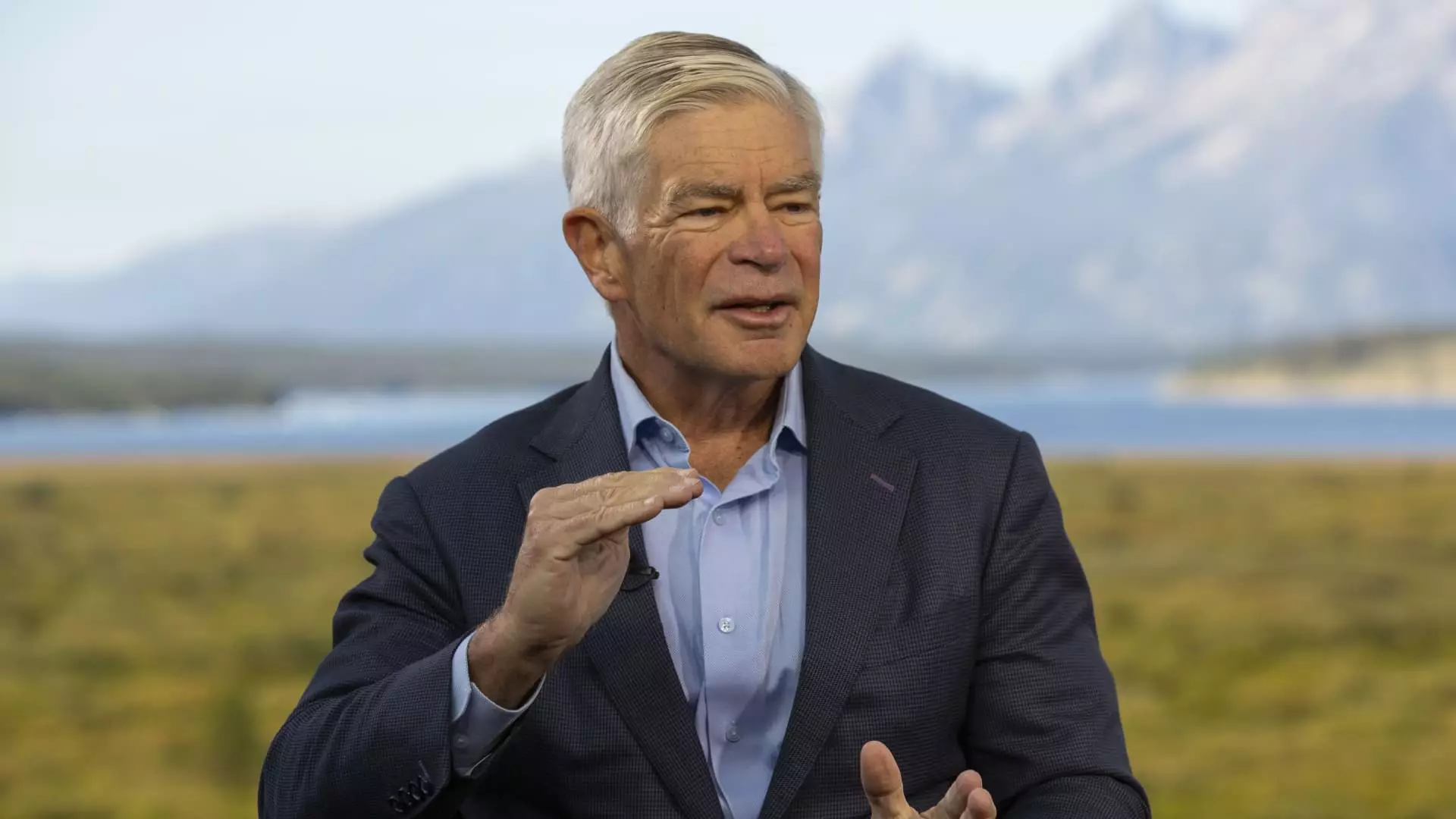

Philadelphia Federal Reserve President Patrick Harker recently voiced his support for an interest rate cut, indicating that a monetary policy easing is highly likely to occur in September. This endorsement came during the Fed’s annual retreat in Jackson Hole, Wyoming. Harker emphasized the importance of a methodical approach to easing and the necessity of signaling well in advance. This indicates a strong push for a rate cut in the near future.

Market expectations currently predict a 100% likelihood of a 25 basis point cut and a 1-in-4 chance of a 50 basis point reduction. However, Harker expressed uncertainty regarding the magnitude of the rate cut, stating that he needs to analyze more data before making a decision. The Federal Reserve has maintained its benchmark overnight borrowing rate at 5.25%-5.5% since July 2023, focusing on addressing ongoing inflation concerns.

Harker emphasized the Fed’s commitment to making policy decisions based on data rather than political pressure. He reiterated the importance of being a proud technocrat and highlighted the Fed’s role in responding appropriately to economic indicators. Despite the upcoming presidential election, Harker maintained the Fed’s independence in making monetary policy decisions.

Kansas City Fed President Jeffrey Schmid echoed Harker’s sentiments, indicating a leaning towards a rate cut in the near future. Schmid pointed to rising unemployment rates as a key factor influencing policy decisions. He acknowledged the cooling of job indicators and the gradual increase in the unemployment rate, indicating a need for further analysis of labor market conditions.

Schmid also highlighted the resilience of banks under the current high-rate environment, suggesting that monetary policy is not overly restrictive. Despite the challenges posed by inflation and labor market dynamics, Schmid expressed confidence in the stability of the banking sector. This assessment reinforces the idea that a rate cut may be necessary to address emerging economic challenges.

The statements made by Philadelphia Federal Reserve President Patrick Harker and Kansas City Fed President Jeffrey Schmid reflect a growing push for an interest rate cut in the near future. Both officials emphasized the importance of data-driven decisions, political independence, and careful consideration of market trends. As the Fed prepares to convene in September, the likelihood of a rate cut appears increasingly probable based on the feedback provided by these two regional Fed presidents.