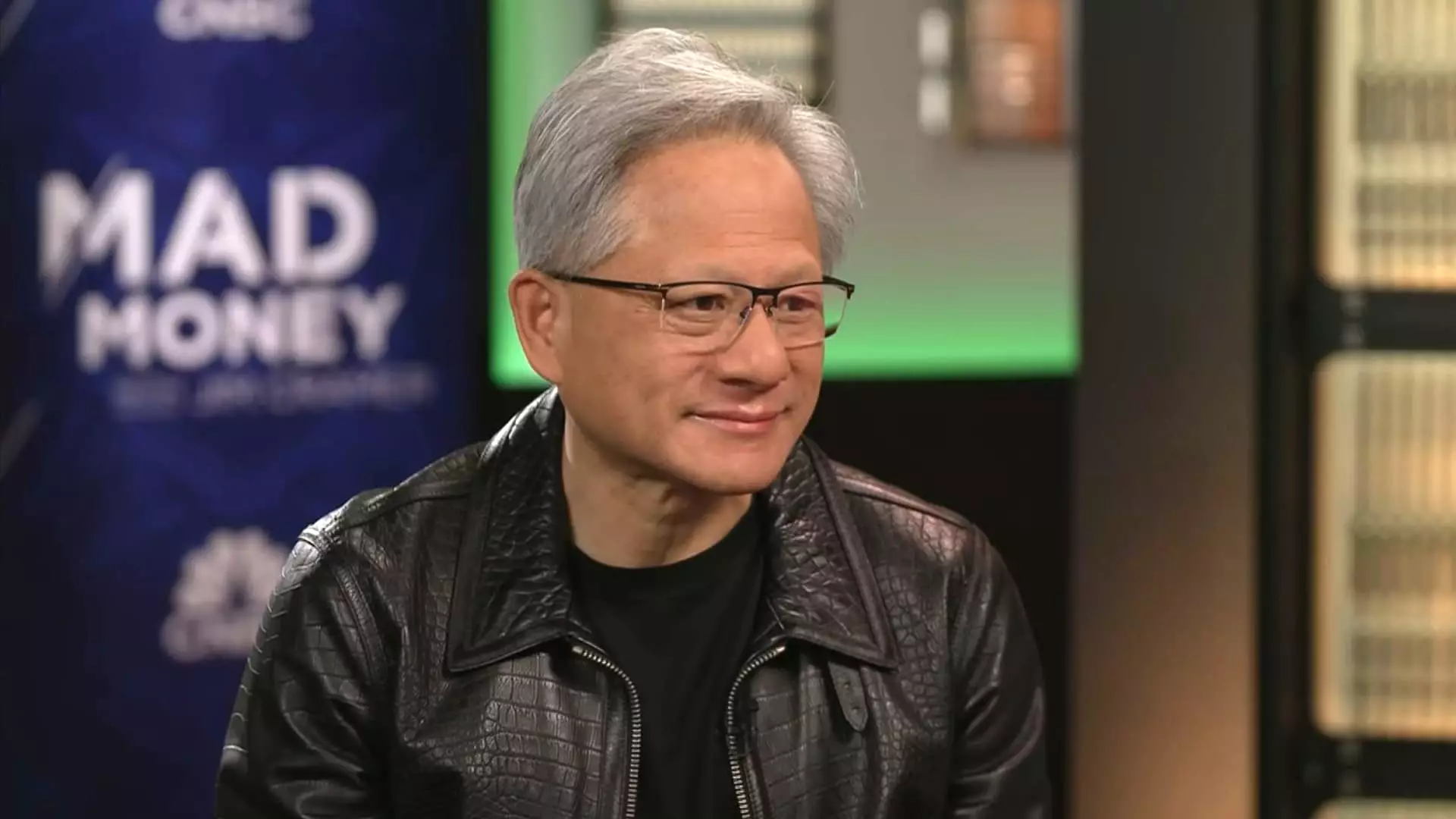

Jensen Huang, the charismatic CEO of Nvidia, recently attempted to paint a rosy picture regarding the potential fallout from President Trump’s trade tariffs. His claim that the tariffs would have a minimal short-term impact is deeply concerning. While it’s certainly admirable to foster enthusiasm about advancing AI and American manufacturing, downplaying the serious long-term implications of such trade policies is sheer folly. Huang’s optimism may be a coping mechanism, but it neglects the realities emerging from this trade war—realities that could spiral into devastating consequences for industries across the board.

The Manufacturing Mirage

Huang’s assertion that “long-term manufacturing onshore is going to be something very, very possible” raises eyebrows. Partnering with manufacturers like TSMC, Foxconn, and Wistron sounds ideal, but is it realistic given the current geopolitical climate? Tariffs are often met with retaliation, and the crafting of a U.S. manufacturing ecosystem for semiconductors or other tech products is no simple feat. This is not a Netflix series where problems resolve in one episode; it involves substantial investment, labor force training, and navigating a complex web of international trade laws. It is downright naïve to act as if this transition is a matter of enthusiasm alone.

AI’s Double-Edged Sword

AI is indeed poised to revolutionize industries, making Huang’s vision of it being “the foundation of every industry” seem plausible. However, his dismissal of Chinese competitors, particularly entities like DeepSeek, suggests a troubling lack of awareness about the competitive landscape. The notion that U.S. companies can maintain their AI supremacy without addressing the challenges posed by more cost-efficient rivals is dangerously simplistic. As long as Nvidia remains barred from the lucrative Chinese market due to stringent export controls, the company risks losing its foothold in an area it once dominated. This is not a mere inconvenience but a severe blow to long-term revenue potential.

Financial Reality Check

The financial markets reacted predictably to Huang’s optimistic spin, with Nvidia’s shares plummeting over 20% since January. The sell-off is no trivial matter; it signals deep-rooted fears about the future. When industry leaders grapple with existential threats — from regulations to competitive pressures — it becomes crucial to temper optimism with realism. Huang’s confidence in Nvidia’s fundamental position is admirable, yet believing in a swift recovery without acknowledging ongoing headwinds may be misguided. The current economic landscape is turbulent, and theory alone won’t stabilise a faltering stock.

The Illusion of Control

Lastly, Huang’s dismissal of tariffs as an immediate concern overlooks the broader implications of Trump’s trade policies. These tariffs are not mere blips; they mark the onset of a trade war that shows no signs of abating. They could reshape supply chains and create a cascade of repercussions that companies like Nvidia will have to adapt to. The notion that things will remain unchanged in the face of such instability is bewilderingly optimistic. True leadership requires not only vision but also the judicious approach of grappling with uncomfortable truths. Huang’s current stance, while well-intentioned, seems woefully unprepared for the complexities ahead.