Jim Cramer, a prominent figure in the investment community, is eyeing BlackRock— the world’s foremost asset manager— as a promising addition to his watchlist for potential investments. This comes in light of BlackRock’s recent performance, where the company reported third-quarter earnings significantly exceeding market expectations. Such announcements have a profound impact, as they not only affect stock prices but also shape investor sentiment, prompting analysts to reassess the asset manager’s overall potential in the financial landscape.

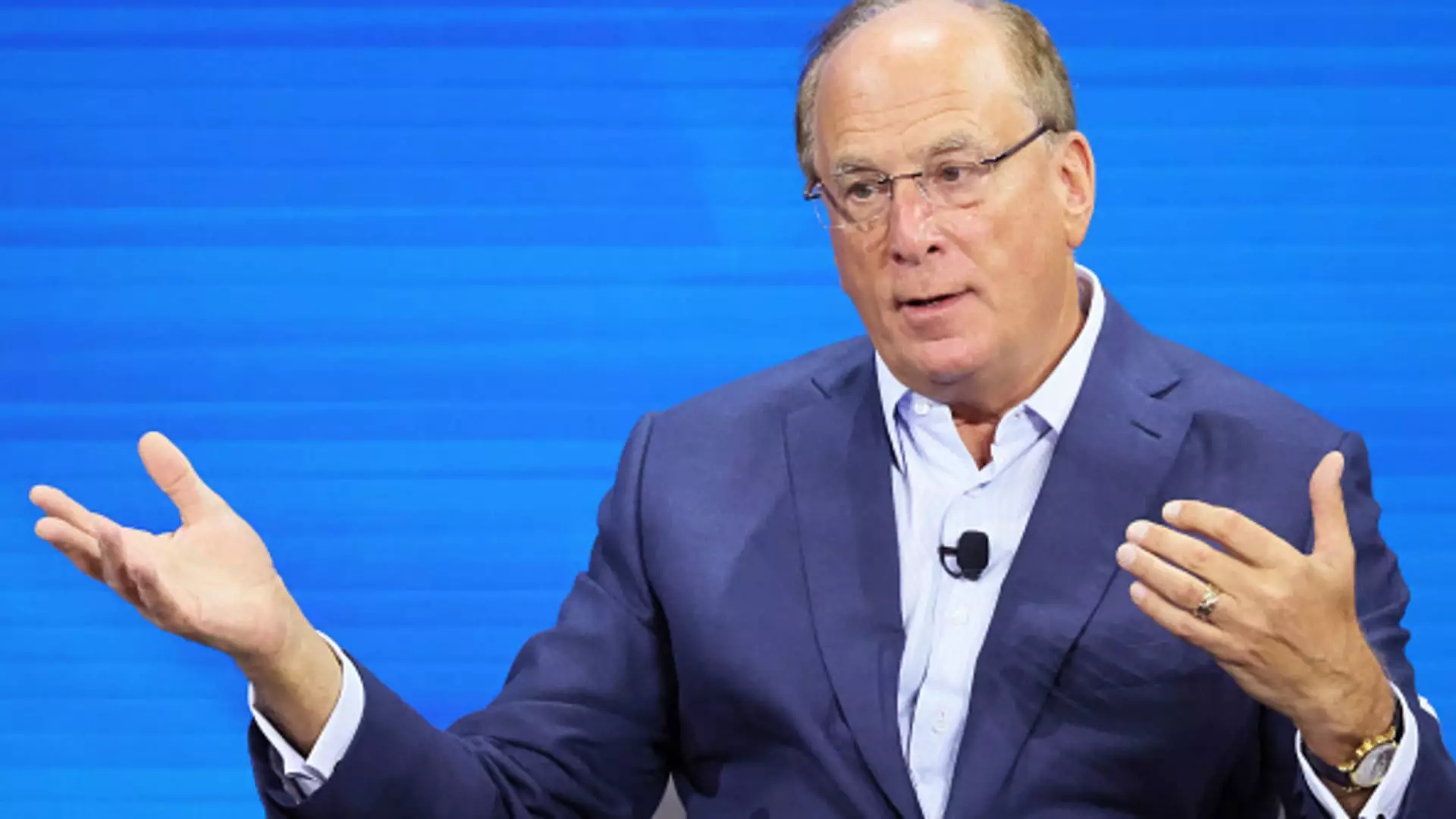

Last Friday, BlackRock’s shares soared to an all-time high, a testament to the firm’s robust operational strength. The company revealed that its assets under management (AUM) have now reached an astounding $11.5 trillion, up from previous years, reflecting an impressive $2 trillion in organic growth over the last five years. The perception that this kind of growth positions BlackRock among the top-tier asset managers also strengthens Cramer’s interest. CEO Larry Fink’s comments about BlackRock’s recent acquisition of Global Infrastructure Partners—worth $12.5 billion—further bolster this notion, as it added over $100 billion in assets. This indicates not only growth through client investments but also strategic maneuvers to position the firm favorably against competitors.

The Market Context: Navigating a Complex Economic Landscape

These developments don’t exist in a vacuum, however; they transpire against the backdrop of a challenging regulatory and economic environment. The financial industry commenced its quarterly earnings season with not just BlackRock reporting strong results but other giants like Wells Fargo also showcasing resilience despite the higher-for-longer interest rate environment. The Federal Reserve’s recent decisions concerning interest rates might influence market dynamics, especially as institutions like BlackRock maneuver through the implications of shifting monetary policies. Analysts debate the prospect of future rate cuts, which remains a critical aspect of the market environment that could either benefit or constrain financial entities based on their asset management capabilities.

Cramer’s cautious approach towards initiating a position in BlackRock demonstrates a disciplined investment philosophy. In his commentary, he openly expresses regret about not having moved more swiftly in the past, conflicted by other commitments such as monitoring Wells Fargo and Morgan Stanley. This aspect of his strategy highlights the importance he places on prioritization, ensuring that he doesn’t rush into decisions without a comprehensive understanding of the market status. By placing BlackRock shares in his ‘Bullpen’, Cramer signals potential bullish sentiment, indicating that he, like many active investors, is continuously weighing potential risks against the reward elements in asset management investments.

Over the recent month, BlackRock’s stock performance has outstripped that of the broader S&P 500 index, gaining over 12%, while the index itself only recorded roughly a 4% rise. This disparity is noteworthy; it highlights BlackRock’s capacity to attract sustained inflows, setting it apart even in tumultuous markets. Cramer’s acknowledgment that this stock can continue its upward trajectory reflects both optimism and recognition of the company’s intrinsic value in managing assets effectively. There’s a palpable sense in the investing community that seasoned leaders like Fink can continue to drive performance in a competitive sector, thanks to adaptive strategies in an evolving market landscape.

The current trajectory of BlackRock stock signifies not just past success but also future potential that could captivate risk-on investors. For Jim Cramer and others in the investment club, the decision to consider BlackRock’s stock isn’t merely impulsive; it’s rooted in analytic observations of outperformance, considerable asset management, and strategic acquisitions. As investors continue navigating uncertain waters, BlackRock presents a compelling narrative based on its ability to deliver, ensuring it remains in focus during this earnings season and beyond. Ultimately, as the financial markets evolve, the necessity for astute investment decisions will remain paramount, making BlackRock an intriguing prospect for dedicated investors.