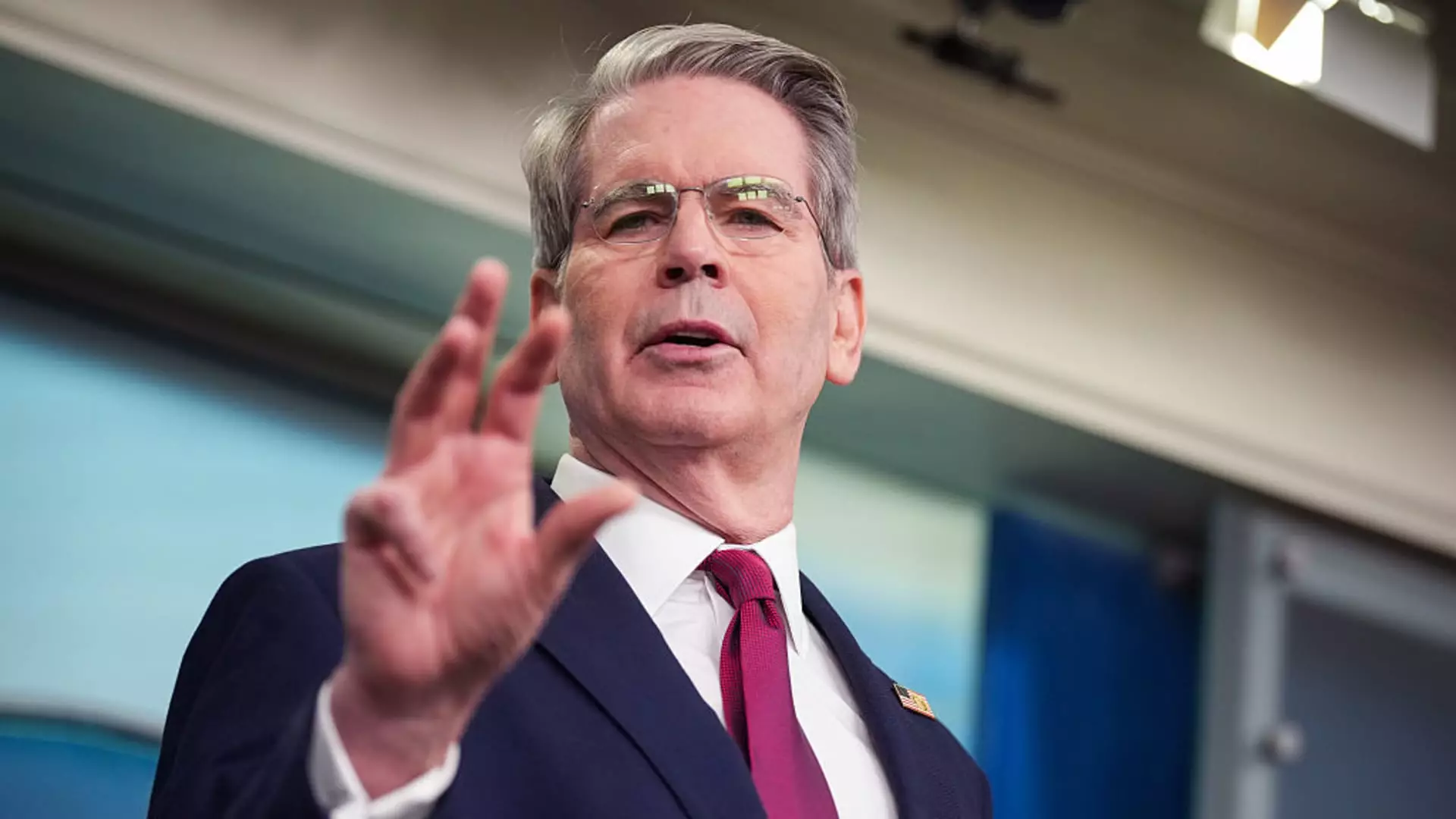

In an age where financial markets are in near-constant flux, the attitude and behavior of individual versus institutional investors reveal much about the underlying sentiment toward U.S. economic policies. Recent remarks from Treasury Secretary Scott Bessent highlight an intriguing dichotomy: while retail investors have maintained steady hands, institutional players are skittish amid market volatility driven by President Trump’s tariff strategies. Bessent’s comments underscore a fascinating resilience among “Main Street” investors, who reportedly held tight during challenging market conditions, contrasting sharply with the panic exhibited by major hedge funds and institutional traders.

One has to ask: what fuels this differential confidence? Bessent emphasized that 97% of American individual investors have seemingly remained unmoved, with Vanguard data indicating minimal trading activity over an extended period. This quiet patience presents a stark contrast to the behaviors of hedge funds, which are exhibiting signs of distress and short-selling as a protective measure against perceived economic decline. Individually, investors may trust in the broader, long-term potential of Trump’s policies, while institutions appear overwhelmed by immediate fears of recession and tariff-induced strain on consumer behavior.

The Tariff Impact: A Double-Edged Sword

The introduction and subsequent suspension of the highest tariffs on imports in generations have led to significant market contraction, most notably a bear market phase for the S&P 500. This period of uncertainty pushed the equity benchmark down nearly 10% from its all-time highs, increasing anxiety over economic stability. Many experts predict dire consequences, including Torsten Slok’s forecasts of a coming summer recession driven by trade-related shortages. While research validates a correlation between tariffs and consumer prices, the full scope of their impact, particularly on the average American, remains to be seen.

What remains perplexing is individual investors’ willingness to continue to trust in an administration’s trade policy that has proven to incite turmoil. Are retail investors blinded by optimism, or are they efficiently reading a larger narrative about U.S. resilience? This brave front could mark a philosophical divide where daily traders envision economic recovery and resurgence, while institutional names like Citadel, which fear reputational damage to the U.S. economy, are leaning into defensive strategies.

Long-Term Perspective: Faith Not Blindness

The stance taken by individual investors should not be confused with naïve complacency. Their approach could emerge from a belief that the tariffs will stabilize in the long run or a simple faith in the president’s commitment to American economic growth. The notion of “holding tight” might reflect a calculated bet on market fundamentals—an expectation that the economy will overcome short-term disruptions, especially when contrasted against the often erratic, short-term nature of institutional decision-making.

As tensions grow with escalating tariffs and subsequent trade disputes, the fundamental question is whether this cautious optimism among everyday investors represents an informed risk assessment. While institutional investors often react to immediate market changes, retail investors might embrace a longer horizon, driven by hope or hoodwinked by the allure of volatility itself. In this contentious political landscape, the unpredictable nature of Trump’s policies may just embolden individual investors, ushering in a wave of new trading mentalities that challenge the traditional playbook.