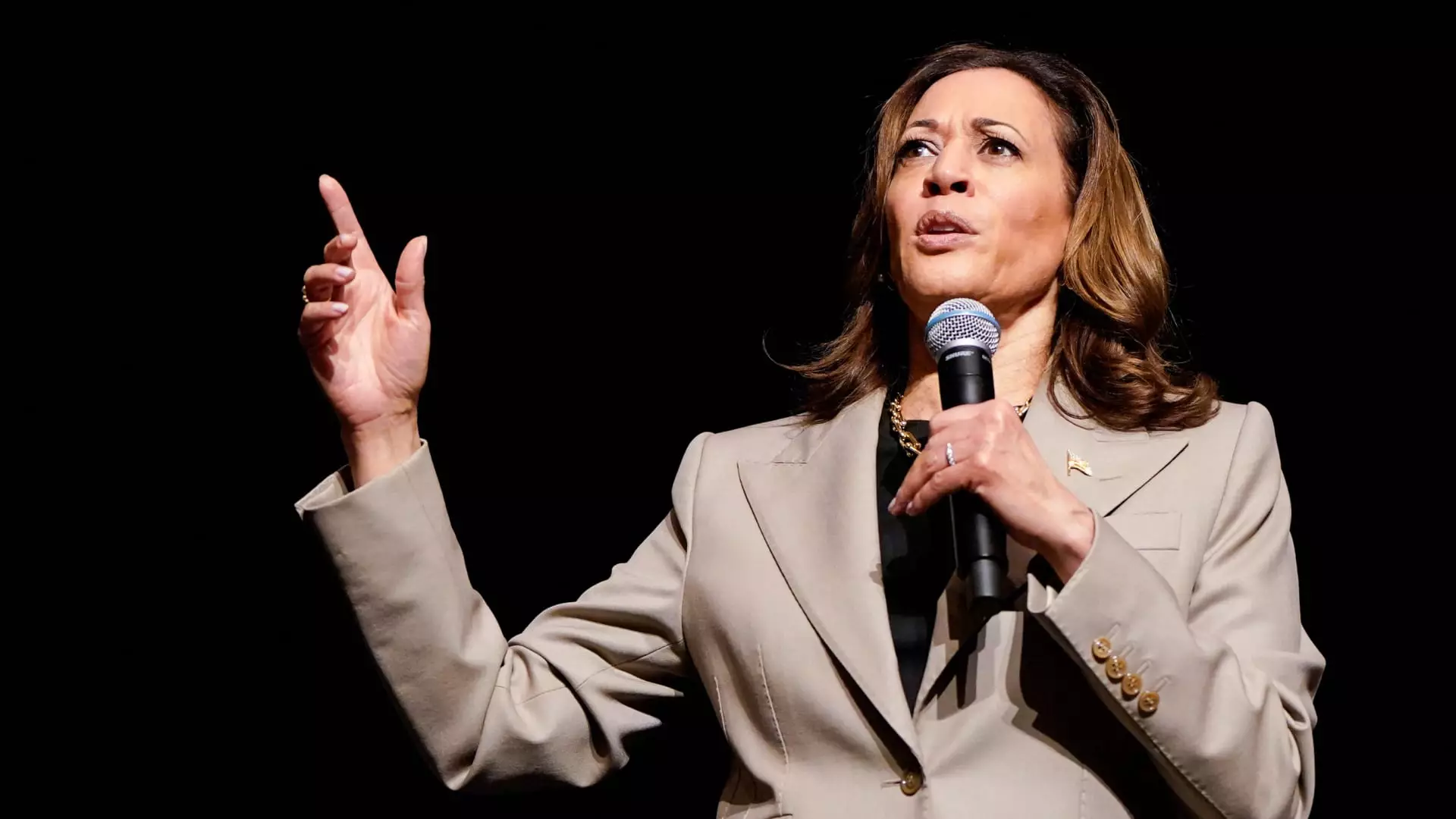

Vice President Kamala Harris recently unveiled an economic plan that includes an expanded child tax credit worth up to $6,000 in total tax relief for families with newborn children. This plan is aimed at restoring the higher child tax credit enacted through the American Rescue Plan in 2021. The proposed tax break would provide $6,000 in tax relief to families during the first year of a child’s life.

The 2021 credit was up to $3,000 or $3,600, depending on the child’s age and family’s income. This new plan from Harris comes shortly after Senator JD Vance of Ohio suggested a $5,000 child tax credit. This act by Harris is seen as a response to Vance’s proposal, and it has surprised experts such as Kyle Pomerleau from the American Enterprise Institute.

Congressional Response

Although the expanded child tax credit passed in the House with broad support, Senate Republicans blocked it earlier in August. However, there is bipartisan momentum behind expanding the child tax credit, as indicated by Andrew Lautz, the associate director for the Bipartisan Policy Center’s economic policy program. The details of the expansion and the future credit design will depend on which party controls the White House and Congress.

The child poverty rate fell to a historic low of 5.2% in 2021, largely due to the credit’s expansion under the American Rescue Plan. If there’s a future child tax credit expansion, experts believe it may not be as large as what Harris or Vance have proposed due to concerns about the federal budget deficit. Lawmakers are already dealing with trillions in expiring tax cuts, making any new tax breaks an expensive endeavor.

The Cost of Expansion

Expanding the child tax credit to $3,000 or $3,600 could cost an estimated $1.1 trillion over a decade, according to the Committee for a Responsible Federal Budget. On the other hand, the expansion to $6,000 for newborns could cost $100 billion. Harris’ economic plan also includes calls for higher taxes on wealthy Americans and large corporations to fulfill her commitment to fiscal responsibility.

Vice President Kamala Harris’ economic plan to expand the child tax credit is a bold proposal aimed at providing financial relief to families with newborn children. While the plan has garnered support from some experts and lawmakers, there are concerns about the cost and feasibility of such a significant tax break. The future of the child tax credit expansion will likely depend on the outcome of the upcoming elections and the priorities of the next administration.