The Consumer Financial Protection Bureau (CFPB), a vital entity set up after the 2008 financial crisis to safeguard consumers against predatory practices in the financial sector, faces a turbulent period. Recent developments signal instability within the agency, raising concerns not only among its employees but also among consumers who rely on its guardianship.

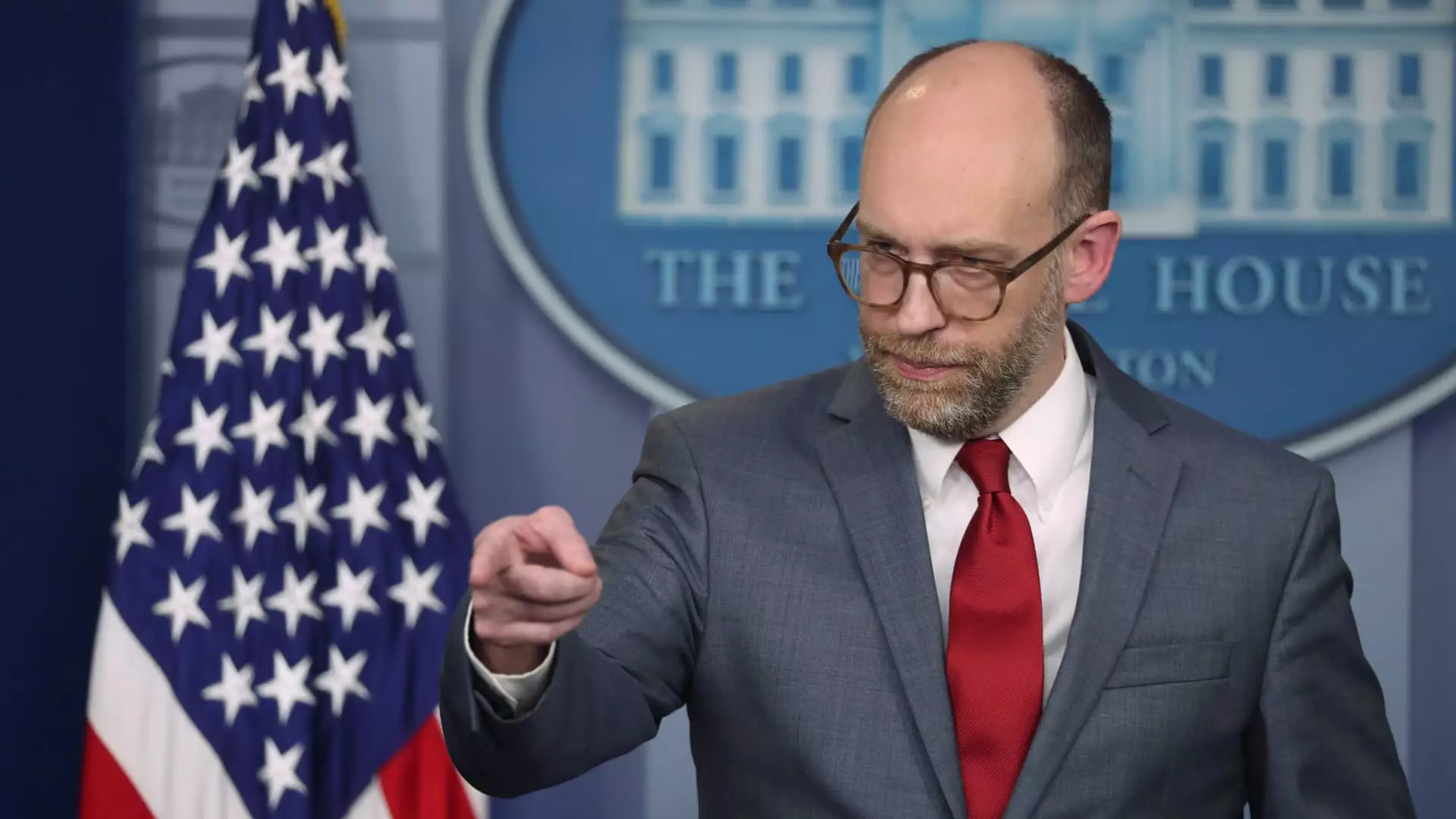

A memo dispatched by Adam Martinez, the Chief Operating Officer of the CFPB, instructed employees to shift to remote work due to the temporary closure of its Washington, D.C. headquarters until mid-February. This announcement follows a surprising directive from newly appointed acting director Russell Vought, who called for a near-total suspension of the bureau’s operational functions, including the supervision of financial institutions. Such sweeping changes indicate a dramatic departure from the operational norms established to ensure consumer protection and financial oversight.

The urgency of this transition can be traced back to broader changes in the political landscape, with Vought’s instructions fueled by a newfound alignment with ideological allies who have long criticized the CFPB. As a result, employees have reported a dark cloud of uncertainty hanging over the agency, with fears of layoffs and administrative leave becoming palpable among the approximately 1,700 staff members.

In an unforeseen twist, the CFPB’s current challenge is exacerbated by the involvement of operatives connected to Elon Musk’s DOGE project, who allegedly gained access to sensitive CFPB data, including employee performance reviews. Musk, a known critic of the CFPB, expressed his disdain on social media by proclaiming “CFPB RIP.” The implications of such a statement are profound, particularly if Musk’s operatives wield influence in shaping the bureau’s direction amidst leadership changes.

The intertwining of Musk’s employees with the CFPB raises ethical questions regarding oversight and the protection of consumer data. It is crucial for regulatory bodies to function independently and transparently, and the infusion of external interests could jeopardize the integrity of the CFPB and its mandate.

The ramifications of Vought’s suspension orders could be detrimental, especially as the CFPB has been a bulwark against exploitative practices in the financial sector. Its efforts to impose restrictions on credit card fees, overdraft fees, and practices that negatively affect credit reporting data have saved consumers substantial amounts of money. The chilling effect of halting CFPB activities could result in a significant rollback of these regulations and unravel years of progress made in consumer financial protections.

Particularly concerning is the agency’s ability to enforce rules aimed at dismantling a pervasive culture of consumer exploitation. Legal challenges from banking organizations have continuously sought to undermine the bureau’s authority, branding it as unaccountable and unconstitutional. The curtailment of its operational capacity could embolden these financial entities to reinstate predatory practices that the CFPB had previously mitigated.

As the CFPB grapples with these tumultuous changes, it stands at a crossroads that could redefine its future. The outcome will depend significantly on the political and organizational responses to the crisis. If the current administration and stakeholders advocate for the preservation of the CFPB’s functions, it may emerge from this turmoil with renewed vigor. Conversely, if the bureau is left vulnerable to external pressures and internal disarray, it could see its mission compromised permanently.

The future of the CFPB is crucial for the economic well-being of millions of Americans. Vigilance from consumer advocates and the public is imperative as the agency navigates these uncertain waters. It remains to be seen how these developments will unfold, but safeguarding the interests of consumers and maintaining robust financial oversight must remain a priority in the face of these challenges.