Oracle Corporation has made headlines following a robust showing in the stock market, with shares climbing approximately 6% in after-hours trading on Thursday. This surge came on the heels of the company’s announcement of an optimistic revenue forecast for fiscal year 2026, estimating earnings of at least $66 billion, a figure that surpasses analysts’ expectations of $64.5 billion. This bullish outlook reflects a steady upward trajectory for Oracle, which has experienced a remarkable 15% rise in shares over the past three trading sessions. In the context of a competitive tech landscape, Oracle’s stock performance is particularly noteworthy, as it positions itself as one of the leading large-cap tech firms, posting a year-to-date gain of 55%, only trailing behind Nvidia.

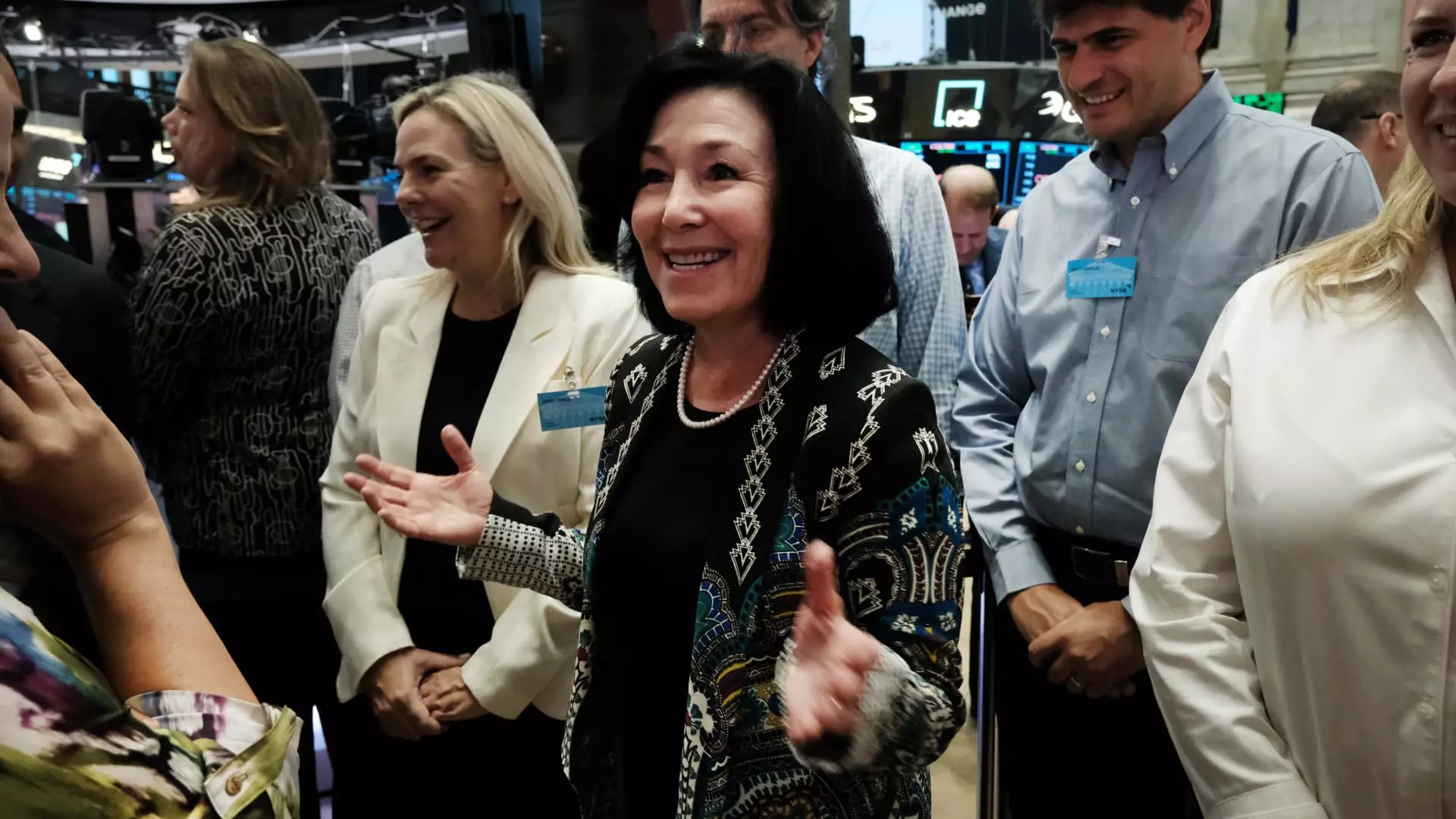

During an analyst session at the Oracle CloudWorld conference in Las Vegas, CEO Safra Catz articulated a vision for the company that extends well beyond the immediate fiscal year. She underscored the company’s anticipation of surpassing $104 billion in revenue by fiscal year 2029, along with a projected 20% growth in earnings per share. Catz emphasized the importance of alliances with major cloud service providers, including Amazon, Google, and Microsoft, which will allow Oracle to bolster its database software offerings. Such partnerships not only enhance Oracle’s market presence but also solidify its competitiveness within the cloud domain, which is increasingly vital as organizations transition their data workloads from traditional in-house data centers.

A critical aspect of Oracle’s growth strategy lies in the burgeoning field of artificial intelligence (AI). As organizations increasingly recognize the transformative potential of AI technologies, Oracle is keen to position itself as a leader in this sphere. The company’s cloud unit has recently made headlines by commencing orders for a cluster of over 131,000 advanced “Blackwell” graphics processing units developed by Nvidia. This move not only allows Oracle to enhance its cloud offerings but also reflects its commitment to supporting AI-driven workloads, which are expected to become vital to businesses in various sectors.

Alongside its ambitious revenue forecasts, Oracle is preparing to ramp up its capital expenditures significantly. Catz indicated that the company plans to double its investments during the current 2025 fiscal year. This commitment to reinvesting in infrastructure and technology signifies Oracle’s readiness to plant its flag firmly in high-growth areas, ensuring that it remains competitive against tech giants that dominate the cloud landscape. As Oracle forges ahead with its strategic vision, the extent of its success will hinge on its ability to execute these plans effectively and maintain momentum in a rapidly evolving marketplace.

Oracle’s recent performance and forward-looking guidance indicate a strong belief in its capacity to sustain growth and capture emerging opportunities, particularly in the cloud and AI sectors. As it strives for innovation and substantial returns, the company is clearly on a path aimed at redefining its place in the technology world.