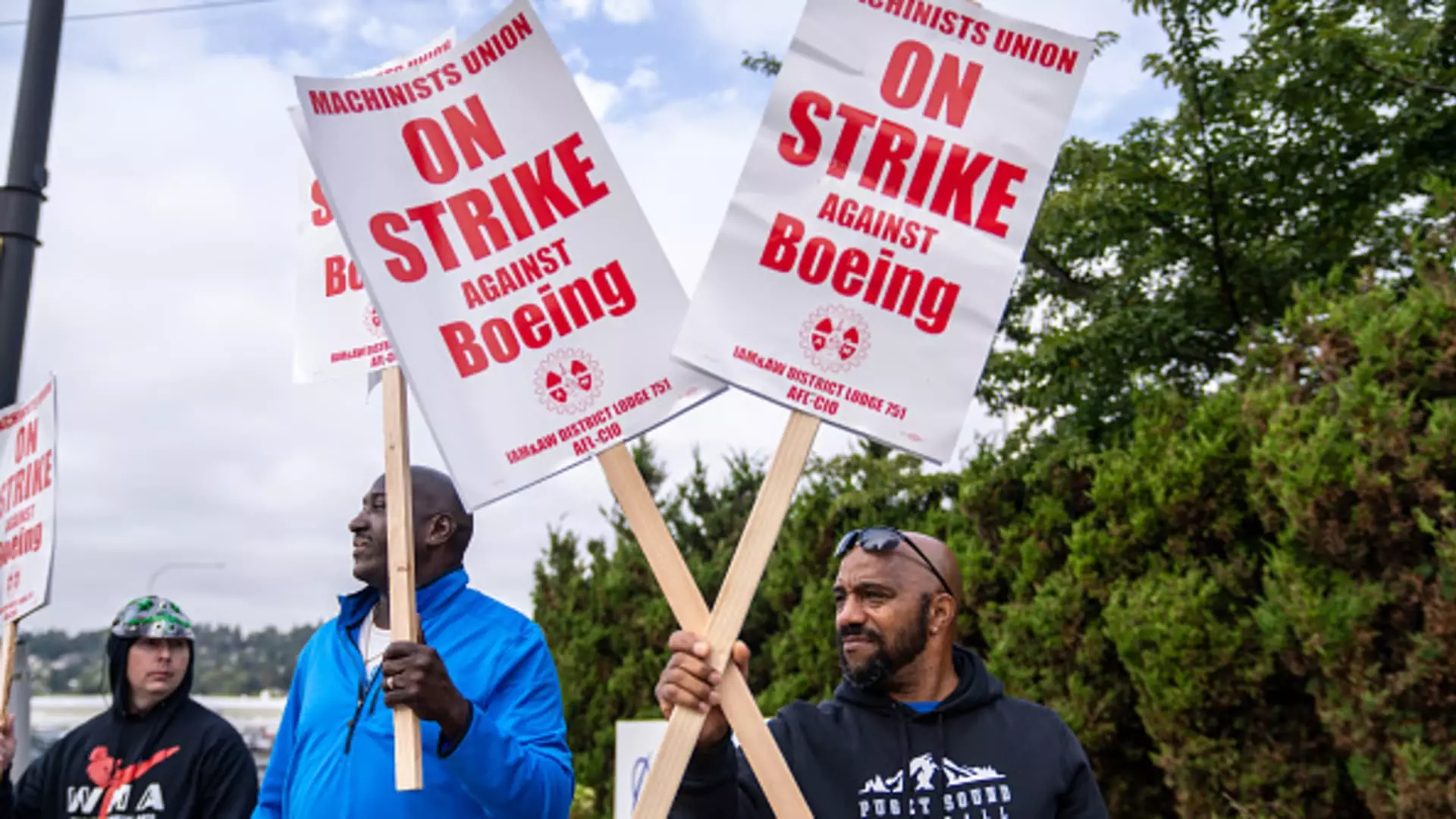

The challenges facing Boeing have escalated significantly over the past month following the striking actions of over 30,000 machinists who walked off the job. Their refusal to accept a tentative contract, coupled with a string of operational failures and a shaky economic footing, presents a troubling tableau for Boeing’s management and stakeholders. These recent events not only highlight the company’s ongoing labor disputes but also foreshadow severe financial implications that could ripple through the wider aviation industry.

The strike, which has persisted since September 13, represents a critical inflection point for Boeing as the company grapples with numerous setbacks. Following an overwhelming rejection of a contract, which passed with a 95% dissenting vote from workers, negotiations have become deadlocked. This impasse is particularly consequential given the mounting pressure from the aviation market and the pressing need for Boeing to stabilize its production capabilities. According to S&P Global Ratings, the labor action is costing the company over $1 billion each month, exacerbating an already challenging financial landscape that has seen the manufacturer struggle to regain its footing since the 737 Max disasters.

Despite prior optimism from company officials regarding a quick resolution, their statements have failed to materialize into tangible outcomes. The process has turned more complicated as federally mediated talks recently broke down, pushing both sides further apart. What was initially a potential pathway to reconciliation has devolved into mutual accusations of bad faith negotiations, a dynamic that only deepens the crisis. Jon Holden, president of the machinist’s union, has articulated a desire for renewed negotiations, signaling that the unity of labor may ultimately dictate the terms of any forthcoming agreement.

While the unionized machinists endure the hardships of strike-induced pay cuts and the loss of healthcare benefits, Boeing is facing its own financial reckoning. The company has announced significant steps to lay off about 10% of its workforce, affecting executives, managers, and employees alike. Such measures illustrate an economically precarious position, one that is compounded by the failure to deliver commercially viable aircraft in a timely manner.

Boeing’s forecasts indicate it could lose nearly $10 per share for the third quarter, with cumulative losses ballooning to approximately $5 billion across both commercial and defense divisions. Such staggering deficits underline Boeing’s struggle to return to profitability—a situation that has persisted since 2018. Despite prior predictions suggesting that stabilizing production might alleviate financial woes, the reality is that the company continues to hemorrhage capital while repairs remain unconvincing. Richard Aboulafia, an aerospace analyst, remarked on the absurdity of reducing the workforce of those essential for ramping up production—an act described metaphorically as “burning down their own house.”

The ongoing turbulence at Boeing could also have far-reaching consequences for its supply chain partners. Companies like Spirit AeroSystems, responsible for the manufacturing of 737 fuselages, are reportedly weighing furloughs as a contingency plan in reaction to Boeing’s declining orders. Should Boeing’s internal struggles deepen, it is likely that these repercussions will extend beyond the primary manufacturer, affecting smaller suppliers and the entire aerospace ecosystem in the process.

In a broader context, Bank of America analysts recently highlighted the multidimensional crises likely to ensue for Boeing, which range from labor relations and quality assurance challenges to financial sustainability. Without immediate and effective remedial action, Boeing could initiate a downward spiral that jeopardizes both short-term performance and long-term viability.

As Boeing limps through a turbulent period marked by labor unrest, financial losses, and strategic missteps, urgency is paramount. The company’s new CEO, Kelly Ortberg, must steer Boeing towards reconciliation with its skilled labor force while addressing looming financial threats. The stakes are high, with investor confidence waning, and a downturn to junk status on the horizon if production and operational efficiencies do not improve.

Ultimately, the resolution of labor disputes, the realignment of corporate strategy, and a focus on quality execution are essential for Boeing to chart a course back to stability. Whether through renewed negotiations, strategic workforce adjustments, or targeted financial maneuvers, the path forward for Boeing will require a deft balance—a balancing act fraught with challenges yet ripe with the opportunity for renewal amid adversity.