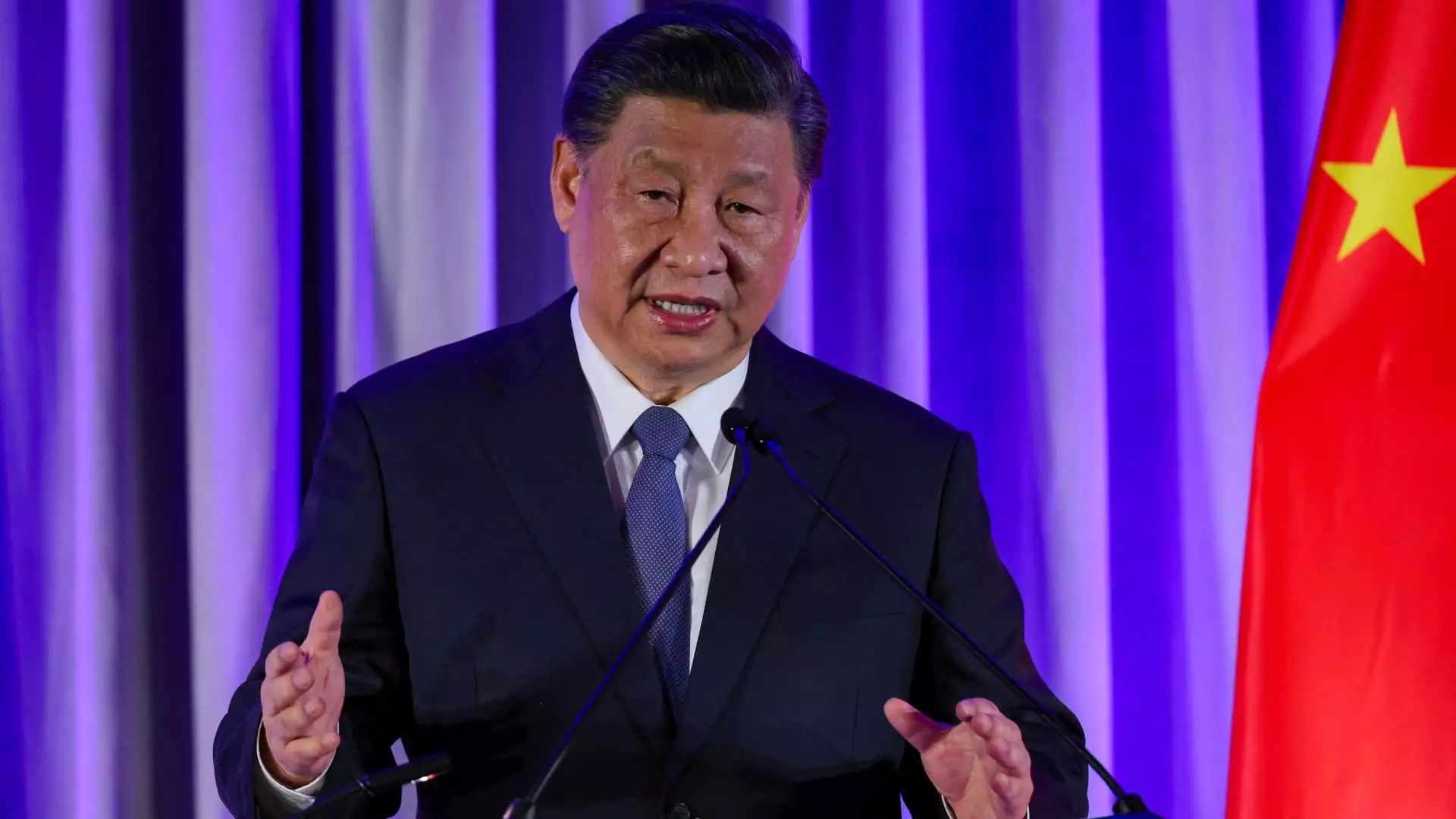

In a critical meeting of high-ranking officials on Thursday, the Chinese government made an explicit declaration regarding its aim to halt the ongoing slump in the real estate sector. Reported by state media, key leaders emphasized the importance of curtailing the decline of the real estate market and fostering a stable recovery, a cornerstone of the nation’s economic architecture. This meeting led by President Xi Jinping, who presides over the Politburo—the ruling Chinese Communist Party’s senior decision-making body—highlighted an urgent need to address the economic challenges facing the country, which are intricately tied to the health of the real estate industry.

Real estate previously contributed over a quarter of China’s GDP, making its recent downturn particularly alarming. This decline, which has been exacerbated by government crackdowns on high-debt levels among developers initiated in 2020, has not only dented household wealth but has also severely impacted local government revenues. As the broader economic expansion shifts into lower gear, concerns mount regarding the feasibility of achieving the full-year GDP growth target of around 5%.

The immediate market response to the high-level meeting indicated a positive sentiment among investors, with stocks in mainland China and Hong Kong surging sharply. The Chinese property stock index in Hong Kong saw nearly a 12% increase, suggesting that market participants received the news with optimism. However, underlying concerns about the fundamental state of the economy remain prevalent. Analysts were quick to point out that while these discussions represent a step in the right direction, more substantive fiscal and monetary measures are required to ensure a robust recovery.

To provide context, the Chinese real estate market has shown signs of slight stabilization recently. The latest data indicates a 23.6% year-on-year drop in new home sales up to August, which, while still alarming, is an improvement over the 24.3% decline observed previously. Average home prices also fell by 6.8% in August—a marginal recovery from previous months. Notably, the People’s Bank of China’s recent announcements regarding interest rate cuts and supportive measures for real estate signify a tactical shift designed to alleviate pressure on households.

Adequate fiscal support has become a pressing issue, particularly in light of the reluctance among consumers to make substantial real estate purchases. As Yue Su, a principal economist at the Economist Intelligence Unit, highlighted, stabilizing the housing market must take precedence over merely boosting housing prices to create a wealth effect. A shift in consumer sentiment toward more proactive engagement in the housing sector could become the linchpin for revitalizing the broader economy.

The Politburo’s latest meeting did touch upon crucial measures, including limited growth in housing supply, increased loan availability for designated projects, and reduced interest rates on existing mortgages. Such actions are projected to alleviate the burden on households, with an estimated $21.37 billion reduction in mortgage payments anticipated annually due to these adjustments. Although specifics were scant, the meeting’s outcomes indicate a clear movement towards a more considered economic strategy.

The newly articulated economic plan represents a significant departure from more aggressive postures seen in previous meetings, particularly the one held in July, which conveyed a sense of urgency. In contrast, the latest directive seemed to aim for a balanced approach between immediate growth and long-term structural reforms intended to transition China toward a high-tech-driven economy.

Analysts from leading institutions, including Goldman Sachs and Capital Economics, have adjusted their forecasts, noting that a growth rate below the previously projected 5% may be acceptable as policymakers navigate this critical juncture. Moreover, the timing of this meeting—held earlier than its scheduled counterparts—underscores the urgency conveyed by officials regarding current economic trends.

Disparate views have emerged from the analyst community in the aftermath of the meeting. While HSBC posited that the moment may herald more proactive fiscal measures, others, like Capital Economics, registered skepticism over the potential scale and immediacy of such stimulus.

As China seeks to stabilize its economy against a backdrop of significant challenges, the outcomes of this high-level meeting yield both cautious optimism and persistent apprehension. Acknowledging the intricate interdependencies between the housing market and overall economic health is crucial as the Chinese government formulates its response to the pressing economic realities. The pathway forward is sure to involve a delicate balancing act—one that prioritizes both immediate recovery and sustainable future growth in an evolving economic landscape.