In a remarkable display of growth, AppLovin’s shares surged by an impressive 45% on a single day, fueled by strong earnings reports and optimistic guidance. This leap in stock value marked a pivotal moment for the online gaming and advertising entity, originating from a robust earnings report that exceeded market expectations. The stock’s performance pushed it beyond the $245 threshold during early afternoon trading, underscoring the high stakes in the rapidly evolving tech landscape.

By mid-2023, AppLovin’s stock price had climbed a staggering 515%, establishing it as a standout performer among tech firms valued over $5 billion, according to FactSet’s analytics. With a market capitalization surpassing $80 billion, the company has positioned itself as a formidable player in the sectors of mobile gaming and advertising. For the third quarter alone, AppLovin reported revenues reaching $1.2 billion, a 39% increase from the prior year and demonstrating robust market confidence as it outperformed the average expectation of $1.13 billion. Furthermore, earnings per share also surpassed forecasts, pegged at $1.25 compared to the anticipated 92 cents.

Looking toward the final quarter, AppLovin has set revenue projections between $1.24 billion and $1.26 billion, indicating a steady growth trajectory of 31% at the mid-range estimate. This optimism contrasts analysts’ more conservative expectations of $1.18 billion, highlighting AppLovin’s strategic prowess in navigating market demands and leveraging its technological advantages.

Founded 12 years ago and public since 2021, AppLovin has matured significantly, particularly in its advertising segment. While the gaming unit’s slow growth presents a challenge, its AI-driven advertising engine, known as AXON, stands out as a beacon of innovation. Enhancements from the 2.0 version of AXON have greatly facilitated more effective ad targeting, both within the company’s gaming applications and for external studios utilizing its licensing options. This has resulted in a substantial 66% increase in revenue from its software platform, reaching $835 million—a testament to the company’s focus on technological refinement and user engagement.

A hallmark of AppLovin’s recent success is its exceptional profitability. The company reported a staggering 300% increase in net income, amounting to $434.4 million—equivalent to $1.25 per share, a significant leap from the previous year’s $108.6 million. This translates into an impressive adjusted profit margin of 78% for its software platform, indicating that the company is not just growing its revenue but doing so in a fiscally responsible manner.

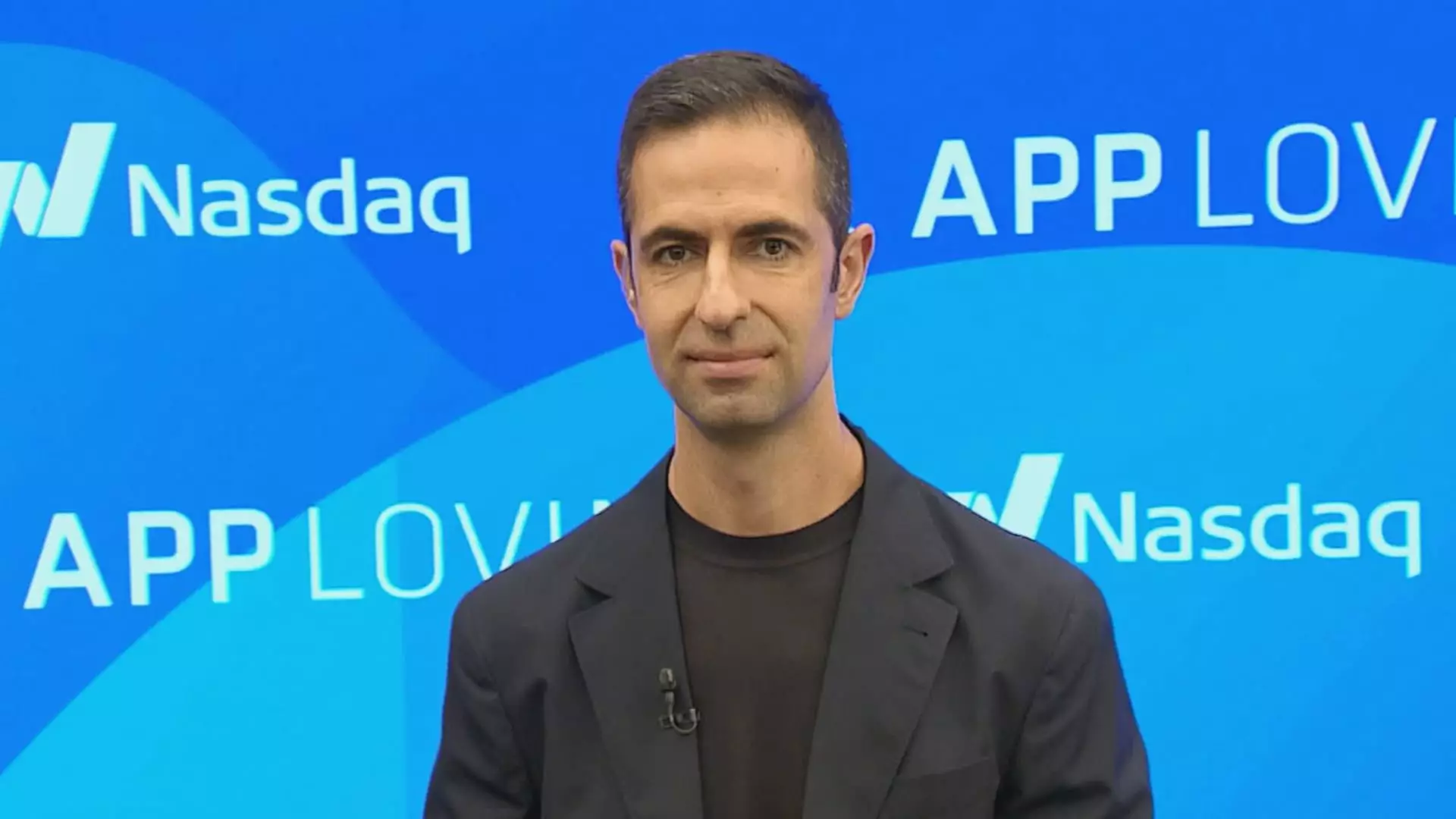

AppLovin’s upward trajectory has drawn considerable interest from Wall Street. Analysts have responded positively, with firms like Wedbush upgrading their price targets based on the company’s strong performance indicators. AppLovin’s CEO Adam Foroughi emphasized the success of a pilot project aimed at integrating targeted ads into gaming experiences, which has further bolstered investor confidence. With a compelling strategy centered around AI advancements and engagement initiatives, AppLovin appears poised for continued success in the competitive tech arena. The future looks promising for this dynamic company, as it captures the intersection of gaming and advertising innovation.