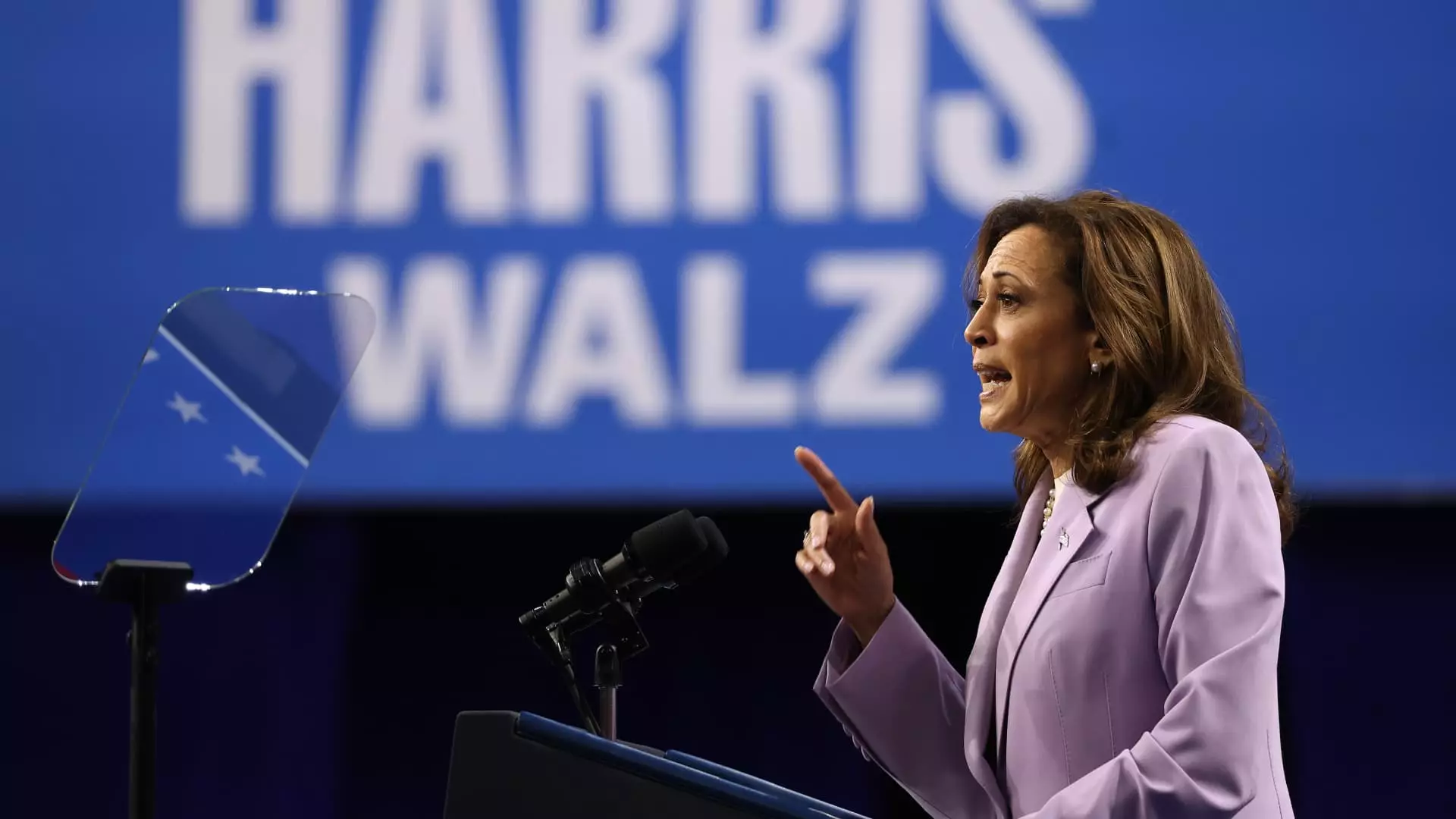

Affordable housing has become a significant topic in the current economic landscape, with various proposals being put forth by political figures to address the issue. Vice President Kamala Harris recently highlighted the need to make homeownership more accessible by lowering the costs associated with buying and renting homes in the U.S. During a speech in Raleigh, North Carolina, Harris emphasized the importance of increasing the supply of housing units by constructing 3 million new homes over the next four years. Housing experts believe that this initiative could significantly improve affordability in the housing market. The focus on increasing supply is seen as a bipartisan approach to tackling the challenges of housing affordability, particularly in the wake of the foreclosure crisis that greatly impacted the construction of new homes in the U.S.

While the idea of providing incentives for homebuilders to sell starter homes to first-time buyers seems promising, there are challenges that need to be addressed. The definition of a “starter home” may vary depending on the region, leading to disparities in pricing across different markets. Additionally, the high costs associated with building homes, including labor, land, borrowing, and materials, pose obstacles to keeping expenses low for first-time homebuyers. It will be crucial for policymakers to establish a clear range of price points for starter homes to ensure that the initiative is effective nationwide.

Harris’ proposal to establish a $40 billion innovation fund to support local governments in building housing solutions has raised concerns among experts. While the intention behind the fund is to empower local communities, there are doubts about the federal government’s ability to influence local planning decisions. The reluctance of local governments and homeowners to embrace incentives for building more housing could hinder the effectiveness of the innovation fund. Moreover, the high price tag associated with the fund may deter bipartisan support, making it challenging to implement successfully.

In an effort to assist first-time homebuyers, Harris has suggested providing $25,000 in down-payment assistance to individuals who have timely rent payments for two years. This proposal aims to expand homeownership opportunities for qualifying applicants, including first-generation homeowners. However, skepticism remains regarding the level of bipartisan support for such initiatives, as some lawmakers believe that increased demand without a corresponding increase in supply could drive up prices and lead to higher default rates.

Furthermore, Harris has called on Congress to pass legislation aimed at curbing predatory investing practices in the rental housing market. The proposed bills seek to limit tax benefits for individuals owning multiple single-family properties and regulate the use of algorithmic systems to set rental prices. These measures are designed to prevent large investors from dominating the rental housing market and ensure fair pricing for renters.

The implementation of affordable housing policies has the potential to reshape the U.S. housing market and make homeownership more attainable for a broader population. However, navigating the challenges associated with increasing housing supply, defining affordability criteria, and garnering bipartisan support for legislative proposals will be crucial in determining the success of these initiatives. By addressing these issues proactively, policymakers can pave the way for a more inclusive and sustainable housing market in the years to come.