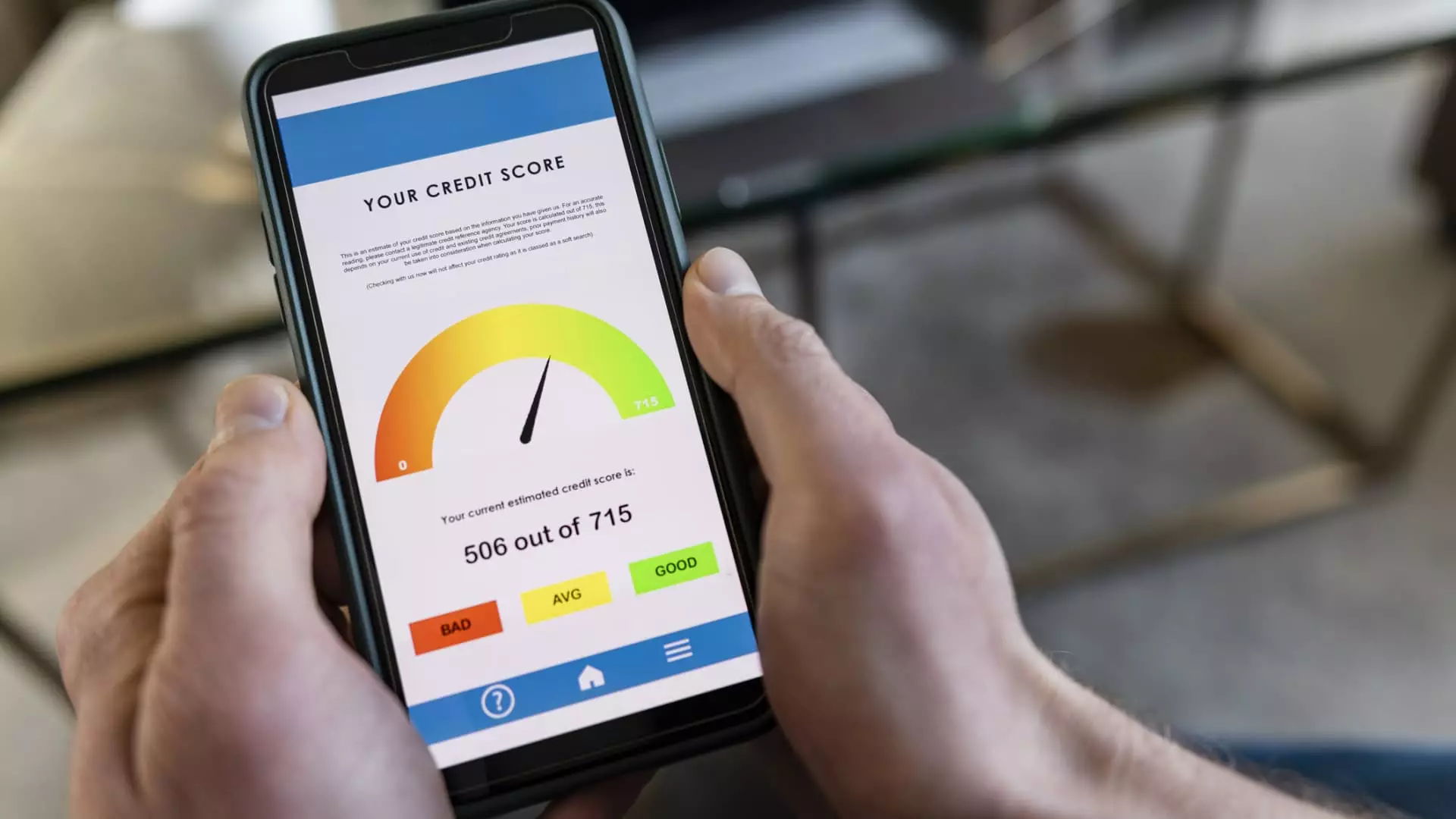

For years, Americans watched their credit scores steadily climb—a symbol of economic resilience and personal financial growth. Yet, in an unsettling turn, recent data reveals a decline for the second consecutive year, shattering expectations and exposing deep vulnerabilities within our economy. The national average credit score now stands at 715, a modest dip from 717 in 2024 and 718 in 2023. This downward trend signals more than just numbers on paper; it reflects a society grappling with economic hardship, irresponsible lending practices, and policy failures that have left many Americans slipping deeper into financial insecurity.

This decline is not accidental or mere statistical noise. It embodies the broader significance of a country struggling to maintain fiscal stability amidst soaring inflation, high interest rates, and a fragile job market. When consumers find themselves increasingly burdened with debt and struggling to keep up with payments, their credit scores suffer. Such deterioration reveals a fundamental truth: financial resilience is failing for many, often as a consequence of systemic issues that continue to go unaddressed.

The Role of Student Loan Policies and Economic Uncertainty

One of the most sobering factors behind the credit score slide is the end of pandemic-era forbearance on federal student loans. During the height of the pandemic, borrowers enjoyed a temporary reprieve, which artificially maintained their credit standings. Now, with the official return to standard reporting, delinquencies have spiked. Many who were previously shielded from the impact of missed payments face the reality that their scores are plummeting, potentially hurting their access to future credit and financial opportunities.

This policy rollback exposes ongoing failures within the system—failure to provide sustainable pathways for borrowers to manage their debt, and a lack of proactive measures to bolster financial literacy and resilience. The economic landscape remains unpredictable; inflation persists, interest rates stay high, and job security remains elusive for many. These conditions force families into impossible choices—prioritizing debt repayment over essential expenses, and accepting lower credit scores as collateral damage. It underscores a fragile societal fabric where economic stability is more a matter of luck than policy.

The Wealth Divide and the Myth of Equitable Growth

Interestingly, the data exposes an ironic dichotomy: while the average credit score declines, some segments are experiencing unprecedented wealth. Thanks to surging stock markets and appreciating real estate, a subset of Americans has bolstered their financial positions. These individuals see their credit scores stabilize or even improve, highlighting the persistent inequalities embedded in the current economic system.

This uneven landscape suggests that national financial health is hingeing on a small, privileged minority, rather than a true collective recovery. Such disparities threaten to widen the wealth gap further, fostering resentment and social division. A center-left perspective recognizes the necessity of addressing these disparities not through token policies but by implementing measures that create more equitable economic opportunities—like improved social safety nets, fair lending practices, and reform of student debt policies.

What Can Be Done? The Power of Personal and Policy Action

Though the news may seem bleak, there remains room for strategic action—both on an individual level and through broader policy reform. Experts emphasize that credit scores are inherently dynamic; consumers can improve their standing with intentional effort. Paying bills on time, reducing credit utilization, and limiting unnecessary credit inquiries are practical steps that can yield near-immediate improvements.

Yet, focusing solely on individual responsibility ignores the systemic failures that create these challenges. Policy reforms, including better protections for borrowers, expanded income-driven repayment options, and targeted social programs, are critical to addressing the root causes of declining credit health. Solutions must balance personal accountability with systemic change, recognizing that a financially healthier population is essential for societal stability.

Furthermore, the data encourages us to rethink how we measure and value economic success. Relying on credit scores as a barometer of individual worth or economic standing is flawed; it reinforces inequality and obscures the need for a more comprehensive approach to assessing financial well-being.

In the end, the declining national credit score is not just a statistical anomaly—it is a clarion call for a more equitable, transparent, and sustainable approach to economic growth. Our society’s future depends on recognizing that financial health isn’t just about numbers, but about ensuring that opportunity and stability are accessible to all, not just the privileged few.